MasterCard 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

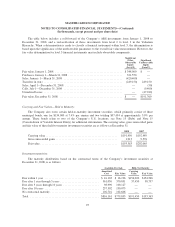

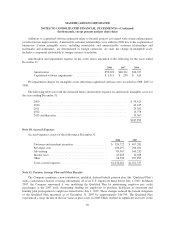

Note 4. Investment Securities

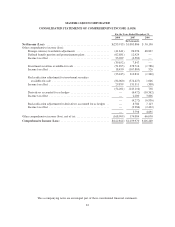

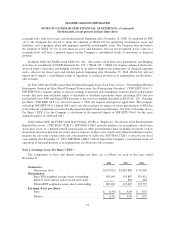

Costs and Fair Values—Available for Sale:

The major categories of the Company’s available-for-sale investment securities, for which unrealized gains

and losses are recorded as a separate component of other comprehensive income (loss) on the consolidated

statements of comprehensive income (loss), and their respective cost bases and fair values are as follows:

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss1

Fair Value at

December 31,

2008

Municipal bonds .................................... $ 473,746 $ 12,771 $ (1,027) $ 485,490

Taxable short-term bond funds ......................... 102,588 — — 102,588

Auction rate securities ............................... 239,700 — (47,940) 191,760

Other ............................................. 127 (110) 17

Total ............................................. $ 816,161 $ 12,771 $(49,077) $ 779,855

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss

Fair Value at

December 31,

2007

Municipal bonds .................................... $ 550,855 $ 5,865 $ (1,271) $ 555,449

Taxable short-term bond funds ......................... 306,674 — (1,040) 305,634

Auction rate securities ............................... 348,000 — — 348,000

Other ............................................. 2,948 96,095 — 99,043

Total ............................................. $1,208,477 $101,960 $ (2,311) $1,308,126

1The majority of the unrealized losses above are related to investments that have been in a continuous loss

position fewer than 12 months.

The cost bases of the Company’s taxable short-term bond funds include $6,379 and $8,719 of other than

temporary impairments as of December 31, 2008 and 2007, respectively.

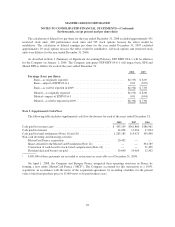

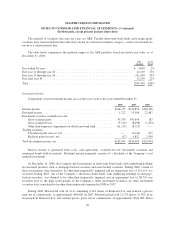

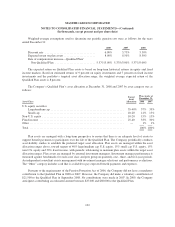

The Company holds investments in auction rate securities (“ARS”). Interest on these securities is exempt

from U.S. federal income tax and the interest rate on the securities typically resets every 35 days. The securities

are fully collateralized by student loans with guarantees, ranging from approximately 95% to 98% of principal

and interest, by the U.S. government, via the Department of Education.

Beginning on February 11, 2008, the auction mechanism that normally provided liquidity to the ARS

investments began to fail. Since mid-February 2008, all 44 investment positions in the Company’s ARS

investment portfolio have experienced failed auctions. The securities for which auctions have failed have

continued to pay interest in accordance with the contractual terms of such instruments and will continue to accrue

interest and be auctioned at each respective reset date until the auction succeeds, the issuer redeems the securities

or they mature. No ARS were sold or called by the issuer at less than par value during the year ended

December 31, 2008. Due to the lack of liquidity and management’s intent and ability to hold until recovery, the

Company reclassified its ARS portfolio from short-term available-for-sale to long-term available-for-sale

investment securities as of March 31, 2008.

As of December 31, 2008, the ARS market remained illiquid but issuer call and redemption activity in the

ARS student loan sector occurred during the year. Due to the continued lack of liquidity in the ARS market, the

Company has determined that the fair value of the ARS does not approximate par value. Accordingly, the

93