MasterCard 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

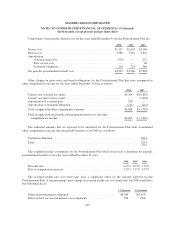

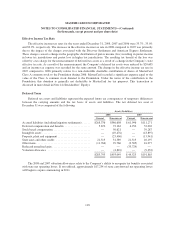

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

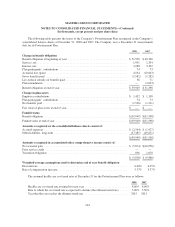

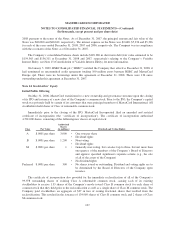

The Company issued 66,135 newly authorized shares of Class A common stock in the IPO, including 4,614

shares sold to the underwriters pursuant to an option to purchase additional shares, at a price of $39 per share.

The Company received net proceeds from the IPO of approximately $2,449,910. The Company issues and retires

one share of Class M common stock at the inception or termination, respectively, of each principal membership

of MasterCard International.

Redemption of Shares

On June 30, 2006, in accordance with the certificate of incorporation, the Company used all but $650,000 of

the net proceeds from the IPO, or $1,799,910, to redeem 79,632 shares of Class B common stock from the Class

B stockholders, the customers and principal members of MasterCard International. This number of redeemed

shares equaled the aggregate number of shares of Class A common stock issued to investors in the IPO and

donated to the Foundation (as defined below). The redemption amount paid to Class B stockholders was

allocated primarily between additional paid-in capital and retained earnings. Since 59% of the shares of Class B

common stock were redeemed, 59% of the additional paid-in capital balance which existed prior to the IPO and

was associated with shares of Class B common stock, or $575,001, was reduced against additional paid-in

capital. The remaining $1,224,901 was charged to retained earnings since this amount was in excess of the

original additional paid-in capital attributed to the shares of Class B common stock.

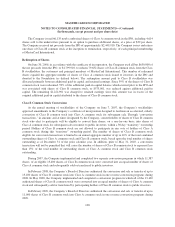

Class B Common Stock Conversions

At the annual meeting of stockholders of the Company on June 7, 2007, the Company’s stockholders

approved amendments to the Company’s certificate of incorporation designed to facilitate an accelerated, orderly

conversion of Class B common stock into Class A common stock for subsequent sale. Through “conversion

transactions,” in amounts and at times designated by the Company, current holders of shares of Class B common

stock who elect to participate will be eligible to convert their shares, on a one-for-one basis, into shares of

Class A common stock for subsequent sale or transfer to public investors, within a 30 day “transitory” ownership

period. Holders of Class B common stock are not allowed to participate in any vote of holders of Class A

common stock during this “transitory” ownership period. The number of shares of Class B common stock

eligible for conversion transactions is limited to an annual aggregate number of up to 10% of the total combined

outstanding shares of Class A common stock and Class B common stock, based upon the total number of shares

outstanding as of December 31 of the prior calendar year. In addition, prior to May 31, 2010, a conversion

transaction will not be permitted that will cause the number of shares of Class B common stock to represent less

than 15% of the total number of outstanding shares of Class A common stock and Class B common stock

outstanding.

During 2007, the Company implemented and completed two separate conversion programs in which 11,387

shares, of an eligible 13,400 shares, of Class B common stock were converted into an equal number of shares of

Class A common stock and subsequently sold or transferred to public investors.

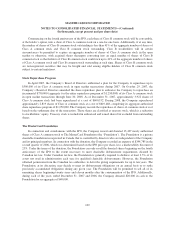

In February 2008, the Company’s Board of Directors authorized the conversion and sale or transfer of up to

13,100 shares of Class B common stock into Class A common stock in one or more conversion programs during

2008. In May 2008, the Company implemented and completed a conversion program in which all of the 13,100

authorized shares of Class B common stock were converted into an equal number of shares of Class A common

stock and subsequently sold or transferred by participating holders of Class B common stock to public investors.

In February 2009, the Company’s Board of Directors authorized the conversion and sale or transfer of up to

11,000 shares of Class B common stock into Class A common stock in one or more conversion programs during

2009.

108