MasterCard 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

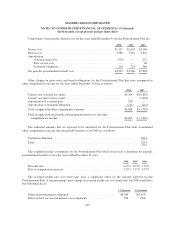

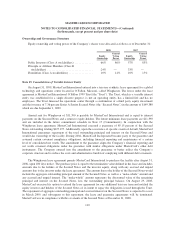

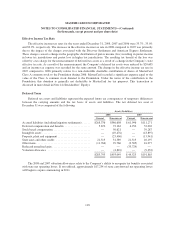

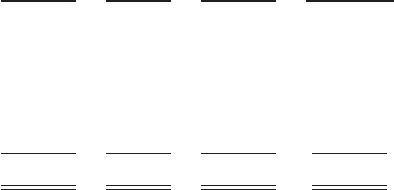

Note 17. Commitments

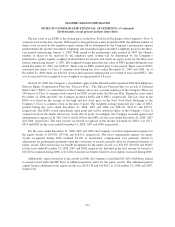

At December 31, 2008, the Company had the following future minimum payments due under

non-cancelable agreements:

Total

Capital

Leases

Operating

Leases

Sponsorship,

Licensing &

Other

2009 .................................... $372,320 $ 8,435 $ 40,327 $323,558

2010 .................................... 140,659 2,758 18,403 119,498

2011 .................................... 80,823 1,978 11,555 67,290

2012 .................................... 50,099 1,819 9,271 39,009

2013 .................................... 50,012 36,837 7,062 6,113

Thereafter ................................ 21,292 — 19,380 1,912

Total .................................... $715,205 $51,827 $105,998 $557,380

Included in the table above are capital leases with imputed interest expense of $9,483 and a net present

value of minimum lease payments of $42,343. In addition, at December 31, 2008, $92,300 of the future

minimum payments in the table above for leases, sponsorship, licensing and other agreements was accrued.

Consolidated rental expense for the Company’s office space, which is recognized on a straight line basis over the

life of the lease, was approximately $42,905, $35,614 and $31,467 for the years ended December 31, 2008, 2007

and 2006, respectively. Consolidated lease expense for automobiles, computer equipment and office equipment

was $7,694, $7,679 and $8,419 for the years ended December 31, 2008, 2007 and 2006, respectively.

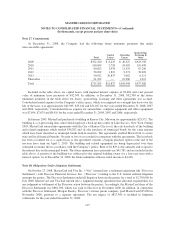

In January 2003, MasterCard purchased a building in Kansas City, Missouri for approximately $23,572. The

building is a co-processing data center which replaced a back-up data center in Lake Success, New York. During

2003, MasterCard entered into agreements with the City of Kansas City for (i) the sale-leaseback of the building

and related equipment which totaled $36,382 and (ii) the purchase of municipal bonds for the same amount

which have been classified as municipal bonds held-to-maturity. The agreements enabled MasterCard to secure

state and local financial benefits. No gain or loss was recorded in connection with the agreements. The leaseback

has been accounted for as a capital lease as the agreement contains a bargain purchase option at the end of the

ten-year lease term on April 1, 2013. The building and related equipment are being depreciated over their

estimated economic life in accordance with the Company’s policy. Rent of $1,819 is due annually and is equal to

the interest due on the municipal bonds. The future minimum lease payments are $45,781 and are included in the

table above. A portion of the building was subleased to the original building owner for a five-year term with a

renewal option. As of December 31, 2008, the future minimum sublease rental income is $4,416.

Note 18. Obligations Under Litigation Settlements

On October 27, 2008, MasterCard and Visa Inc. (“Visa”) entered into a settlement agreement (the “Discover

Settlement”) with Discover Financial Services, Inc. (“Discover”) relating to the U.S. federal antitrust litigation

amongst the parties. The Discover Settlement ended all litigation between the parties for a total of $2,750,000. In

July 2008, MasterCard and Visa had entered into a judgment sharing agreement that allocated responsibility for

any judgment or settlement of the Discover action between the parties. Accordingly, the MasterCard share of the

Discover Settlement was $862,500, which was paid to Discover in November 2008. In addition, in connection

with the Discover Settlement, Morgan Stanley, Discover’s former parent company, paid MasterCard $35,000 in

November 2008, pursuant to a separate agreement. The net impact of $827,500 is included in litigation

settlements for the year ended December 31, 2008.

115