MasterCard 2008 Annual Report Download - page 121

Download and view the complete annual report

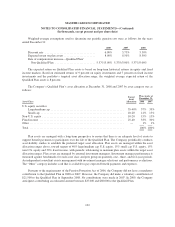

Please find page 121 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

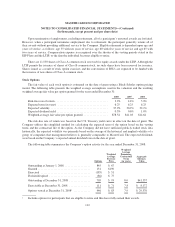

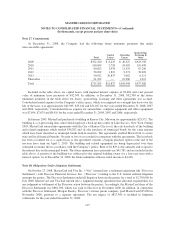

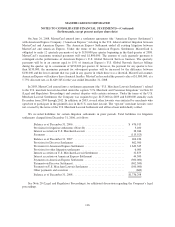

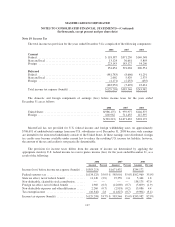

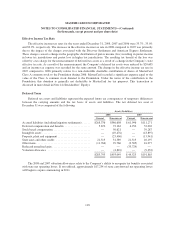

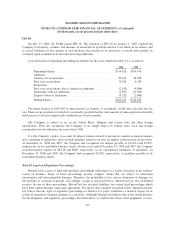

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

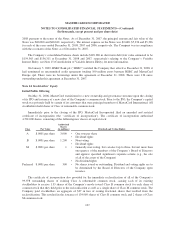

MasterCard International has determined that it is the primary beneficiary of the Trust as a result of the

guarantee of the principal and interest on the Secured Notes described above which potentially exposes the

Company to the majority of the expected losses of the Trust. Accordingly, as of December 31, 2008, the

Company’s consolidated balance sheets included $154,000 in short-term municipal bonds held by the Trust,

$149,380 in short-term debt and $4,620 of minority interest relating to the equity in the Trust held by a third

party. The redemption value of the minority interest approximates its carrying value and will be redeemed by the

minority interest holders upon maturity of the Secured Notes. Leasehold improvements for Winghaven are

amortized over the economic life of the improvements. For the years ended December 31, 2008, 2007 and 2006,

the consolidation had no impact on net income. However, interest income and interest expense were each

increased by $11,390 in each of the years ended December 31, 2008, 2007 and 2006. The Company did not

provide any financial or other support that it was not contractually required to provide during each of the years

ended December 31, 2008, 2007, and 2006.

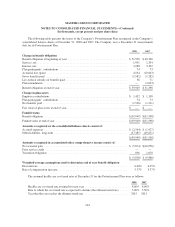

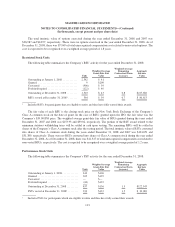

Note 16. Share Based Payment and Other Benefits

Prior to May 2006, the Company had never granted stock-based compensation awards to employees. In

contemplation of the Company’s IPO and to better align Company management with a new ownership and

governance structure (see Note 14 (Stockholders’ Equity)), the Company implemented the MasterCard

Incorporated 2006 Long-Term Incentive Plan (the “LTIP”). The LTIP is a shareholder-approved omnibus plan

that permits the grant of various types of equity awards to employees. In May 2006, the Company adopted SFAS

123R, upon granting of awards under the LTIP.

Historically, the Company provided cash compensation to certain employees under its EIP Plans. The EIP

Plans were cash-based performance unit plans, in which participants received grants of units with a value

contingent on the achievement of the Company’s long-term performance goals. The final value of units under the

EIP Plans was calculated based on the Company’s performance over a three-year period. The performance goals

were not, in whole or in part, based upon the Company’s stock price as there was no trading of the Company’s

stock at the time the goals were set. Upon completion of the three-year performance period, participants received

a cash payment equal to 80 percent of the award earned. The remaining 20 percent of the award was paid upon

completion of two additional years of service. The performance units vested over three and five year periods.

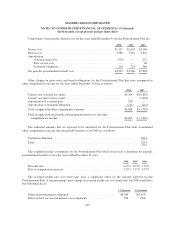

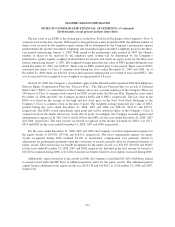

During 2006, in connection with the IPO, the Company offered employees who had outstanding awards

under the EIP Plans the choice of converting certain of those awards to restricted stock units (“RSUs”). Certain

other awards under the EIP Plans were mandatorily converted to RSUs. In each case, a 20 percent premium was

applied in the conversion. Approximately three hundred participants converted their existing awards under the

EIP Plans to RSUs in conjunction with the Company’s IPO in May 2006. The RSUs resulting from this

conversion retained the same vesting schedule as the original EIP Plan awards. The Company’s liability related

to the EIP Plans at December 31, 2008 and 2007 was $291 and $611, respectively, and the expense was $146,

$372 and $28,024 for the years ending December 31, 2008, 2007 and 2006, respectively.

The Company has granted RSUs, non-qualified stock options (“options”) and Performance Stock Units

(“PSUs”) under the LTIP. The RSUs generally vest after three to four years. The options, which expire ten years

from the date of grant, vest ratably over four years from the date of grant. The PSUs generally vest after three

years. Additionally, the Company made a one-time grant to all non-executive management employees upon the

IPO for a total of approximately 440 RSUs (the “Founders’ Grant”). The Founders’ Grant RSUs will vest three

years from the date of grant. The Company uses the straight-line method of attribution for expensing equity

awards. Compensation expense is recorded net of estimated forfeitures. Estimates are adjusted as appropriate.

111