MasterCard 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

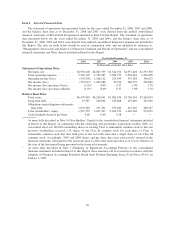

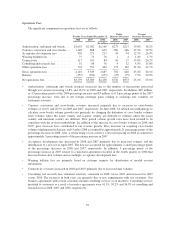

Item 6. Selected Financial Data

The statement of operations data presented below for the years ended December 31, 2008, 2007 and 2006,

and the balance sheet data as of December 31, 2008 and 2007, were derived from the audited consolidated

financial statements of MasterCard Incorporated included in Item 8 in this Report. The statement of operations

data presented below for the years ended December 31, 2005 and 2004, and the balance sheet data as of

December 31, 2006, 2005 and 2004, were derived from audited consolidated financial statements not included in

this Report. The data set forth below should be read in conjunction with, and are qualified by reference to,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements and Notes thereto included in Item 8 in this Report.

Year Ended December 31,

2008 2007 2006 2005 2004

(In thousands, except per share data)

Statement of Operations Data:

Revenues, net .................... $4,991,600 $4,067,599 $3,326,074 $2,937,628 $2,593,330

Total operating expenses ............ 5,526,105 2,959,487 3,096,579 2,544,444 2,246,658

Operating income (loss) ............ (534,505) 1,108,112 229,495 393,184 346,672

Net income (loss) ................. (253,915) 1,085,886 50,190 266,719 238,060

Net income (loss) per share (basic) .... (1.95)28.0520.37 1.9811.761

Net income (loss) per share (diluted) . . (1.95)28.0020.37 1.9811.761

Balance Sheet Data:

Total assets ...................... $6,475,849 $6,260,041 $5,082,470 $3,700,544 $3,264,670

Long-term debt ................... 19,387 149,824 229,668 229,489 229,569

Obligations under litigation settlements,

long-term ...................... 1,023,263 297,201 359,640 415,620 468,547

Total stockholders’ equity ........... 1,927,355 3,027,307 2,364,359 1,169,148 974,952

Cash dividends declared per share .... 0.60 0.60 0.18 — —

1As more fully described in Note 14 (Stockholders’ Equity) to the consolidated financial statements included

in Item 8 of this Report, in connection with the ownership and governance transactions in May 2006, we

reclassified all of our 100,000 outstanding shares of existing Class A redeemable common stock so that our

previous stockholders received 1.35 shares of our Class B common stock for each share of Class A

redeemable common stock that they held prior to the reclassification and a single share of our Class M

common stock. Accordingly, 2005 and 2004 shares and per share data were retroactively restated in the

financial statements subsequent to the reclassification to reflect the reclassification as if it were effective at

the start of the first period being presented in the financial statements.

2As more fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated

financial statements included in Item 8 of this Report, these amounts will be revised in accordance with the

adoption of Financial Accounting Standards Board Staff Position Emerging Issues Task Force 03-6-1 on

January 1, 2009.

46