MasterCard 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

On February 25, 2008, the Antitrust Division of the DOJ issued a Civil Investigative Demand (“CID”) to

MasterCard seeking information regarding a potential violation of the final judgment in the DOJ litigation

discussed in the preceding paragraphs. The CID sought documents, data and narrative responses to several

interrogatory and document requests which focused on whether early termination and waiver provisions in

agreements between MasterCard and issuers violated the DOJ final judgment. On February 10, 2009, the DOJ

informed MasterCard that it had closed its investigation that led to the issuance of this CID.

On October 4, 2004, Discover Financial Services, Inc. filed a complaint against MasterCard, Visa U.S.A.

Inc. and Visa International Services Association. The complaint was filed in the U.S. District Court for the

Southern District of New York and was designated as a related case to the DOJ litigation, and was assigned to

Judge Barbara Jones, the same judge who issued the DOJ decision described above. In an amended complaint

filed on January 7, 2005, Discover alleged that the implementation and enforcement of MasterCard’s CPP, Visa’s

bylaw provision and the Honor All Cards rule violated Sections 1 and 2 of the Sherman Act in an alleged market

for general purpose card network services and an alleged market for debit card network services. Discover sought

treble damages in an amount to be proved at trial along with attorneys’ fees and costs. On June 7, 2007, Discover

filed a second amended complaint that mirrored the claims in its amended complaint but deleted allegations

relating to MasterCard’s Honor All Cards rule as well as Discover’s Section 2 monopolization and attempted

monopolization claims against MasterCard based upon an earlier ruling by the court dismissing those claims.

Fact discovery was completed on May 31, 2007. Discover submitted expert reports purporting to demonstrate

that it had incurred damages in excess of $6,000,000 before trebling. MasterCard submitted expert reports

countering the damages arguments made in Discover’s reports and concluding that damages are negative. Trial

was scheduled to commence on October 14, 2008. On July 29, 2008, MasterCard and Visa entered into a

judgment sharing agreement that provided for the apportionment of certain costs and liabilities which

MasterCard and Visa might incur, jointly and/or severally, in the event of an adverse judgment or settlement in

the Discover litigation. The judgment sharing agreement provided that Visa would be responsible for the

substantial majority of any judgment or settlement in the litigation, based primarily on relevant volumes. On

October 27, 2008, MasterCard and Visa entered into a settlement agreement with Discover, ending all litigation

between the parties for a total of $2,750,000. The MasterCard share of the settlement, paid to Discover in

November 2008, was $862,500. In addition, in connection with the Discover Settlement and pursuant to a

separate agreement, Morgan Stanley, Discover’s former parent company, paid MasterCard $35,000 in November

2008.

On November 15, 2004, American Express filed a complaint against MasterCard, Visa and eight member

banks, including JPMorgan Chase & Co., Bank of America Corp., Capital One Financial Corp., U.S. Bancorp,

Household International Inc., Wells Fargo & Co., Providian Financial Corp. and USAA Federal Savings Bank.

The complaint, which was filed in the U.S. District Court for the Southern District of New York, was designated

as a related case to the DOJ litigation and was assigned to Judge Jones. The complaint alleges that the

implementation and enforcement of MasterCard’s CPP and Visa’s bylaw provision violated Sections 1 and 2 of

the Sherman Act in an alleged market for general purpose card network services and a market for debit card

network services. In November 2007, Visa and the remaining bank defendants reached a settlement with

American Express and were dismissed from the case. On June 24, 2008, MasterCard entered into a settlement

agreement with American Express to resolve all current litigation between American Express and MasterCard,

following which Judge Jones dismissed the case without prejudice, pending full payment. Under the terms of the

settlement agreement, MasterCard is obligated to make twelve quarterly payments of up to $150,000 per quarter.

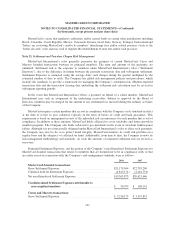

See Note 18 (Obligations under Litigation Settlements) for additional discussion. MasterCard’s maximum

nominal payments will total $1,800,000. The amount of each quarterly payment is contingent on the performance

of American Express’ U.S. Global Network Services business. The quarterly payments will be in an amount

equal to 15% of American Express’s U.S. Global Network Services billings during the quarter, up to a maximum

121