MasterCard 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

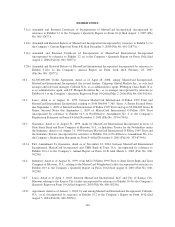

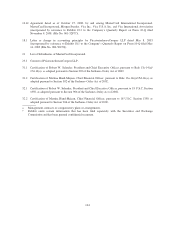

Reconciliation to Net Income, Earnings Per Share and Total Operating Expenses*

This annual report contains forward-looking information pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without

limitation, the ability of MasterCard to advance commerce in markets around the world, continue the trend of growth being led by expanding use and acceptance of MasterCard-branded cards in markets

outside the United States, and help its customers optimize their portfolios, maximize efficiencies, mitigate risks and reduce charge-offs; and the expectation that net revenue growth in 2009 will be

restrained by recessionary conditions in many economies. Although MasterCard believes that its expectations are based on reasonable assumptions, it can give no assurance that its objectives will be

achieved. Actual results may differ materially from such forward-looking statements for a number of reasons, including changes in financial condition, estimates, expectations or assumptions, or changes

in general economic or industry conditions, or other circumstances such as those set forth in MasterCard Incorporated’s filings with the Securities and Exchange Commission (SEC), including its Annual

Report on Form 10-K for the year ended December 31, 2008, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that it has filed with the SEC. MasterCard disclaims any obligation to

update publicly or revise any forward-looking information.

Year-Over-Year

For the year ended 12/31/08 For the year ended 12/31/07 Growth

Special As Special As As

($ million except percentages) Actual Items Adjusted Actual Items Adjusted Adjusted

Revenues, Net $ 4,992 $ — $ 4,992 $ 4,068 — $ 4,068 22.7%

Operating Expenses

General and Administrative 1,914 — 1,914 1,758 — 1,758 8.8%

Advertising and Marketing 1,018 — 1,018 1,080 — 1,080 (5.8)%

Litigation Settlements 2,483 2,4831 — 3 31 — NM

Charitable Contributions to

The MasterCard Foundation — — — 20 — 20 (100.0)%

Depreciation and Amortization 112 — 112 98 — 98 14.7%

Total Operating Expenses 5,526 2,483 3,043 2,959 3 2,956 2.9%

Operating Income (loss) (535) 2,483 1,948 1,108 3 1,111 75.3%

Operating Margin (10.7)% — 39.0% 27.2% — 27.3% 11.7 ppt.

Other Income (expense)

Investment Income, Net 183 — 183 530 — 530 (65.5)%

Interest Expense (104) — (104) (57) — (57) 80.9%

Other Expense, Net 72 752 (3) 90 903 — NM

Total Other Income (expense) 151 75 76 563 90 473 (83.9)%

Income (loss) before Income Taxes (383) 2,408 2,025 1,671 (87) 1,584 27.8%

Income Tax Expense (benefi t) (129) 914 785 586 30 556 41.2%

Net Income (loss) $ (254) $ 1,494 $ 1,239 $ 1,086 $ (57) $ 1,029 20.4%

Basic Net Income (loss) per Share $ (1.95) $ 11.47 $ 9.52 $ 8.05 $ (0.42) $ 7.63 24.8%

Diluted Net Income (loss) per Share $ (1.95) $ 11.40 $ 9.45 $ 8.00 $ (0.42) $ 7.58 24.7%

(1) Litigation settlements.

(2) Gain from the termination of a customer business agreement.

(3) Other income related to a settlement agreement to discontinue the company’s sponsorship of the 2010 and 2014 World Cup soccer events.

NM = not meaningful

*Note that figures in this table may not sum due to rounding.