MasterCard 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

MasterCard is aware that regulatory authorities and/or central banks in certain other jurisdictions including

Brazil, Colombia, Czech Republic, Mexico, Venezuela, Estonia, Israel, Italy, Norway, Portugal, Switzerland and

Turkey are reviewing MasterCard’s and/or its members’ interchange fees and/or related practices (such as the

“honor all cards” rule) and may seek to regulate the establishment of such fees and/or such practices.

Note 21. Settlement and Travelers Cheque Risk Management

MasterCard International’s rules generally guarantee the payment of certain MasterCard, Cirrus and

Maestro branded transactions between its principal members. The term and amount of the guarantee are

unlimited. Settlement risk is the exposure to members under MasterCard International’s rules (“Settlement

Exposure”), due to the difference in timing between the payment transaction date and subsequent settlement.

Settlement Exposure is estimated using the average daily card charges during the quarter multiplied by the

estimated number of days to settle. The Company has global risk management policies and procedures, which

include risk standards, to provide a framework for managing the Company’s settlement risk. Member-reported

transaction data and the transaction clearing data underlying the settlement risk calculation may be revised in

subsequent reporting periods.

In the event that MasterCard International effects a payment on behalf of a failed member, MasterCard

International may seek an assignment of the underlying receivables. Subject to approval by the Board of

Directors, members may be charged for the amount of any settlement loss incurred during the ordinary activities

of the Company.

MasterCard requires certain members that are not in compliance with the Company’s risk standards in effect

at the time of review to post collateral, typically in the form of letters of credit and bank guarantees. This

requirement is based on management review of the individual risk circumstances for each member that is out of

compliance. In addition to these amounts, MasterCard holds collateral to cover variability and future growth in

member programs. The Company also holds collateral to pay merchants in the event of merchant bank/acquirer

failure. Although it is not contractually obligated under MasterCard International’s rules to effect such payments,

the Company may elect to do so to protect brand integrity. MasterCard monitors its credit risk portfolio on a

regular basis and the adequacy of collateral on hand. Additionally, from time to time, the Company reviews its

risk management methodology and standards. As such, the amounts of estimated settlement risk are revised as

necessary.

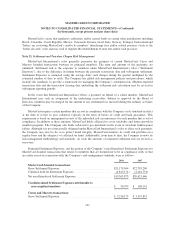

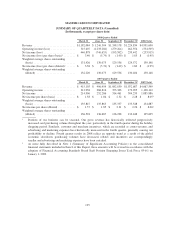

Estimated Settlement Exposure, and the portion of the Company’s uncollateralized Settlement Exposure for

MasterCard-branded transactions that relates to members that are deemed not to be in compliance with, or that

are under review in connection with, the Company’s risk management standards, were as follows:

2008 2007

MasterCard-branded transactions:

Gross Settlement Exposure ................................... $21,179,044 $22,783,200

Collateral held for Settlement Exposure ......................... (1,813,171) (2,161,754)

Net uncollateralized Settlement Exposure ....................... $19,365,873 $20,621,446

Uncollateralized Settlement Exposure attributable to

non-compliant members ................................. $ 56,795 $ 108,141

Cirrus and Maestro transactions:

Gross Settlement Exposure ................................... $ 3,236,175 $ 3,347,853

131