MasterCard 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

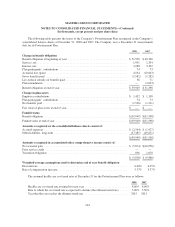

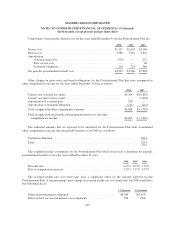

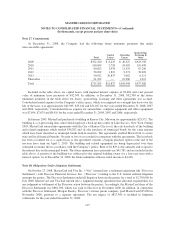

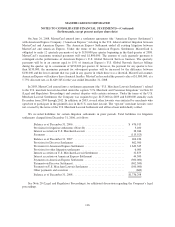

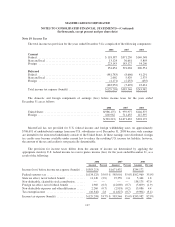

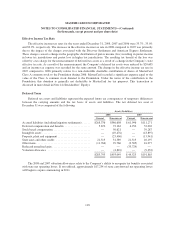

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

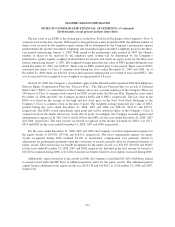

Commencing on the fourth anniversary of the IPO, each share of Class B common stock will be convertible,

at the holder’s option, into a share of Class A common stock on a one-for-one basis. Additionally, if at any time,

the number of shares of Class B common stock outstanding is less than 41% of the aggregate number of shares of

Class A common stock and Class B common stock outstanding, Class B stockholders will in certain

circumstances be permitted to acquire an aggregate number of shares of Class A common stock in the open

market or otherwise, with acquired shares thereupon converting into an equal number of shares of Class B

common stock so that holders of Class B common stock could own up to 41% of the aggregate number of shares

of Class A common stock and Class B common stock outstanding at such time. Shares of Class B common stock

are non-registered securities that may be bought and sold among eligible holders of Class B common stock

subject to certain limitations.

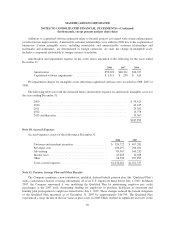

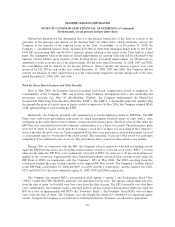

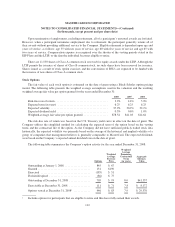

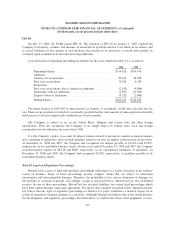

Stock Repurchase Program

In April 2007, the Company’s Board of Directors authorized a plan for the Company to repurchase up to

$500,000 of its Class A common stock in open market transactions during 2007. On October 29, 2007, the

Company’s Board of Directors amended the share repurchase plan to authorize the Company to repurchase an

incremental $750,000 (aggregate for the entire repurchase program of $1,250,000) of its Class A common stock

in open market transactions through June 30, 2008. As of December 31, 2007, approximately 3,922 shares of

Class A common stock had been repurchased at a cost of $600,532. During 2008, the Company repurchased

approximately 2,819 shares of Class A common stock at a cost of $649,468, completing its aggregate authorized

share repurchase program of $1,250,000. The Company records the repurchase of shares of common stock at cost

based on the settlement date of the transaction. These shares are classified as treasury stock, which is a reduction

to stockholders’ equity. Treasury stock is included in authorized and issued shares but excluded from outstanding

shares.

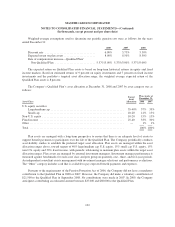

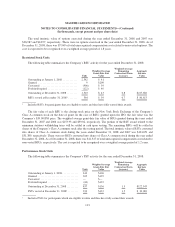

The MasterCard Foundation

In connection and simultaneous with the IPO, the Company issued and donated 13,497 newly authorized

shares of Class A common stock to The MasterCard Foundation (the “Foundation”). The Foundation is a private

charitable foundation incorporated in Canada that is controlled by directors who are independent of the Company

and its principal members. In connection with the donation, the Company recorded an expense of $394,785 in the

second quarter of 2006, which was determined based on the IPO price per share, less a marketability discount of

25%. Under the terms of the donation, the Foundation can only resell the donated shares beginning on the fourth

anniversary of the IPO to the extent necessary to meet charitable disbursement requirements dictated by

Canadian tax law. Under Canadian tax law, the Foundation is generally required to disburse at least 3.5% of its

assets not used in administration each year for qualified charitable disbursements. However, the Foundation

obtained permission from the Canadian tax authorities to defer the giving requirements for up to ten years. The

Foundation, at its discretion, may decide to meet its disbursement obligations on an annual basis or to settle

previously accumulated obligations during any given year. The Foundation will be permitted to sell all of its

remaining shares beginning twenty years and eleven months after the consummation of the IPO. Additionally,

during each of the years ended December 31, 2007 and 2006, the Company donated $20,000 in cash to the

Foundation for an aggregate of $40,000.

109