MasterCard 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

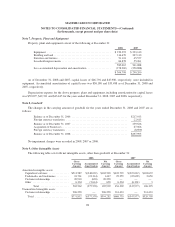

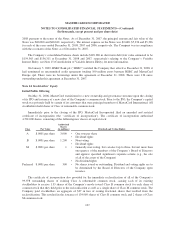

The accumulated benefit obligation of the Pension Plans was $196,536 and $193,421 at December 31, 2008

and 2007, respectively.

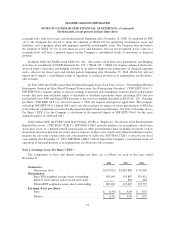

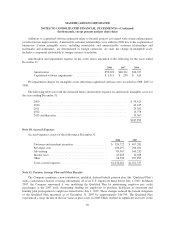

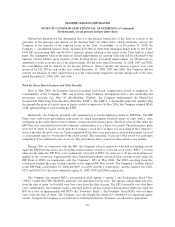

The projected benefit obligation and fair value of plan assets of the Pension Plans with a projected benefit

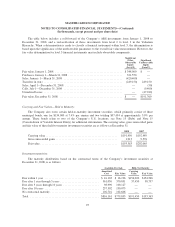

obligation in excess of plan assets were as follows at December 31:

2008 2007

Projected benefit obligation ....................................... $217,035 $214,805

Accumulated benefit obligation .................................... 196,536 193,421

Fair value of plan assets .......................................... 148,846 195,966

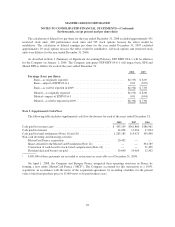

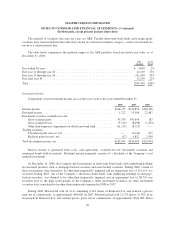

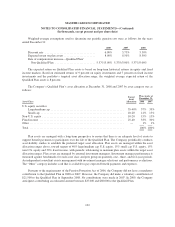

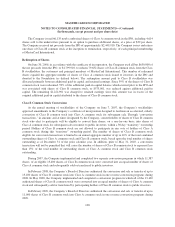

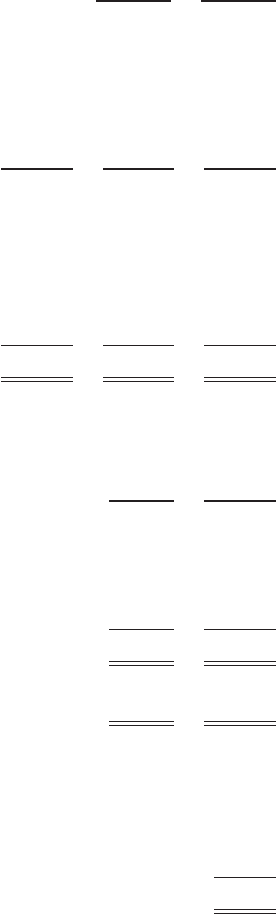

Components of net periodic pension costs were as follows for each of the years ended December 31:

2008 2007 2006

Service cost .......................................... $19,980 $ 18,866 $ 18,599

Interest cost .......................................... 13,638 12,191 10,869

Expected return on plan assets ............................ (16,030) (16,366) (15,321)

Amortization:

Actuarial loss ..................................... 1,675 — 1,199

Prior service credit ................................. (2,329) (229) (206)

Settlement gain .................................... (773) — —

Net periodic pension cost ................................ $16,161 $ 14,462 $ 15,140

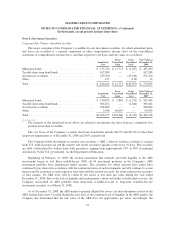

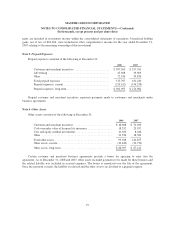

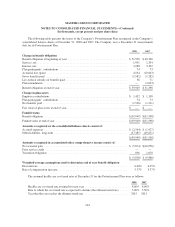

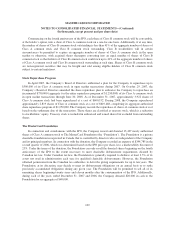

Other Changes in Plan Assets and Benefit Obligations Recognized in Other Comprehensive Income for the

years ended December 31:

2008 2007

Settlement gain ................................................... $ 773 $ —

Current year actuarial loss .......................................... 56,386 17,705

Amortization of actuarial loss ....................................... (1,675) —

Current year prior service credit ..................................... — (16,793)

Amortization of prior service credit ................................... 2,329 229

Total recognized in other comprehensive income ........................ $57,813 $ 1,141

Total recognized in net periodic benefit cost and other comprehensive

income ....................................................... $73,974 $ 15,603

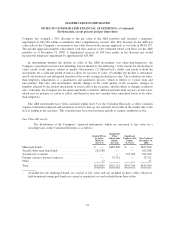

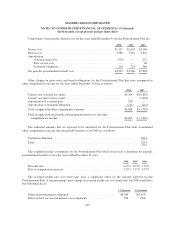

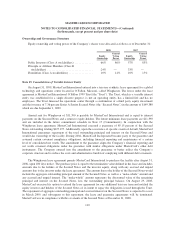

The estimated amounts that are expected to be amortized from accumulated other comprehensive income

into net periodic benefit cost in 2009 are as follows:

Actuarial loss .............................................................. $8,670

Prior service credit .......................................................... (2,286)

Total ..................................................................... $6,384

101