MasterCard 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

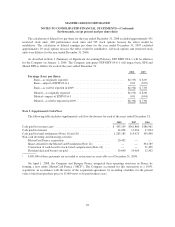

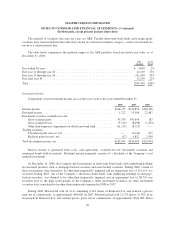

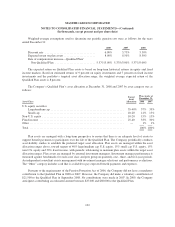

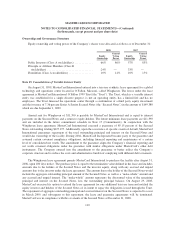

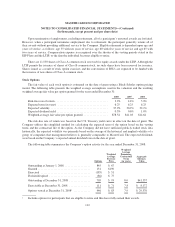

Weighted-average assumptions used to determine net periodic pension cost were as follows for the years

ended December 31:

2008 2007 2006

Discount rate ................................... 6.00% 5.75% 5.50%

Expected return on plan assets ...................... 8.00% 8.50% 8.50%

Rate of compensation increase—Qualified Plan/

Non-Qualified Plan ............................ 5.37%/5.00% 5.37%/5.00% 5.37%/5.00%

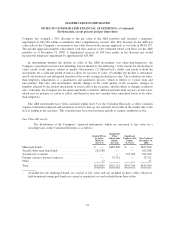

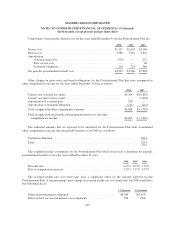

The expected return on Qualified Plan assets is based on long-term historical returns in equity and fixed

income markets. Based on estimated returns of 9 percent on equity investments and 7 percent on fixed income

investments and the portfolio’s targeted asset allocation range, the weighted average expected return of the

Qualified Plan assets is 8 percent.

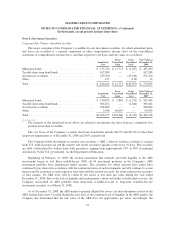

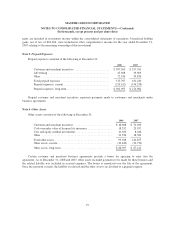

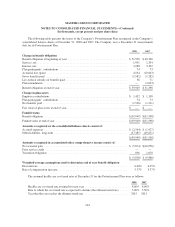

The Company’s Qualified Plan’s asset allocation at December 31, 2008 and 2007 by asset category was as

follows:

Asset Class

Target

Asset

Allocation

Plan Assets at

December 31,

2008 2007

U.S. equity securities

Large/medium cap ................................................... 35-40% 37% 39%

Small cap .......................................................... 10-20 14% 15%

Non-U.S. equity ......................................................... 10-20 15% 15%

Fixed income ........................................................... 25-40 33% 30%

Other .................................................................. — 1% 1%

Total .................................................................. 100% 100%

Plan assets are managed with a long-term perspective to ensure that there is an adequate level of assets to

support benefit payments to participants over the life of the Qualified Plan. The Company periodically conducts

asset-liability studies to establish the preferred target asset allocation. Plan assets are managed within the asset

allocation ranges above, toward targets of 40% large/medium cap U.S. equity, 15% small cap U.S. equity, 15%

non-U.S. equity and 30% fixed income, with periodic rebalancing to maintain plan assets within the target asset

allocation ranges. Plan assets are managed by external investment managers. Investment manager performance is

measured against benchmarks for each asset class and peer group on quarterly, one-, three- and five-year periods.

An independent consultant assists management with investment manager selections and performance evaluations.

The “Other” category includes cash that is available to pay expected benefit payments and expenses.

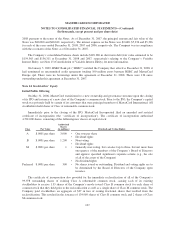

Pursuant to the requirements of the Pension Protection Act of 2006, the Company did not have a mandatory

contribution to the Qualified Plan in 2008 or 2007. However, the Company did make a voluntary contribution of

$21,500 to the Qualified Plan in September 2008. No contributions were made in 2007. In 2009, the Company

anticipates contributing an estimated amount between $25,000 and $60,000 to the Qualified Plan.

102