MasterCard 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in consolidated financial

statements—an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 amends ARB No. 51 “Consolidated

Financial Statements” and establishes accounting and reporting standards that require non-controlling interests

(previously referred to as minority interests) to be reported as a component of equity. In addition, changes in a

parent’s ownership interest while the parent retains its controlling interest are accounted for as equity

transactions, and upon a loss of control, retained ownership interests are remeasured at fair value, with any gain

or loss recognized in earnings. SFAS 160 is effective for the Company on January 1, 2009, except for the

presentation and disclosure requirements, which will be applied retrospectively. Early adoption is not allowed.

The Company does not expect that the adoption of SFAS 160 will have a material impact on the Company’s

consolidated results of operations or financial position.

In February 2008, the FASB issued Staff Position 157-2 (“FSP 157-2”). FSP 157-2 permits delayed

adoption of SFAS 157 for certain non-financial assets and liabilities, which are not recognized at fair value on a

recurring basis, until fiscal years and interim periods beginning after November 15, 2008. As permitted by FSP

157-2, the Company has elected to delay the adoption of SFAS 157 for qualifying non-financial assets and

liabilities, such as property, plant and equipment, goodwill and intangible assets. The Company does not believe

the adoption of SFAS 157 for its non-financial assets and liabilities, that are not recognized at fair value on a

recurring basis, will have a material impact on the Company’s consolidated results of operations or financial

position.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities an amendment of FASB Statement No. 133” (“SFAS 161”). SFAS 161 requires enhanced disclosures

about an entity’s derivative and hedging activities in an effort to improve the transparency of financial reporting

and is effective for fiscal years and interim periods beginning after November 15, 2008. SFAS 161 will not

impact the Company’s consolidated results of operations or financial position as its requirements are disclosure-

only in nature.

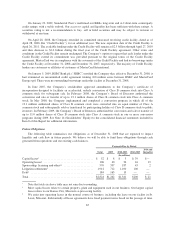

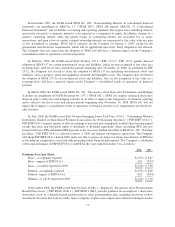

In June 2008, the FASB issued Staff Position Emerging Issues Task Force 03-6-1, “Determining Whether

Instruments Granted in Share-Based Payment Transactions Are Participating Securities” (“FSP EITF 03-6-1”).

FSP EITF 03-6-1 requires entities to allocate earnings to unvested and contingently issuable share-based payment

awards that have non-forfeitable rights to dividends or dividend equivalents when calculating EPS and also

present both basic EPS and diluted EPS pursuant to the two-class method described in SFAS No. 128, “Earnings

per Share”. FSP EITF 03-6-1 is effective January 1, 2009 and requires retrospective application. The Company

will adopt FSP EITF 03-6-1 during 2009 and is not able to project its impact on future presentations of EPS due

to the inherent complexities associated with projecting future financial performance. The Company’s calculation

of the expected impact of FSP EITF 03-6-1 on EPS for the years ended December 31 is as follows:

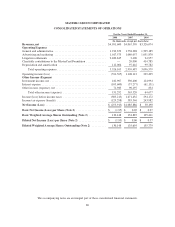

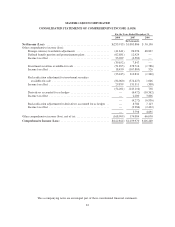

2008 2007

Earnings (Loss) per Share:

Basic—as originally reported ................................................. $(1.95) $ 8.05

Basic—impact of EITF 03-6-1 ................................................ 0.01 (0.07)

Basic—as will be reported in 2009 ............................................ $(1.94) $ 7.98

Diluted—as originally reported ............................................... $(1.95) $ 8.00

Diluted—impact of EITF 03-6-1 .............................................. 0.01 (0.04)

Diluted—as will be reported in 2009 ........................................... $(1.94) $ 7.96

In December 2008, the FASB issued Staff Position 132(R)-1, “Employers’ Disclosures about Postretirement

Benefit Plan Assets” (“FSP SFAS 132R-1”). FSP SFAS 132R-1 provides guidance on an employer’s disclosures

about plan assets of a defined benefit pension plan or other postretirement plan, including disclosure of how

investment allocation decisions are made, major categories of plan assets, inputs and valuation techniques used to

73