MasterCard 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

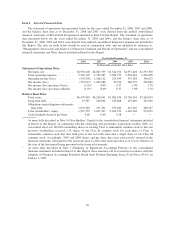

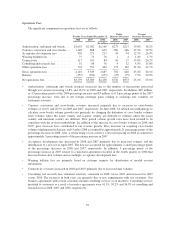

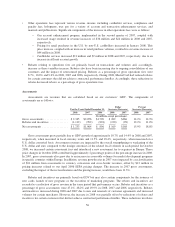

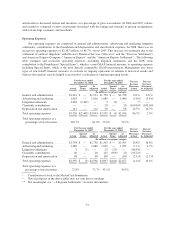

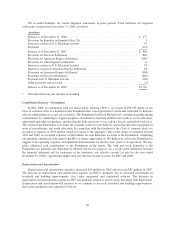

Financial Results*

For the Years Ended December 31, Percent Increase (Decrease)

2008 2007 2006 2008 2007

(In millions, except per share, percentages and GDV amounts)

Net operations fees .......................... $ 3,759 $ 3,003 $ 2,430 25.2% 23.6 %

Net assessments ............................ 1,233 1,064 896 15.9% 18.8 %

Total revenue .............................. 4,992 4,068 3,326 22.7% 22.3 %

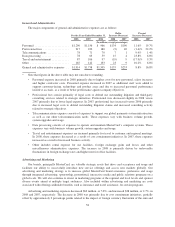

General and administrative ................... 1,914 1,758 1,505 8.8% 16.8 %

Advertising and marketing .................... 1,018 1,080 1,052 (5.8)% 2.7 %

Litigation settlements ........................ 2,483 3 25 ** (86.4)%

Charitable contributions to the MasterCard

Foundation .............................. — 20 415 (100.0)% (95.2)%

Depreciation and amortization ................. 112 98 100 14.7% (2.1)%

Total operating expenses ..................... 5,526 2,959 3,097 86.7% (4.4)%

Operating income (loss) ...................... (535) 1,108 229 (148.2)% 382.8%

Total other income .......................... 151 563 65 (73.1)% 771.0%

Income (loss) before income tax expense ........ (383) 1,671 294 (122.9)% 468.2%

Income tax expense (benefit) .................. (129) 586 244 (122.1)% 140.0%

Net income (loss) ........................... $ (254) $ 1,086 $ 50 (123.4)% 2,063.6%

Net income (loss) per share (basic) ............. $(1.95)4$ 8.054$ 0.37 (124.2)% 2,075.7%

Weighted average shares outstanding (basic) ..... 130 135 135 (3.5)% (0.4)%

Net income (loss) per share (diluted) ............ $(1.95)4$ 8.004$ 0.37 (124.4)% 2,062.2%

Weighted average shares outstanding (diluted) .... 130 136 136 (4.1)% (0.1)%

Effective income tax rate ..................... 33.7% 35.0% 82.9%1** **

Gross dollar volume (“GDV”) on a U.S. dollar

converted basis (in billions) ................. 2,533 2,272 1,919211.5% 18.4%

Processed transactions5...................... 20,966 18,752316,141311.8% 16.2%

* Note that figures in the above table may not sum due to rounding.

** Not meaningful, see “—Operating Expenses” and “—Litigation Settlements” for more information.

1The 2006 effective tax rate includes the impact of a $395 million donation of shares of Class A common

stock to the MasterCard Foundation, a charitable contribution which is not deductible for tax purposes. See

“—Income Taxes” for more information.

2In 2007, we updated GDV to exclude commercial funds transfers in China, which are generally transactions

that facilitate the transfer of funds between bank branches but do not involve traditional cash withdrawals or

balance transfers. Data for 2006 has been restated to be consistent with this approach.

3In 2008, we updated our processed transactions numbers to apply reversals and include certain cash

transactions. Prior period numbers have been restated to be consistent with this revised methodology.

Revenue has not been impacted by these changes.

4As more fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated

financial statements included in Item 8 of this Report, these amounts will be revised in accordance with the

adoption of Financial Accounting Standards Board (“FASB”) Staff Position Emerging Issues Task Force

03-6-1 on January 1, 2009.

5The data set forth for processed transactions represents all transactions processed by MasterCard, including

PIN-based online debit transactions.

50