MasterCard 2008 Annual Report Download - page 94

Download and view the complete annual report

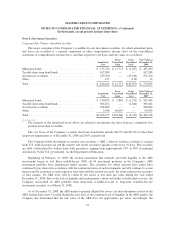

Please find page 94 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

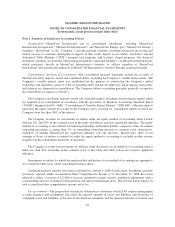

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except percent and per share data)

Note 1. Summary of Significant Accounting Policies

Organization—MasterCard Incorporated and its consolidated subsidiaries, including MasterCard

International Incorporated (“MasterCard International”) and MasterCard Europe sprl (“MasterCard Europe”)

(together, “MasterCard” or the “Company”), provide payment solutions, including transaction processing and

related services to customers principally in support of their credit, deposit access (debit), electronic cash and

Automated Teller Machine (“ATM”) payment card programs, and travelers cheque programs. Our financial

institution customers are generally either principal members (“principal members”) of MasterCard International,

which participate directly in MasterCard International’s business, or affiliate members of MasterCard

International, which participate indirectly in MasterCard International’s business through a principal member.

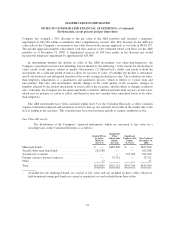

Consolidation and basis of presentation—The consolidated financial statements include the accounts of

MasterCard and its majority-owned and controlled entities, including the Company’s variable interest entity. The

Company’s variable interest entity was established for the purpose of constructing the Company’s global

technology and operations center; it is not an operating entity and has no employees. Intercompany transactions

and balances are eliminated in consolidation. The Company follows accounting principles generally accepted in

the United States of America (“GAAP”).

The Company consolidates majority-owned and controlled entities, including variable interest entities which

are required to be consolidated in accordance with the provisions of Financial Accounting Standards Board

(“FASB”) Interpretation No. 46(R), “Consolidation of Variable Interest Entities” (“FIN 46R”). Minority interest

represents the equity interest not owned by the Company and is recorded for consolidated entities in which the

Company owns less than 100% of the interest.

The Company accounts for investments in entities under the equity method of accounting when it holds

between 20% and 50% of the common stock in the entity and when it exercises significant influence. The equity

method of accounting is also utilized for limited partnerships and limited liability companies if the investment

ownership percentage is greater than 3% of outstanding ownership interests or common stock, respectively,

regardless of whether MasterCard has significant influence over the investees. MasterCard’s share of net

earnings or losses of entities accounted for under the equity method of accounting is included in other income

(expense) on the consolidated statements of operations.

The Company accounts for investments in affiliates under the historical cost method of accounting when it

holds less than 20% ownership in the common stock of the entity and when it does not exercise significant

influence.

Investments in entities for which the equity method and historical cost method of accounting are appropriate

are recorded in other assets on the consolidated balance sheets.

Certain prior period amounts have been reclassified to conform to 2008 classifications. In addition, amounts

previously reported within Accumulated Other Comprehensive Income as of December 31, 2006 have been

adjusted to reflect a revision of $22,804 to increase cumulative foreign currency translation adjustments with a

corresponding decrease in defined benefit pension and other postretirement plans. The revision had no impact on

total accumulated other comprehensive income, net of tax.

Use of estimates—The preparation of financial statements in conformity with GAAP requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and

84