MasterCard 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

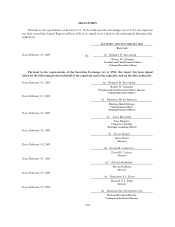

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

Note 22. Foreign Exchange Risk Management

The Company enters into foreign currency forward contracts to minimize risk associated with anticipated

receipts and disbursements which are either transacted in a non-functional currency or valued based on a

currency other than our functional currencies. The Company also enters into contracts to offset possible changes

in value due to foreign exchange fluctuations of assets and liabilities denominated in foreign currencies. At

December 31, 2008, all contracts to purchase and sell foreign currency had been entered into with customers of

MasterCard International. MasterCard’s forward contracts are classified by functional currency as summarized

below:

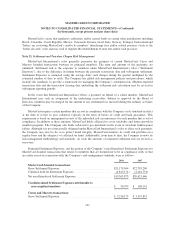

U.S. Dollar Functional Currency

December 31, 2008 December 31, 2007

Notional

Estimated

Fair Value Notional

Estimated

Fair Value

Commitments to purchase foreign currency ................... $292,538 $21,913 $39,933 $(286)

Commitments to sell foreign currency ........................ 154,187 12,227 22,088 388

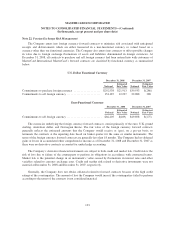

Euro Functional Currency

December 31, 2008 December 31, 2007

Notional

Estimated

Fair Value Notional

Estimated

Fair Value

Commitments to sell foreign currency ......................... $66,405 $(409) $49,698 $(275)

The currencies underlying the foreign currency forward contracts consist primarily of the euro, U.K. pound

sterling, Australian dollar, and Norwegian Krone. The fair value of the foreign currency forward contracts

generally reflects the estimated amounts that the Company would receive or (pay), on a pre-tax basis, to

terminate the contracts at the reporting date based on broker quotes for the same or similar instruments. The

terms of the foreign currency forward contracts are generally less than 18 months. The Company had no deferred

gains or losses in accumulated other comprehensive income as of December 31, 2008 and December 31, 2007 as

there were no derivative contracts accounted for under hedge accounting.

The Company’s derivative financial instruments are subject to both credit and market risk. Credit risk is the

risk of loss due to failure of the counterparty to perform its obligations in accordance with contractual terms.

Market risk is the potential change in an instrument’s value caused by fluctuations in interest rates and other

variables related to currency exchange rates. Credit and market risk related to derivative instruments were not

material at December 31, 2008 and December 31, 2007, respectively.

Generally, the Company does not obtain collateral related to forward contracts because of the high credit

ratings of the counterparties. The amount of loss the Company would incur if the counterparties failed to perform

according to the terms of the contracts is not considered material.

133