MasterCard 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

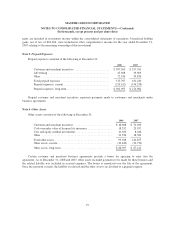

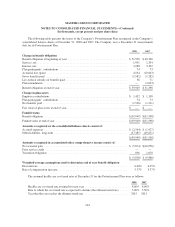

Additions to capitalized software primarily relate to internal projects associated with system enhancements

or infrastructure improvements. Amortizable customer relationships were added in 2008 due to the acquisition of

businesses. Certain intangible assets, including amortizable and unamortizable customer relationships and

trademarks and tradenames, are denominated in foreign currencies. As such, the change in intangible assets

includes a component attributable to foreign currency translation.

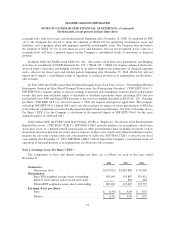

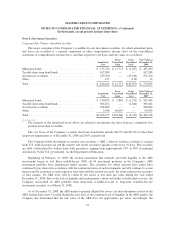

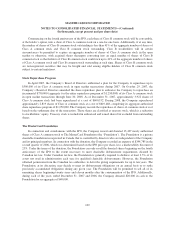

Amortization and impairment expense on the assets above amounted to the following for the years ended

December 31:

2008 2007 2006

Amortization .................................... $52,909 $48,331 $56,337

Capitalized software impairments ................... $ 1,011 $ 298 $ 614

No impairment charges for intangible assets other than capitalized software were recorded in 2008, 2007 or

2006.

The following table sets forth the estimated future amortization expense on amortizable intangible assets for

the years ending December 31:

2009 ............................................................ $ 59,421

2010 ............................................................ 49,445

2011 ............................................................ 29,381

2012 ............................................................ 15,778

2013 and thereafter ................................................. 33,967

$187,992

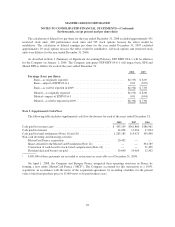

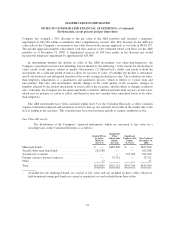

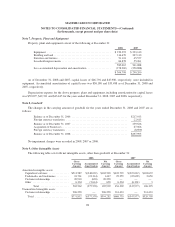

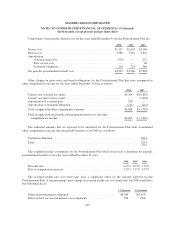

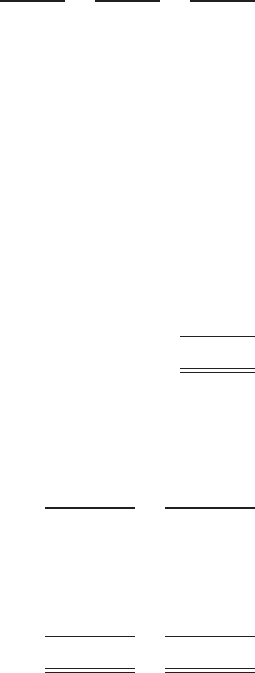

Note 10. Accrued Expenses

Accrued expenses consist of the following at December 31:

2008 2007

Customer and merchant incentives ....................... $ 526,722 $ 497,281

Personnel costs ...................................... 296,497 296,031

Advertising ......................................... 89,567 160,232

Income taxes ........................................ 20,685 10,028

Other .............................................. 98,590 107,985

Total accrued expenses ................................ $1,032,061 $1,071,557

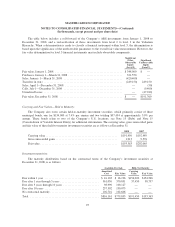

Note 11. Pension, Savings Plan and Other Benefits

The Company maintains a non-contributory, qualified, defined benefit pension plan (the “Qualified Plan”)

with a cash balance feature covering substantially all of its U.S. employees hired before July 1, 2007. In March

2007, the Company announced it was modifying the Qualified Plan by maintaining employee pay credit

percentages at the 2007 level, eliminating funding for employees to purchase healthcare in retirement and

limiting plan participation to employees hired before July 1, 2007. These changes reduced the benefit obligation

of the Qualified Plan measured as of December 31, 2007 by approximately $16,794. The Qualified Plan

experienced a steep decline in the fair value of plan assets in 2008 which resulted in significant increases in the

99