MasterCard 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160

|

|

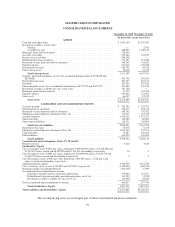

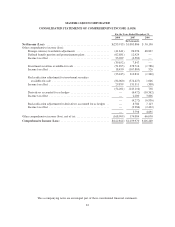

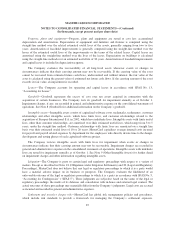

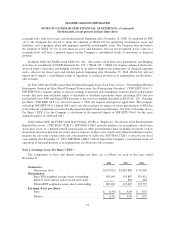

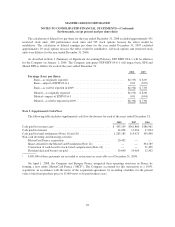

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

For the Years Ended December 31,

2008 2007 2006

(In thousands)

Net Income (Loss) ............................................ $(253,915) $1,085,886 $ 50,190

Other comprehensive income (loss):

Foreign currency translation adjustments ....................... (41,611) 96,996 68,837

Defined benefit pension and postretirement plans ................. (62,681) 12,429 —

Income tax effect .......................................... 23,029 (4,582) —

(39,652) 7,847 —

Investment securities available-for-sale ......................... (51,895) 478,716 (1,786)

Income tax effect .......................................... 18,450 (167,885) 526

(33,445) 310,831 (1,260)

Reclassification adjustment for investment securities

available-for-sale ........................................ (84,060) (374,427) 1,046

Income tax effect .......................................... 29,859 131,311 (308)

(54,201) (243,116) 738

Derivatives accounted for as hedges ........................... — (6,472) (10,562)

Income tax effect .......................................... — 2,200 3,606

— (4,272) (6,956)

Reclassification adjustment for derivatives accounted for as hedges . . — 8,784 7,123

Income tax effect .......................................... — (2,986) (2,432)

— 5,798 4,691

Other comprehensive income (loss), net of tax ....................... (168,909) 174,084 66,050

Comprehensive Income (Loss) .................................. $(422,824) $1,259,970 $116,240

The accompanying notes are an integral part of these consolidated financial statements.

83