MasterCard 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

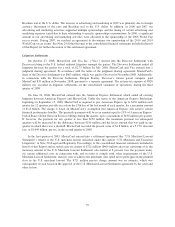

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

assessment revenues, representing

6%, 7% and 7% of total net

revenues for the years ended

December 31, 2008, 2007 and 2006,

respectively. Our revenue

recognition policies are fully

described in Note 1 (Summary of

Significant Accounting Policies) to

the consolidated financial

statements in Item 8 of this Report.

Differences are adjusted in the

period the customer reports.

Customers’ performance is

estimated by using historical

performance, customer reported

information, transactional

information accumulated from our

systems and discussions with our

customers.

performance by less than 5% of the

estimates on a quarterly basis.

Rebates and incentives are

estimated.

Rebates and incentives are

generally recorded as contra-

revenue based on our estimate of

each customer’s performance in a

given period and according to the

terms of the related customer

agreements.

If our customers’ actual

performance is not consistent with

our estimates of their performance,

contra-revenues may be materially

different than initially recorded.

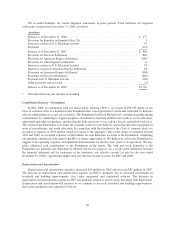

Legal and Regulatory Matters

Legal Proceedings

We are party to legal and regulatory

proceedings with respect to a

variety of matters. Except as

described in Notes 18 (Obligations

Under Litigation Settlements) and

20 (Legal and Regulatory

Proceedings) to the consolidated

financial statements in Item 8 of this

Report, MasterCard does not

believe that any legal or regulatory

proceedings to which it is a party

would have a material adverse

impact on its business or prospects.

We evaluate the likelihood of an

unfavorable outcome of the legal

or regulatory proceedings to which

we are party in accordance with

SFAS No. 5, “Accounting for

Contingencies” (“SFAS No. 5”).

Our judgments are subjective

based on the status of the legal or

regulatory proceedings, the merits

of our defenses and consultation

with in-house and outside legal

counsel.

Due to the inherent uncertainties of

the legal and regulatory process in

the multiple jurisdictions in which

we operate, our judgments may be

materially different than the actual

outcomes.

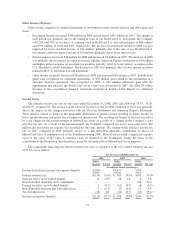

Discount Rates for Litigation

Settlements

We have discounted two litigation

settlements over their respective

payment terms.

The U.S. Merchant Lawsuit

Settlement was discounted at 8%

over the ten-year payment term.

We estimated the discount rate

used to calculate the present value

of our obligations under litigation

settlements. The discount rate is a

matter of management judgment at

the time of each settlement, which

considers our expected post-

settlement credit rating and rates

for sources of credit that could be

used to finance the payment of

such obligations with similar

terms.

For the U.S. Merchant Lawsuit

Settlement, a one percent increase in

the discount rate would have

increased annual interest expense in

2008 by approximately $3 million,

and declining amounts thereafter.

The reverse impact would be

experienced for a one percent

decrease in such discount rate.

69