MasterCard 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

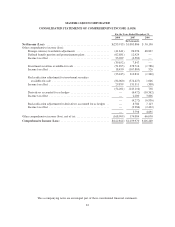

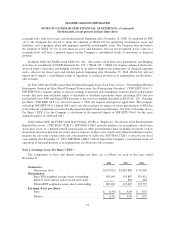

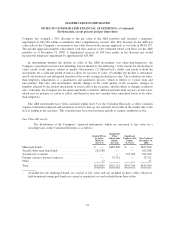

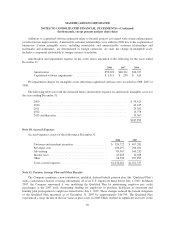

The calculation of diluted loss per share for the year ended December 31, 2008 excluded approximately 951

restricted stock units, 408 performance stock units and 705 stock options because the effect would be

antidilutive. The calculation of diluted earnings per share for the year ended December 31, 2007 excluded

approximately 10 stock options because the effect would be antidilutive. All stock options and restricted stock

units were dilutive for the year ended December 31, 2006.

As described in Note 1 (Summary of Significant Accounting Policies), FSP EITF 03-6-1 will be effective

for the Company on January 1, 2009. The Company anticipates FSP EITF 03-6-1 will impact basic EPS and

diluted EPS as follows for each of the years ended December 31:

2008 2007

Earnings (Loss) per Share:

Basic—as originally reported ....................................... $(1.95) $ 8.05

Basic—impact of EITF 03-6-1 ...................................... 0.01 (0.07)

Basic—as will be reported in 2009 .................................. $(1.94) $ 7.98

Diluted—as originally reported ..................................... $(1.95) $ 8.00

Diluted—impact of EITF 03-6-1 .................................... 0.01 (0.04)

Diluted—as will be reported in 2009 ................................. $(1.94) $ 7.96

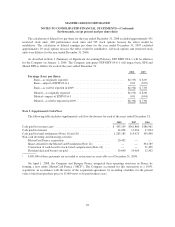

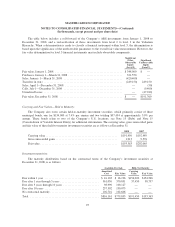

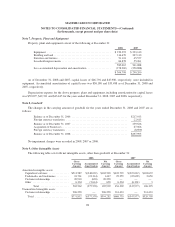

Note 3. Supplemental Cash Flows

The following table includes supplemental cash flow disclosures for each of the years ended December 31:

2008 2007 2006

Cash paid for income taxes1...................................... $ 493,199 $561,860 $186,961

Cash paid for interest ............................................ 14,058 17,094 17,034

Cash paid for legal settlements (Notes 18 and 20) ..................... 1,263,185 113,925 195,840

Non-cash investing and financing activities:

MasterCard France acquisition ................................ 20,432 — —

Shares donated to the MasterCard Foundation (Note 14) ............ — — 394,785

Conversion of cash-based to stock-based compensation (Note 16) .... — — 51,209

Dividend declared but not yet paid ............................. 19,690 19,969 12,402

1$198,308 of these payments are recorded as an income tax receivable as of December 31, 2008.

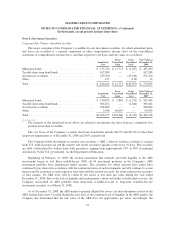

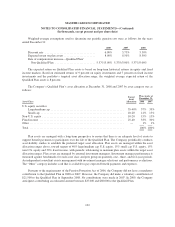

On April 1, 2008, the Company and Europay France integrated their operating structures in France by

forming a new entity, MasterCard France (“MCF”). The Company accounted for this transaction as a 100%

acquisition, in accordance with the terms of the acquisition agreement, by recording a liability for the present

value of the fixed purchase price of 15,000 euros to be paid in three years.

92