MasterCard 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

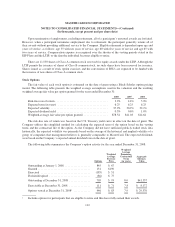

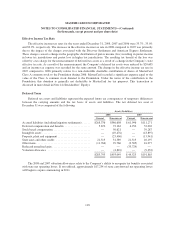

Effective Income Tax Rate

The effective income tax rates for the years ended December 31, 2008, 2007 and 2006 were 33.7%, 35.0%

and 82.9%, respectively. The decrease in the effective income tax rate in 2008 compared to 2007 was primarily

due to the impact of the charges associated with the Discover Settlement and American Express Settlement.

These charges caused a change in the geographic distribution of pretax income (loss) resulting in pretax income

in lower tax jurisdictions and pretax loss in higher tax jurisdictions. The resulting tax benefit of the loss was

offset by a tax charge for the remeasurement of deferred tax assets as a result of a change in the Company’s state

effective tax rate. As a result of the remeasurement, the Company’s deferred tax assets were reduced by $20,605

and an income tax expense was recorded for the same amount. The change in the effective income tax rate in

2007 compared to 2006 primarily relates to a non-deductible charitable contribution of shares of MasterCard

Class A common stock to the Foundation during 2006. MasterCard recorded a significant expense equal to the

value of the Class A common stock donated to the Foundation. Under the terms of the contribution to the

Foundation, this donation is generally not deductible to MasterCard for tax purposes. This transaction is

discussed in more detail in Note 14 (Stockholders’ Equity).

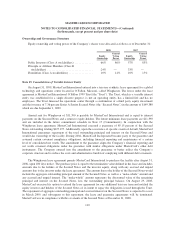

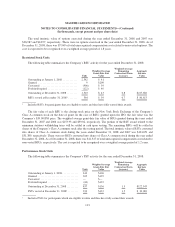

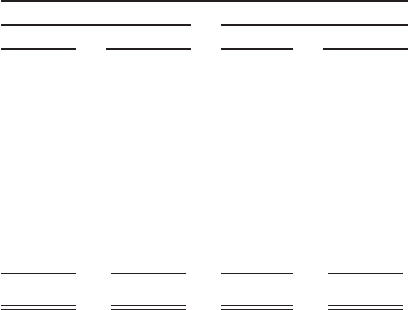

Deferred Taxes

Deferred tax assets and liabilities represent the expected future tax consequences of temporary differences

between the carrying amounts and the tax bases of assets and liabilities. The net deferred tax asset at

December 31 was comprised of the following:

Assets (Liabilities)

2008 2007

Current Non-current Current Non-current

Accrued liabilities (including litigation settlements) ...... $268,376 $386,608 $ 61,996 $111,271

Deferred compensation and benefits .................. 5,670 72,163 4,250 52,003

Stock based compensation .......................... — 50,621 — 39,287

Intangible assets .................................. — (49,476) — (43,897)

Property, plant and equipment ....................... — (23,406) — (13,941)

State taxes and other credits ........................ 21,513 31,589 21,513 40,197

Other items ...................................... (11,764) 29,760 (9,505) 16,277

Redecard unrealized gain ........................... — — (33,729) —

Valuation allowance .............................. — (4,810) — (9,332)

$283,795 $493,049 $ 44,525 $191,865

The 2008 and 2007 valuation allowances relate to the Company’s ability to recognize tax benefits associated

with state net operating losses. If not utilized, approximately $17,234 of state carryforward net operating losses

will begin to expire commencing in 2011.

118