MasterCard 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

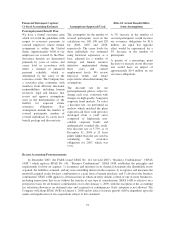

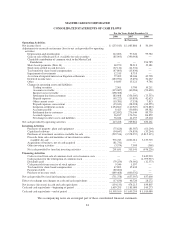

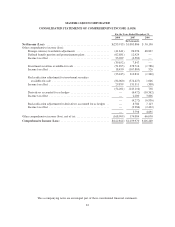

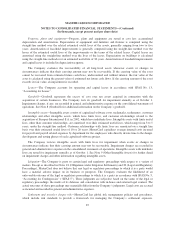

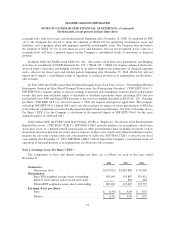

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31,

2008 2007 2006

(In thousands)

Operating Activities

Net income (loss) ................................................. $ (253,915) $ 1,085,886 $ 50,190

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation and amortization ................................... 112,006 97,642 99,782

Gain on sale of Redecard S.A. available-for-sale securities ............ (85,903) (390,968) —

Charitable contribution of common stock to the MasterCard

Foundation ................................................ — — 394,785

Share based payments (Note 16) ................................. 60,970 58,213 19,181

Stock units settled in cash for taxes ............................... (67,111) (11,334) —

Tax benefit for share based compensation .......................... (47,803) (15,430) —

Impairment of investments ...................................... 12,515 8,719 —

Accretion of imputed interest on litigation settlements ................ 77,202 38,046 42,798

Deferred income taxes ......................................... (483,952) (5,492) 32,267

Other ....................................................... 14,645 15,121 9,746

Changes in operating assets and liabilities:

Trading securities ......................................... 2,561 9,700 10,211

Accounts receivable ....................................... (115,687) (60,984) (93,428)

Income taxes receivable .................................... (198,308) — —

Settlement due from customers .............................. 183,008 (356,305) (75,553)

Prepaid expenses .......................................... (65,222) (19,859) 42,623

Other current assets ....................................... (19,381) (7,538) 7,813

Prepaid expenses, non-current ............................... (35,631) (28,398) (30,555)

Litigation settlement accruals ................................ 1,254,660 (110,525) (170,883)

Accounts payable ......................................... 8,425 (30,650) 89,382

Settlement due to customers ................................. (52,852) 276,144 89,739

Accrued expenses ......................................... 36,817 176,716 86,859

Net change in other assets and liabilities ....................... 76,184 41,157 45,204

Net cash provided by operating activities .............................. 413,228 769,861 650,161

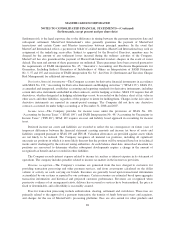

Investing Activities

Purchases of property, plant and equipment ........................ (75,626) (81,587) (61,204)

Capitalized software ........................................... (94,647) (74,835) (33,264)

Purchases of investment securities available-for-sale ................. (519,514) (3,578,357) (3,815,115)

Proceeds from sales and maturities of investment securities

available-for-sale ........................................... 976,743 4,042,011 3,233,725

Acquisition of business, net of cash acquired ....................... (81,731) — —

Other investing activities ....................................... (3,574) 7,909 (368)

Net cash provided by (used in) investing activities ................... 201,651 315,141 (676,226)

Financing Activities

Cash received from sale of common stock, net of issuance costs ........ — — 2,449,910

Cash payment for the redemption of common stock .................. — — (1,799,937)

Dividends paid ............................................... (79,259) (74,002) (12,373)

Cash proceeds from exercise of stock options ....................... 9,546 1,597 —

Tax benefit for share based compensation .......................... 47,803 15,430 —

Payment of debt .............................................. (80,000) — —

Purchase of treasury stock ...................................... (649,468) (600,532) —

Net cash provided by (used in) financing activities ....................... (751,378) (657,507) 637,600

Effect of exchange rate changes on cash and cash equivalents .............. (17,636) 46,720 28,272

Net increase (decrease) in cash and cash equivalents ..................... (154,135) 474,215 639,807

Cash and cash equivalents—beginning of period ........................ 1,659,295 1,185,080 545,273

Cash and cash equivalents—end of period .............................. $1,505,160 $ 1,659,295 $ 1,185,080

The accompanying notes are an integral part of these consolidated financial statements.

81