MasterCard 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

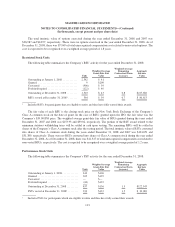

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

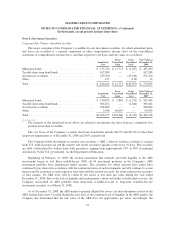

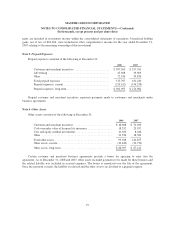

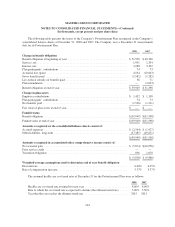

The following table summarizes expected benefit payments through 2018 including those payments

expected to be paid from the Company’s general assets. Since the majority of the benefit payments are made in

the form of lump-sum distributions, actual benefit payments may differ from expected benefits payments.

2009 .................................................................... $ 19,766

2010 .................................................................... 18,182

2011 .................................................................... 25,518

2012 .................................................................... 21,029

2013 .................................................................... 24,578

2014 – 2018 .............................................................. 118,709

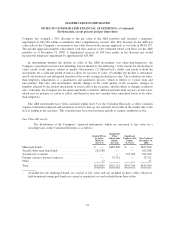

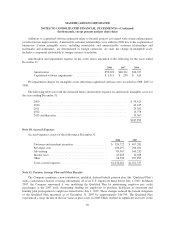

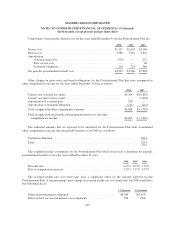

Substantially all of the Company’s U.S. employees are eligible to participate in a defined contribution

savings plan (the “Savings Plan”) sponsored by the Company. The Savings Plan allows employees to contribute a

portion of their base compensation on a pre-tax and after-tax basis in accordance with specified guidelines. The

Company matches a percentage of employees’ contributions up to certain limits. In 2007 and prior years, the

Company could also contribute to the Savings Plan a discretionary profit sharing component linked to Company

performance during the prior year. Beginning in 2008, the discretionary profit sharing amount related to 2007

Company performance was paid directly to employees as a short-term cash incentive bonus rather than as a

contribution to the Savings Plan. In addition, the Company has several defined contribution plans outside of the

United States. The Company’s contribution expense related to all of its defined contribution plans was $35,341,

$26,996 and $43,594 for 2008, 2007 and 2006, respectively.

The Company had a Value Appreciation Program (“VAP”), which was an incentive compensation plan

established in 1995. Annual awards were granted to VAP participants from 1995 through 1998, which entitled

participants to the net appreciation on a portfolio of securities of members of MasterCard International. In 1999,

the VAP was replaced by an Executive Incentive Plan (“EIP”) and the Senior Executive Incentive Plan (“SEIP”)

(together the “EIP Plans”) (See Note 16 (Share Based Payments and Other Benefits)). Contributions to the VAP

have been discontinued, all plan assets have been disbursed and no VAP liability remained as of December 31,

2008. The Company’s liability related to the VAP at December 31, 2007 was $986. The expense (benefit) was

$(6), $(267) and $3,406 for the years ended December 31, 2008, 2007 and 2006, respectively.

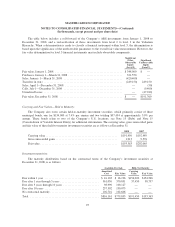

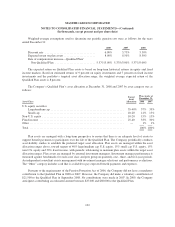

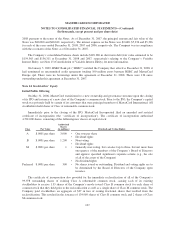

Note 12. Postemployment and Postretirement Benefits

The Company maintains a postretirement plan (the “Postretirement Plan”) providing health coverage and

life insurance benefits for substantially all of its U.S. employees and retirees hired before July 1, 2007.

The Company amended the life insurance benefits under the Postretirement Plan effective January 1, 2007.

The impact, net of taxes, of this amendment was an increase of $1,715 to accumulated other comprehensive

income in 2007.

103