MasterCard 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

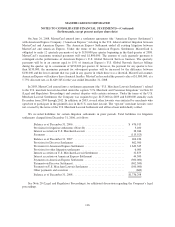

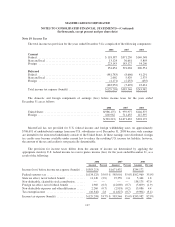

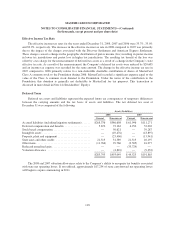

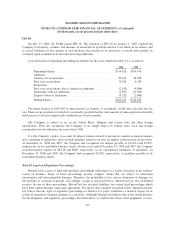

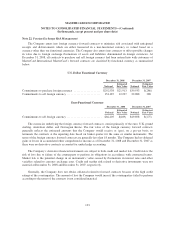

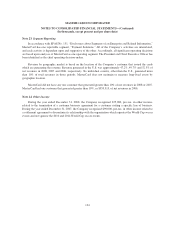

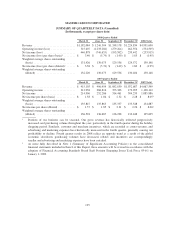

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

On June 9, 2006, MasterCard answered the complaint and moved to dismiss or, alternatively, moved to

strike the pre-2004 damage claims that were contained in the First Amended Class Action Complaint and moved

to dismiss the Section 2 claims that were brought in the individual merchant complaints. On September 7, 2007,

Magistrate Judge Orenstein issued a report and recommendation that MasterCard’s motion to dismiss the

pre-2004 damages claims should be granted in its entirety. On January 8, 2008, the district court adopted the

magistrate judge’s report and recommendation and dismissed the plaintiffs’ pre-2004 damage claims. On

January 11, 2008, the magistrate judge issued a report and recommendation that MasterCard’s motion to dismiss

the individual merchant defendants’ Section 2 claims should be denied. On February 15, 2008, MasterCard filed

objections to the magistrate judge’s report and recommendation. On May 14, 2008, the court issued an order

rejecting MasterCard’s objections and adopted the magistrate’s recommendation denying MasterCard’s motion

to dismiss. Fact discovery has been proceeding and was generally completed by November 21, 2008. Briefing on

class certification was completed on January 29, 2009, and briefing on case dispositive motions is to be

completed by March 8, 2010. No trial date has been scheduled. On July 5, 2006, the group of purported class

plaintiffs filed a supplemental complaint alleging that MasterCard’s initial public offering of its Class A

Common Stock in May 2006 (the “IPO”) and certain purported agreements entered into between MasterCard and

its member financial institutions in connection with the IPO: (1) violate Section 7 of the Clayton Act because

their effect allegedly may be to substantially lessen competition, (2) violate Section 1 of the Sherman Act

because they allegedly constitute an unlawful combination in restraint of trade and (3) constitute a fraudulent

conveyance because the member banks are allegedly attempting to release without adequate consideration from

the member banks MasterCard’s right to assess the member banks for MasterCard’s litigation liabilities in these

interchange-related litigations and in other antitrust litigations pending against it. The plaintiffs seek unspecified

damages and an order reversing and unwinding the IPO. On September 15, 2006, MasterCard moved to dismiss

all of the claims contained in the supplemental complaint. On February 12, 2008, Magistrate Judge Orenstein

issued a report and recommendation that granted in part and denied in part MasterCard’s motion to dismiss.

Specifically, Magistrate Orenstein recommended that MasterCard’s motion to dismiss plaintiffs’ fraudulent

conveyance claims be granted but he allowed plaintiffs leave to replead those claims. Magistrate Orenstein

otherwise recommended the denial of all other aspects of MasterCard’s motion to dismiss plaintiffs’ Section 7

and Section 1 claims described above. On April 4, 2008, MasterCard filed objections to Magistrate Orenstein’s

report and recommendation. On November 25, 2008, the court agreed with MasterCard’s objections and reversed

the portion of Magistrate Orenstein’s report that had recommended the denial of MasterCard’s motion to dismiss.

As such, the court granted MasterCard’s motion to dismiss the plaintiffs’ supplemental complaint in its entirety

with leave to file an amended complaint. On January 29, 2009, the class plaintiffs repled their complaint that is

directed at MasterCard’s IPO by filing a First Amended Supplemental Class Action Complaint. The causes of

action in the complaint generally mirror those in the plaintiffs’ original IPO-related complaint although the

plaintiffs have attempted to expand their factual allegations based upon discovery that has been garnered in the

case. The class plaintiffs seek unspecified damages and injunctive relief including, but not limited to, an order

reversing and unwinding the IPO. MasterCard’s time in which to answer or move to dismiss the complaint is

currently running. The parties have also entered into court-recommended mediation.

On October 10, 2008, the Antitrust Division of the DOJ issued a CID to MasterCard and other payment

industry participants seeking information regarding certain rules relating to merchant acceptance, particularly

with respect to merchants’ ability to steer customers to payment forms preferred by merchants. The CID seeks

documents, data and narrative responses to several interrogatory and document requests which focus on reasons

merchants may have decreased their acceptance of certain cards, information on penetration rates by merchant

category, co-brand cards and transactions in various countries. MasterCard is cooperating with the DOJ in

connection with the CID.

126