MasterCard 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

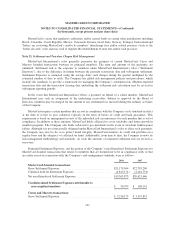

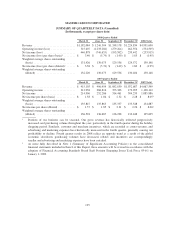

MASTERCARD INCORPORATED

SUMMARY OF QUARTERLY DATA (Unaudited)

(In thousands, except per share data)

2008 Quarter Ended

March 31 June 30 September 30 December 3112008 Total

Revenue ............................. $1,182,084 $ 1,246,504 $1,338,178 $1,224,834 $4,991,600

Operating income (loss) ................. 515,607 (1,233,204) (279,264) 462,356 (534,505)

Net income (loss) ...................... 446,878 (746,653) (193,582) 239,442 (253,915)

Net income (loss) per share (basic)2........ $ 3.40 $ (5.74) $ (1.49) $ 1.85 $ (1.95)

Weighted average shares outstanding

(basic) ............................. 131,426 130,073 129,536 129,572 130,148

Net income (loss) per share (diluted)2...... $ 3.38 $ (5.74) $ (1.49) $ 1.84 $ (1.95)

Weighted average shares outstanding

(diluted) ........................... 132,220 130,073 129,536 130,404 130,148

2007 Quarter Ended

March 31 June 30 September 30 December 3112007 Total

Revenue ............................. $ 915,103 $ 996,959 $1,082,850 $1,072,687 $4,067,599

Operating income ...................... 313,938 268,816 353,303 172,055 1,108,112

Net income ........................... 214,906 252,286 314,461 304,233 1,085,886

Net income per share (basic) ............. $ 1.58 $ 1.86 $ 2.32 $ 2.28 $ 8.052

Weighted average shares outstanding

(basic) ............................. 135,847 135,865 135,357 133,548 134,887

Net income per share (diluted) ............ $ 1.57 $ 1.85 $ 2.31 $ 2.26 $ 8.002

Weighted average shares outstanding

(diluted) ........................... 136,594 136,687 136,228 134,448 135,695

1Portions of our business can be seasonal. Our gross revenue has historically reflected progressively

increased card purchasing volume throughout the year, particularly in the fourth quarter during the holiday

shopping period. Similarly, customer and merchant incentives, which are recorded as contra-revenue, and

advertising and marketing expenses have historically increased in the fourth quarter, generally causing our

profitability to decline. Fourth quarter results in 2008 reflect an opposite trend as a result of the global

economic slowdown; purchasing volumes have decreased, rebates and incentives are correspondingly

smaller and advertising and marketing expenses have been curtailed.

2As more fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated

financial statements included in Item 8 of this Report, these amounts will be revised in accordance with the

adoption of Financial Accounting Standards Board Staff Position Emerging Issues Task Force 03-6-1 on

January 1, 2009.

135