MasterCard 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Other operations fees represent various revenue streams, including cardholder services, compliance and

penalty fees, holograms, user pay for a variety of account and transaction enhancement services, and

manuals and publications. Significant components of the increase in other operations fees were as follows:

• Our account enhancement program, implemented in the second quarter of 2007, coupled with

increased usage resulted in revenue increases of $36 million and $24 million in 2008 and 2007,

respectively.

• Pricing for retail purchases in the U.S. by non-U.S. cardholders increased in January 2008. This

price increase, coupled with an increase in retail purchase volumes, resulted in a revenue increase of

$44 million in 2008.

• Cardholder services increased $21 million and $7 million in 2008 and 2007, respectively, due to an

increase in affluent account growth.

• Rebates relating to operations fees are primarily based on transactions and volumes and, accordingly,

increase as these variables increase. Rebates also have been increasing due to ongoing consolidation of our

customers and the impact of restructured pricing. Rebates as a percentage of gross operations fees were

8.7%, 10.0% and 9.6% in 2008, 2007 and 2006, respectively. During 2008, MasterCard had reduced rebates

for certain customers that did not achieve contractual performance hurdles. Accordingly, these reductions in

rebates decreased rebates as a percentage of gross operations fees.

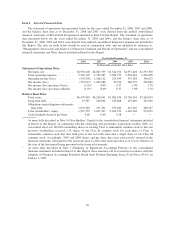

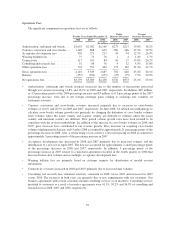

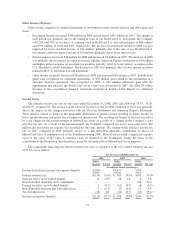

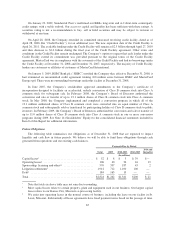

Assessments

Assessments are revenues that are calculated based on our customers’ GDV. The components of

assessments are as follows:

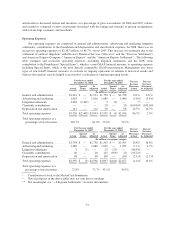

For the Years Ended December 31,

Dollar

Increase (Decrease)

Percent

Increase (Decrease)

2008 2007 2006 2008 2007 2008 2007

(In millions, except percentages)

Gross assessments ................ $2,345 $2,056 $1,790 $ 289 $266 14.1% 14.9%

Rebates and incentives ............. (1,112) (992) (894) (120) (98) 12.1% 11.0%

Net assessments .................. $1,233 $1,064 $ 896 $ 169 $168 15.9% 18.8%

Gross assessments grew partially due to GDV growth of approximately 10.7% and 14.4% in 2008 and 2007,

respectively, when measured in local currency terms and 11.5% and 18.4%, respectively, when measured on a

U.S. dollar converted basis. Assessment revenues are impacted by the overall strengthening or weakening of the

U.S. dollar and euro compared to the foreign currencies of the related local volumes in each period. In October

2008, we increased certain assessment fees and introduced a new assessment fee to acquirers in Europe. These

price changes in October 2008 contributed approximately 2 percentage points of the percentage increase in 2008.

In 2007, gross assessments also grew due to an increase in assessable volumes for market development programs

in specific countries within Europe. In addition, revenue growth rates in 2007 were impacted by a reclassification

of $31 million from assessments to currency conversion and cross-border revenues, offset by $12 million in

pricing increases related to our April 2006 SEPA pricing changes. The increase in 2007 gross assessments,

excluding the impact of the reclassifications and the pricing increase, would have been 11.3%.

Rebates and incentives are primarily based on GDV but may also contain components for the issuance of

new cards, launch of new programs or the execution of marketing programs. The rebates and incentives are

recorded as a reduction of gross revenue in the same period that performance occurs. Rebates and incentives as a

percentage of gross assessments were 47.4%, 48.2% and 49.9% in 2008, 2007 and 2006, respectively. Rebates

and incentives increased during 2008 and 2007 due to new and renewals of customer agreements and increased

volumes for certain merchants. However, the increase in 2008 was partially offset by reductions of rebates and

incentives for certain customers that did not achieve contractual performance hurdles. These reductions in rebates

56