MasterCard 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

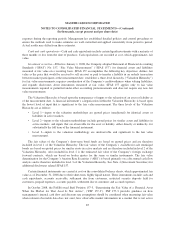

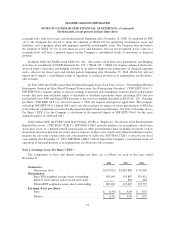

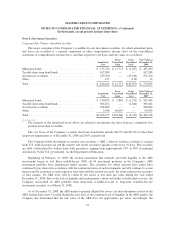

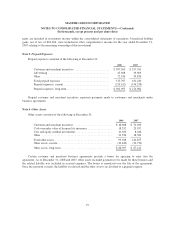

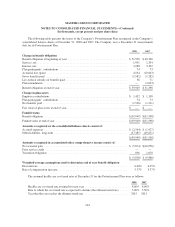

The table below includes a roll-forward of the Company’s ARS investments from January 1, 2008 to

December 31, 2008, and a reclassification of these investments from level 2 to level 3 in the Valuation

Hierarchy. When a determination is made to classify a financial instrument within level 3, the determination is

based upon the significance of the unobservable parameters to the overall fair value measurement. However, the

fair value determination for level 3 financial instruments may include observable components.

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair value, January 1, 2008 ............................................... $348,000 $ —

Purchases, January 1—March 31, 2008 ...................................... 321,550 —

Sales, January 1—March 31, 2008 ......................................... (420,400) —

Transfers in (out) ....................................................... (249,150) 249,150

Sales, April 1—December 31, 2008 ........................................ — (50)

Calls, July 1—December 31, 2008 ......................................... — (9,400)

Unrealized losses ....................................................... — (47,940)

Fair value, December 31, 2008 ............................................ $ — $191,760

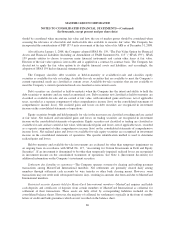

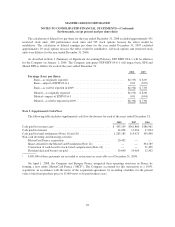

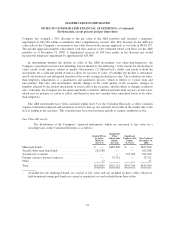

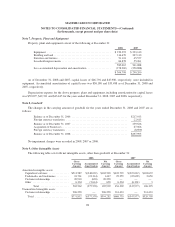

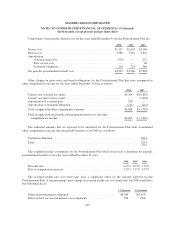

Carrying and Fair Values—Held to Maturity:

The Company also owns certain held-to-maturity investment securities, which primarily consist of three

municipal bonds, one for $154,000 at 7.4% per annum and two totaling $37,434 at approximately 5.0% per

annum. These bonds relate to two of the Company’s U.S. locations; see Note 13 (Debt) and Note 15

(Consolidation of Variable Interest Entity) for additional information. The carrying value, gross unrecorded gains

and fair value of these held-to-maturity investment securities are as follows at December 31:

2008 2007

Carrying value .................................................. $191,450 $192,489

Gross unrecorded gains ........................................... 1,913 9,576

Fair value ...................................................... $193,363 $202,065

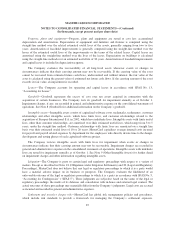

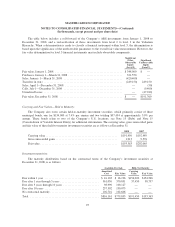

Investment maturities:

The maturity distribution based on the contractual terms of the Company’s investment securities at

December 31, 2008, is as follows:

Available-For-Sale Held-To-Maturity

Amortized

Cost Fair Value

Carrying

Value Fair Value

Due within 1 year ...................................... $ 16,103 $ 16,196 $154,000 $154,566

Due after 1 year through 5 years ........................... 361,050 370,851 37,450 38,797

Due after 5 years through 10 years ......................... 98,990 100,127 — —

Due after 10 years ...................................... 237,302 190,075 — —

No contractual maturity .................................. 102,716 102,606 — —

Total ................................................ $816,161 $779,855 $191,450 $193,363

95