MasterCard 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On January 22, 2009, Standard & Poor’s reaffirmed our BBB+ long-term and A-2 short-term counterparty

credit ratings, with a stable outlook. Our access to capital and liquidity has been sufficient with these ratings. A

securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

On April 28, 2008, the Company extended its committed unsecured revolving credit facility, dated as of

April 28, 2006 (the “Credit Facility”), for an additional year. The new expiration date of the Credit Facility is

April 26, 2011. The available funding under the Credit Facility will remain at $2.5 billion through April 27, 2010

and then decrease to $2.0 billion during the final year of the Credit Facility agreement. Other terms and

conditions in the Credit Facility remain unchanged. The Company’s option to request that each lender under the

Credit Facility extend its commitment was provided pursuant to the original terms of the Credit Facility

agreement. MasterCard was in compliance with the covenants of the Credit Facility and had no borrowings under

the Credit Facility at December 31, 2008 and December 31, 2007, respectively. The majority of Credit Facility

lenders are customers or affiliates of customers of MasterCard International.

On January 5, 2009, HSBC Bank plc (“HSBC”) notified the Company that, effective December 31, 2008, it

had terminated an uncommitted credit agreement totaling 100 million euros between HSBC and MasterCard

Europe sprl. There were no outstanding borrowings under this facility at December 31, 2008.

In June 2007, the Company’s stockholders approved amendments to the Company’s certificate of

incorporation designed to facilitate an accelerated, orderly conversion of Class B common stock into Class A

common stock for subsequent sale. In February 2008, the Company’s Board of Directors authorized the

conversion and sale or transfer of up to 13.1 million shares of Class B common stock into Class A common

stock. In May 2008, the Company implemented and completed a conversion program in which all of the

13.1 million authorized shares of Class B common stock were converted into an equal number of Class A

common stock and subsequently sold or transferred by participating holders of Class B common stock to public

investors. In February 2009, the Company’s Board of Directors authorized the conversion and sale or transfer of

up to 11.0 million shares of Class B common stock into Class A common stock in one or more conversion

programs during 2009. See Note 14 (Stockholders’ Equity) to the consolidated financial statements included in

Item 8 of this Report for additional information.

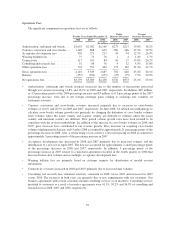

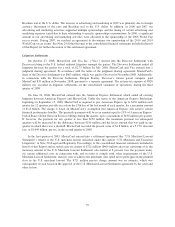

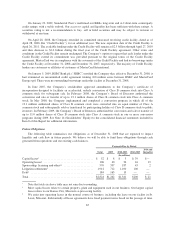

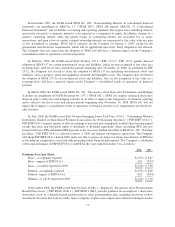

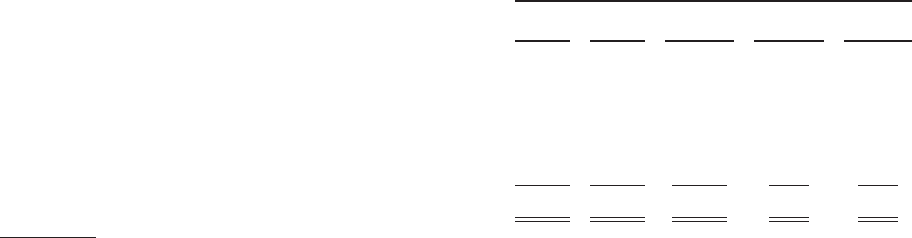

Future Obligations

The following table summarizes our obligations as of December 31, 2008 that are expected to impact

liquidity and cash flow in future periods. We believe we will be able to fund these obligations through cash

generated from operations and our existing cash balances.

Payments Due by Period

Total 2009 2010-2011 2012-2013

2014 and

thereafter

(In millions)

Capital leases1..................................... $ 52 $ 8 $ 5 $ 39 $—

Operating leases2................................... 106 40 30 16 19

Sponsorship, licensing and other3,4 ..................... 570 337 187 45 2

Litigation settlements5............................... 1,912 712 1,100 100 —

Debt6............................................ 184 165 19 — —

Total ............................................. $2,824 $1,262 $1,341 $200 $ 21

*Note that totals in above table may not sum due to rounding.

1Most capital leases relate to certain property, plant and equipment used in our business. Our largest capital

lease relates to our Kansas City, Missouri co-processing facility.

2We enter into operating leases in the normal course of business, including the lease on our facility in St.

Louis, Missouri. Substantially all lease agreements have fixed payment terms based on the passage of time.

65