MasterCard 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

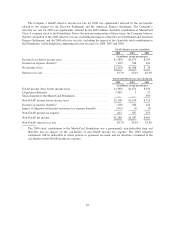

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Goodwill and Intangible Assets

(excluding Capitalized Software)

We perform analyses of goodwill

and intangible assets on an annual

basis or sooner if indicators of

impairment exist. This evaluation

utilizes a two-step approach. The

first step is to identify a potential

impairment and the second step

measures the amount of the

impairment loss, if any. Impairment

is measured as the excess of the

carrying amount over fair value.

The test methods employed in

performing the analyses involve

assumptions concerning interest

and discount rates, growth

projections and other assumptions

of future business conditions. The

assumptions employed are based

on management’s judgment using

internal and external data. We

utilize independent valuation

experts, if needed.

If actual results are not consistent

with our assumptions and estimates,

we may be exposed to an additional

impairment charge associated with

goodwill and/or intangible assets.

The carrying value of goodwill and

intangible assets, excluding

capitalized software, was $527

million, including $206 million of

unamortizable customer

relationships, as of December 31,

2008.

We determined that the majority of

our customer relationships, which

are intangible assets, have indefinite

lives. In addition to the impairment

testing noted above, we assess the

appropriateness of that indefinite

life annually.

We completed our annual

impairment testing for all goodwill

and other intangibles using the

methodology described herein, and

no impairment charges were

recorded for the year ended

December 31, 2008.

Capitalized Software

Our capitalized software, which

includes internal and external costs

incurred in developing or obtaining

computer software for internal use,

is included in other intangible

assets.

We are required to make judgments

to determine if each project will

satisfy its intended use. In addition,

we estimate the average internal

costs incurred for payroll and payroll

related expenses by department for

the employees who directly devote

time relating to the design,

development and testing phases of

the project.

If actual results are not consistent

with our judgments, we may be

exposed to an impairment charge.

The net carrying value of

capitalized software as of December

31, 2008 was $166 million.

On a quarterly basis, we evaluate

whether there are any events that

indicate impairment of our various

technologies.

During the year ended December

31, 2008, no significant impairment

charges were recorded.

Revenue Recognition

Our assessment revenues that are

based on quarterly GDV or GEV are

recorded utilizing an estimate of our

customers’ performance. Total net

assessment revenues included an

estimate as of the end of the period

for 25%, 26% and 26% of those net

Our assessment revenues that are

based on quarterly GDV or GEV

are recorded utilizing an estimate of

our customers’ performance. Such

estimates are subsequently

validated against performance

reported by our customers.

If our customers’ actual performance

is not consistent with our estimates

of their performance, revenues may

be materially different than initially

recorded. Historically, our estimates

have differed from the actual

68