MasterCard 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

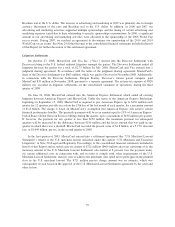

Other Income (Expense)

Other income (expense) is comprised primarily of investment income, interest expense and other gains and

losses.

• Investment income decreased $348 million in 2008 and increased $405 million in 2007. The change in

each period was primarily due to the timing of sales of our RedeCard S.A. investment; the Company

sold 22% and 78% of its shares of common stock in RedeCard S.A, and realized gains of $86 million

and $391 million, in 2008 and 2007, respectively. The decrease in investment income in 2008 was also

impacted by lower dividend income of $14 million, primarily due to the sale of our RedeCard S.A.

investment, and lower interest income of $30 million, primarily due to lower interest rates.

• Interest expense increased $46 million in 2008 and decreased $4 million in 2007. The increase in 2008

was primarily due to interest accretion associated with the American Express Settlement of $44 million

and higher interest expense on uncertain tax positions partially offset by lower interest accretion on the

U.S. Merchant Lawsuit Settlement. The decrease in 2007 was primarily due to lower interest accretion

related to the U.S. Merchant Lawsuit Settlement.

• Other income (expense) decreased $18 million in 2008 and increased $89 million in 2007. In both years

gains were recognized on settlement agreements. A $75 million gain related to the termination of a

customer business agreement was recognized in 2008. A $90 million settlement gain with the

organization that operates the World Cup soccer events was recognized in 2007. See Note 24 (Other

Income) to the consolidated financial statements included in Item 8 of this Report for additional

discussion.

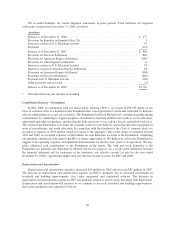

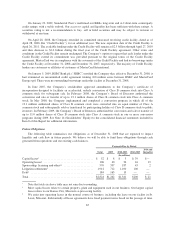

Income Taxes

The effective income tax rate for the years ended December 31, 2008, 2007 and 2006 was 33.7%, 35.0%

and 82.9%, respectively. The decrease in the effective income tax rate in 2008 compared to 2007 was primarily

due to the impact of the charges associated with the Discover Settlement and American Express Settlement.

These charges caused a change in the geographic distribution of pretax income resulting in pretax income in

lower tax jurisdictions and pretax loss in higher tax jurisdictions. The resulting tax benefit of the loss was offset

by a tax charge for the remeasurement of deferred tax assets as a result of a change in the Company’s state

effective tax rate. As a result of the remeasurement, the Company’s deferred tax assets were reduced by $20

million and an income tax expense was recorded for the same amount. The change in the effective income tax

rate in 2007 compared to 2006 primarily relates to a non-deductible charitable contribution of shares of

MasterCard Class A common stock to the Foundation during 2006. MasterCard recorded a significant expense

equal to the value of the Class A common stock we donated to the Foundation. Under the terms of the

contribution to the Foundation, this donation is generally not deductible to MasterCard for tax purposes.

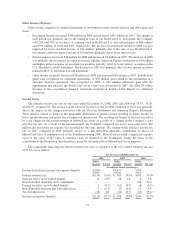

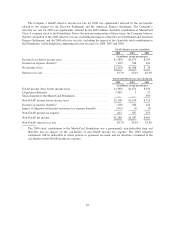

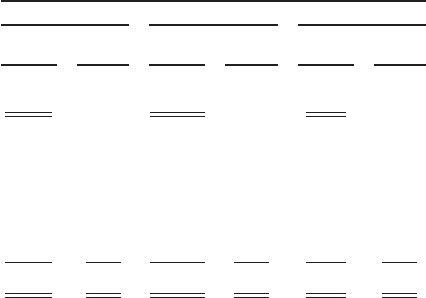

The components impacting the effective income tax rates as compared to the U.S. federal statutory tax rate

of 35.0% are as follows:

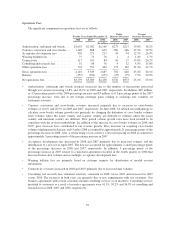

For the years ended December 31,

2008 2007 2006

Dollar

Amount Percent

Dollar

Amount Percent

Dollar

Amount Percent

(In millions, except percentages)

Income (loss) before income tax expense (benefit) ...... $(383) $1,671 $294

Federal statutory tax .............................. $(134) 35.0% $ 585 35.0% $103 35.0%

State tax effect, net of federal benefit ................ 11 (2.9) 28 1.6 6 1.8

Non-deductible charitable stock contribution .......... — — — — 138 47.0

Foreign tax effect, net of federal benefit .............. 2 (0.5) (12) (0.7) (6) (1.9)

Non-deductible expenses and other differences ......... 2 (0.7) (3) (0.2) 13 4.4

Tax exempt income .............................. (10) 2.8 (12) (0.7) (10) (3.4)

Income tax expense (benefit) ....................... $(129) 33.7% $ 586 35.0% $244 82.9%

61