MasterCard 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Impact of Foreign Currency Rates

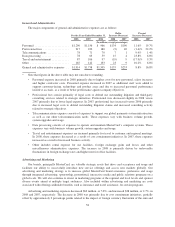

Our overall operating results are impacted by changes in foreign currency exchange rates, especially the

strengthening or weakening of the U.S. dollar versus the euro and Brazilian real. The functional currency of

MasterCard Europe, our principal European operating subsidiary, is the euro, and the functional currency of our

Brazilian subsidiary is the Brazilian real. Accordingly, the strengthening or weakening of the U.S. dollar versus

the euro and Brazilian real impacts the translation of our European and Brazilian subsidiaries’ operating results

into the U.S. dollar. During 2008, 2007 and 2006, the U.S. dollar weakened against the euro and Brazilian real,

which increased revenues and expenses. More recently, the U.S. dollar has begun to strengthen against the euro

and Brazilian real and if this trend continues, revenues and expenses will decrease.

In addition, changes in foreign currency exchange rates directly impact the calculation of gross dollar

volume (“GDV”) and gross euro volume (“GEV”), which are used in the calculation of our assessment revenues.

In most non-European regions, GDV is calculated based on local currency spending volume converted to U.S.

dollars using average exchange rates for the period. In Europe, GEV is calculated based on local currency

spending volume converted to euros using average exchange rates for the period. As a result, our assessment

revenues are impacted by the strengthening or weakening of the U.S. dollar versus most non-European local

currencies and the strengthening or weakening of the euro versus European local currencies. In 2008 and 2007,

GDV growth on a U.S. dollar converted basis was 11.5% and 18.4%, respectively, versus GDV growth on a local

currency basis of 10.7% and 14.4%, respectively.

Business Environment Challenges

We process transactions from approximately 210 countries and territories and in more than 160 currencies.

The competitive and evolving nature of the global payments industry provides challenges to and opportunities for

the continued growth of our business. The United States is our largest geographic market based on revenues.

Revenue generated in the United States was approximately 47.2%, 49.7% and 52.3% of total revenues in 2008,

2007 and 2006, respectively. No individual country, other than the United States, generated more than 10% of

total revenues in any period. However, revenues generated from certain non-U.S. countries have grown faster

than United States revenues due to differences in market maturity, economic health, price changes and foreign

exchange fluctuations in those countries. While the global nature of our business helps protect our operating

results from adverse economic conditions in a single or a few countries, the significant concentration of our

revenues generated in the United States makes our business particularly susceptible to adverse economic

conditions in the United States.

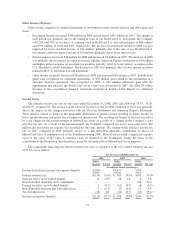

During 2008, unprecedented events occurred in the financial markets around the world, resulting in distress

in the credit environment, equity market volatility and government intervention. In particular, the economies of

the United States and the United Kingdom were significantly impacted by this economic turmoil, however it also

impacted other economies around the world. Some existing customers have gone bankrupt or have been placed in

receivership or administration or have a significant amount of their stock owned by the government. Many of our

financial institution customers, merchants that accept our brands and cardholders who use our brands have been

directly and adversely impacted. As a result, our operating results have begun to be impacted, or could be

negatively impacted, in several ways, including but not limited to the following:

• Our customers may restrict credit lines to cardholders or limit the issuance of new cards to mitigate

increasing cardholder defaults.

• Constriction of consumer and business confidence may cause decreased spending.

• Declining economies can change consumer spending behaviors; for example, a significant portion of our

revenues is dependent on international travel patterns, which may decline.

• Mergers of our customers may lower our pricing due to the tiered pricing structure of most customer

agreements, which typically offer lower pricing as higher business volumes are achieved.

51