MasterCard 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Critical Accounting Estimates

Our accounting policies are integral to understanding our results of operations and financial condition. We

are required to make estimates and assumptions that affect the reported amounts of assets and liabilities, and

disclosure of contingent assets and liabilities, at the date of the financial statements, and the reported amounts of

revenue and expenses during the reporting periods. We have established detailed policies and control procedures

to ensure that the methods used to make estimates and assumptions are well controlled and are applied

consistently from period to period. The following is a brief description of our current accounting policies

involving significant management judgments.

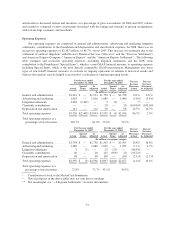

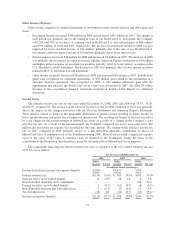

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Asset Impairment Analyses

Investments

The Company invests in certain

short-term and long-term assets,

including municipal bonds, bond

funds and ARS. The Company’s

investment strategy for these assets

is to ensure capital preservation

while capturing some interest return

on the invested funds. The

Company performs on-going

evaluations of its investments to

assess potential impairment.

Impairment of the Company’s

investments in municipal bonds is

assessed based on market prices of

similar assets, as provided by

custodians of such assets.

Impairment of the Company’s

short-term bond funds is assessed

based on quoted prices for these

assets, as they are actively traded

on a daily basis.

If actual results are not consistent

with our assumptions and estimates,

we may be exposed to additional

impairment charges associated with

our investments. The fair value of

our available-for-sale investment

portfolio was $780 million as of

December 31, 2008, which included

$36 million of net unrealized losses.

The primary analysis tool used to

assess impairment of the

Company’s ARS investments is a

discounted cash flow model. This

model considers the original

economic life of the asset, the

relevant cash flows expected over

the life of the asset, an appropriate

discount rate and other factors that

may be relevant. The present value

of the expected future cash flows is

calculated and compared to the

carrying value to determine if an

impairment has occurred and, if so,

what is the expected duration of

the impairment.

Prepaid Customer and Merchant

Incentives

We prepay certain customer and

merchant business incentives to

incent usage and acceptance of our

cards. In the event of customer or

merchant business failure, these

incentives may not have future

economic benefits for our business.

The evaluation of recoverability of

prepaid customer and merchant

incentives is done whenever events

or changes in circumstances

indicate that their carrying amount

may not be recoverable.

If events or changes in

circumstances occur that we are not

aware of, additional impairment

charges related to our prepaid

customer and merchant incentives

may be incurred. The carrying value

of prepaid customer and merchant

incentives was $398 at December

31, 2008.

67