MasterCard 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.transaction details among issuers, acquirers or their designated third-party processors. Then we settle or

exchange the related funds among the issuers and acquirers. We charge a fee for these settlement and

clearing services. These fees are primarily paid by issuers.

• Switch fees are charges for the use of the MasterCard Debit Switch (the “MDS”). The MDS transmits

financial messages between acquirers and issuers and provides transaction and statistical reporting and

performs settlement between customers and other debit transaction processing networks. These fees are

primarily paid by issuers.

• Currency conversion and cross-border are volume-based revenues. Cross-border volumes are generated

by transactions in which the cardholder and merchant geography are different. We process transactions

denominated in more than 160 currencies through our global system, providing cardholders with the

ability to utilize, and merchants to accept, MasterCard cards across multiple country borders. We charge

issuers and acquirers for all cross-border volumes. We can also perform currency conversion services by

processing transactions in a merchant’s local currency and converting the amount to the currency of the

issuer, who in turn may add foreign exchange charges and post the transaction on the cardholder’s

statement in their own home currency. We charge issuers for performing currency conversion.

• Acceptance development fees are charged to issuers based on components of GDV and support our

focus on developing merchant relationships and promoting acceptance at the point of sale. These fees

are primarily U.S.-based.

• Warning bulletin fees are charged to issuers and acquirers for listing invalid or fraudulent accounts

either electronically or in paper form and for distributing this listing to merchants.

• Connectivity fees are charged to issuers and acquirers for network access, equipment, and the

transmission of authorization and settlement messages. These fees are based on the volume of

information being transmitted through and the number of connections to our systems.

• Consulting and research fees are primarily generated by MasterCard Advisors, our professional advisory

services group. We provide a wide range of consulting and research services associated with our

customers’ payment activities and programs. Research includes revenues from subscription-based

services, access to research inquiry, and peer networking services generated by our independent

financial and payments industry research group. We do not anticipate consulting and research fees

becoming a significant percentage of our business.

• Other operations fees represent various revenue streams, including cardholder services, a variety of

account and transaction enhancement services, fees for U.S. acquirers accepting transactions from

cardholders with non-U.S. issuers, compliance and penalty fees, holograms and publications.

Cardholder services are benefits provided with MasterCard-branded cards, such as insurance,

telecommunications assistance for lost cards and locating automated teller machines.

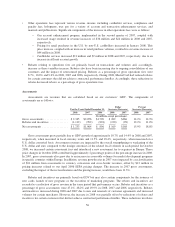

Assessment fees are primarily based on a customer’s GDV for a specific time period and the rates vary

depending on the region and nature of the transactions that generate GDV. Assessments that are based on

quarterly GDV are estimated utilizing aggregate transaction information and projected customer performance.

From time to time, the Company may introduce assessments for specific purposes such as market development

programs.

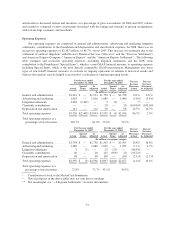

Our gross revenues from operations fees and assessments vary and are dependent on the nature of the

transactions and GDV generated from those transactions. The combination of the following transaction

characteristics for operations and/or assessment fees determines the pricing:

• Domestic or cross-border

• Credit, online debit (PIN-based), offline debit (signature-based)

• Tiered pricing with rates decreasing as customers meet incremental volume/transaction hurdles

53