MasterCard 2008 Annual Report Download - page 100

Download and view the complete annual report

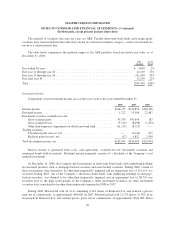

Please find page 100 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

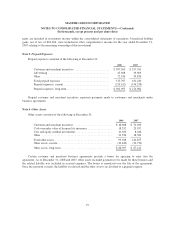

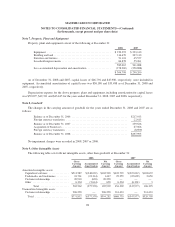

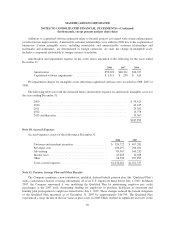

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

Advertising expense—Cost of media advertising is expensed when the advertising takes place. Production

costs are expensed as costs are incurred. Promotional items are expensed at the time the promotional event

occurs. Sponsorship costs are recognized over the period of benefit based on the estimated value of certain

events.

Foreign currency translation—The U.S. dollar is the functional currency for the majority of the Company’s

businesses except for MasterCard Europe’s operations, for which the functional currency is the euro, and

MasterCard’s operations in Brazil, for which the functional currency is the real. Where the U.S. dollar is

considered the functional currency, monetary assets and liabilities are re-measured to U.S. dollars using current

exchange rates in effect at the balance sheet date; non-monetary assets and liabilities are re-measured at historical

exchange rates; and revenue and expense accounts are re-measured at a weighted average exchange rate for the

period. Resulting exchange gains and losses and transactional foreign exchange gains and losses are not material

therefore they are included in general and administrative expenses in the statement of operations. Where local

currency is the functional currency, translation from the local currency to U.S. dollars is performed for balance

sheet accounts using current exchange rates in effect at the balance sheet date and for revenue and expense

accounts using a weighted average exchange rate for the period. Resulting translation adjustments are reported as

a component of other comprehensive income (loss).

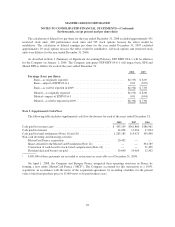

Net income (loss) per share—In accordance with SFAS No. 128, “Earnings per Share”, MasterCard

calculates basic net income (loss) per common share by dividing net income (loss) by the weighted average

number of common shares outstanding. MasterCard calculates diluted net income (loss) per share consistent with

that of basic net income (loss) per share but gives effect to all potential common shares (e.g., options and

unvested restricted stock units) that were outstanding during the period, unless the effect is antidilutive.

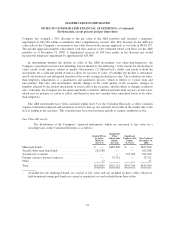

Recent accounting pronouncements—In December 2007, the FASB issued SFAS No. 141 (revised 2007),

“Business Combinations” (“SFAS 141R”) which replaces SFAS No. 141, “Business Combinations”. SFAS 141R

establishes the principles and requirements for how an acquirer: 1) recognizes and measures in its financial

statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree;

2) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase;

and 3) discloses the business combination. SFAS 141R applies to all transactions in which an entity obtains control

of one or more businesses, including transactions that occur without the transfer of any type of consideration. SFAS

141R is effective on a prospective basis for all business combinations on or after January 1, 2009, with the

exception of the accounting for valuation allowances on deferred taxes and acquired tax contingencies. Early

adoption is not allowed. The Company will adopt SFAS 141R on January 1, 2009 and its effect on future periods

will be dependent upon the nature and significance of any acquisitions subject to this Statement.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements—an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 amends Accounting Research Bulletin

(“ARB”) No. 51 “Consolidated Financial Statements” and establishes accounting and reporting standards that

require non-controlling interests (previously referred to as minority interests) to be reported as a component of

equity. In addition, changes in a parent’s ownership interest while the parent retains its controlling interest are

accounted for as equity transactions, and upon a loss of control, retained ownership interests are remeasured at

fair value, with any gain or loss recognized in earnings. SFAS 160 is effective for the Company on January 1,

2009, except for the presentation and disclosure requirements, which will be applied retrospectively. Early

adoption is not allowed. The Company does not expect that the adoption of SFAS 160 will have a material

impact on the Company’s consolidated results of operations or financial position.

In February 2008, the FASB issued Staff Position 157-2 (“FSP 157-2”). FSP 157-2 permits delayed

adoption of SFAS 157 for certain non-financial assets and liabilities, which are not recognized at fair value on a

90