MasterCard 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

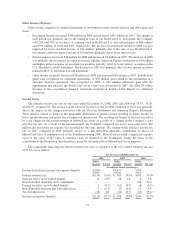

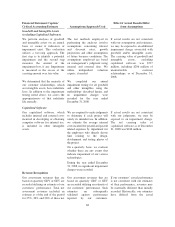

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Pensions and Postretirement

Benefit Plans

The Company maintains a

noncontributory defined benefit

pension plan with a cash balance

feature covering substantially all of

its U.S. employees hired before

July 1, 2007. This pension plan

credits participants annually with an

amount equal to a fixed percentage

of eligible pay based on age and

service, as well as providing

earnings credits based on each

participant’s account balance.

Additionally, the Company has an

unfunded nonqualified supplemental

executive retirement plan that

provides certain key employees with

supplemental retirement benefits in

excess of limits imposed on

qualified plans by U.S. tax laws.

The Company also maintains a

postretirement plan providing health

coverage and life insurance benefits

for most of its U.S. employees and

retirees.

Company management representing

the functional areas of

compensation, benefits, treasury and

finance review and approve on an

annual basis assumptions used in

the determination of the annual

costs for our pension and

postretirement plans and the

disclosure of the funded position of

our plans. Key assumptions include

the discount rate used to measure

each of the plans’ projected benefit

obligations for pension and

postretirement, the expected rate of

return on pension plan assets and

the health care cost trend rate for

our postretirement plan.

The discount rates for the

Company’s pension and

postretirement plans are subject to

change each year, consistent with

changes in high-quality, long-term

corporate bond markets. To select

a discount rate for each plan, we

performed an analysis which

matched the plans expected cash

flows (determined on PBO basis)

with spot rates developed from a

yield curve comprised of high-

grade non-callable corporate bonds

and arithmetically rounded this

result. For the pension plan, our

discount rate of 6.00% as of

December 31, 2008 is equal to the

6.00% rate used in calculating the

projected benefit obligation for

2007. For the postretirement plan,

our discount rate of 6.00% as of

December 31, 2008 is 25 basis

points less than the 6.25% rate

used in calculating the projected

benefit obligation for 2007.

Net actuarial gains and/or losses in

our benefit plans are amortized on

straight-line basis over the

expected average remaining

service of active participants

expected to benefit under the

plans.

We determine the expected return

on plan assets primarily based on

long-term historical returns in

equity and fixed income markets.

The expected rate of return on our

pension plan assets is 8.00% for

the year ended December 31, 2008

and 8.50% for the years ended

December 31, 2007 and 2006.

The Company reviews external

data and its own historical trends

to determine the health care trend

rates for postretirement medical

costs.

A quarter of a percentage point

decrease in our discount rate would

increase our pension projected

benefit obligation by $0.9 million,

and increase our postretirement

projected benefit obligation by $2.3

million. These decreases would

have a negligible effect on our

annual pension and postretirement

expense. An approximately equal,

but opposite effect would be

experienced for a quarter of a

percentage point increase in the

discount rate.

A quarter of a percentage point

increase or decrease in the expected

rate of return on plan assets would

decrease or increase the annual

pension costs by $0.4 million.

71