MasterCard 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

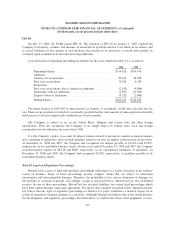

FIN 48

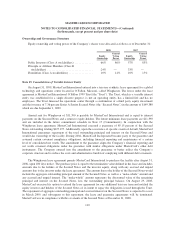

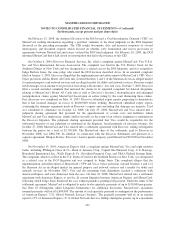

On July 13, 2006, the FASB issued FIN 48. The adoption of FIN 48 on January 1, 2007 required the

Company to inventory, evaluate, and measure all uncertain tax positions taken or to be taken on tax returns, and

to record liabilities for the amount of such positions that would not be sustained, or would only partially be

sustained, upon examination by the relevant taxing authorities.

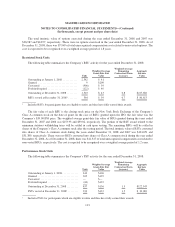

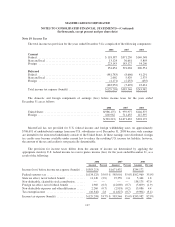

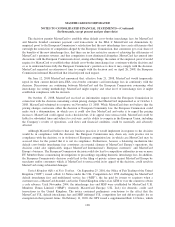

A reconciliation of beginning and ending tax benefits for the years ended December 31, is as follows:

2008 2007

Beginning balance ....................................... $134,826 $109,476

Additions:

Current year tax positions ................................. 20,447 40,288

Prior year tax positions ................................... 15,654 4,544

Reductions:

Prior year tax positions, due to changes in judgments ........... (2,613) (4,886)

Settlements with tax authorities ............................ (1,397) (11,990)

Expired statute of limitations .............................. (3,732) (2,606)

Ending balance ......................................... $163,185 $134,826

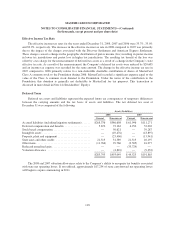

The entire balance of $163,185 of unrecognized tax benefits, if recognized, would affect the effective tax

rate. There are no positions for which it is reasonably possible that the total amounts of unrecognized tax benefits

will increase or decrease significantly within the next twelve months.

The Company is subject to tax in the United States, Belgium and various state and other foreign

jurisdictions. With few exceptions, the Company is no longer subject to federal, state, local and foreign

examinations by tax authorities for years before 2001.

It is the Company’s policy to account for interest expense related to income tax matters as interest expense

in its statement of operations, and to include penalties related to income tax matters in the income tax provision.

At December 31, 2008 and 2007, the Company had recognized net interest payable of $14,014 and $5,897,

respectively, in its consolidated balance sheets. For the years ended December 31, 2008 and 2007, the Company

recorded interest expense of $8,118 and $800, respectively, in its consolidated statements of operations. At

December 31, 2008 and 2007, the Company had recognized $2,609, respectively, of penalties payable in its

consolidated balance sheets.

Note 20. Legal and Regulatory Proceedings

MasterCard is a party to legal and regulatory proceedings with respect to a variety of matters in the ordinary

course of business. Some of these proceedings involve complex claims that are subject to substantial

uncertainties and unascertainable damages. Therefore, the probability of loss and an estimation of damages are

not possible to ascertain at present. Accordingly, except as discussed below, MasterCard has not established

reserves for any of these proceedings. MasterCard has recorded liabilities for certain legal proceedings which

have been settled through contractual agreements. Except for those matters described below, MasterCard does

not believe that any legal or regulatory proceedings to which it is a party would have a material impact on its

results of operations, financial position, or cash flows. Although MasterCard believes that it has strong defenses

for the litigations and regulatory proceedings described below, it could in the future incur judgments or fines,

119