MasterCard 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Geographic region or country

• Retail purchase or cash withdrawal

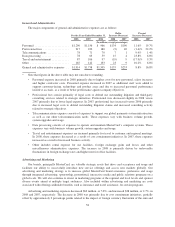

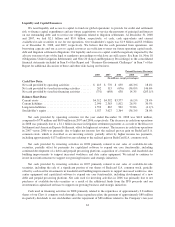

We process most of the cross-border transactions using MasterCard, Maestro and Cirrus-branded cards and

process the majority of MasterCard-branded domestic transactions in the United States, United Kingdom,

Canada, Brazil and Australia. Cross-border transactions generate greater revenue than domestic transactions due

to higher operations fees for settlement, authorization and switch, and are also subject to cross-border and

currency conversion fees. In addition, higher operations fees are charged on signature transactions than online

transactions.

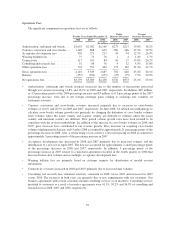

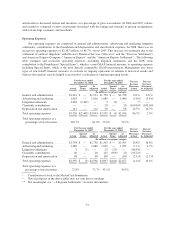

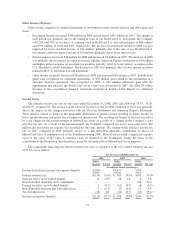

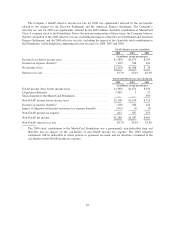

In 2008 and 2007, gross revenues grew 19.8% and 20.4%, respectively. Revenue growth was the result of

increased transactions and GDV, as well as price increases and currency fluctuation. Our overall revenue growth

is being moderated by the demand from our customers for better pricing arrangements and greater rebates and

incentives. Accordingly, we have entered into business agreements with certain customers and merchants to

provide GDV and other performance-based support incentives. The rebates and incentives are calculated on a

monthly basis based upon estimated performance and the terms of the related business agreements. Rebates and

incentives are recorded as a reduction of gross revenue in the same period that performance occurs. The

continued consolidation of our customers and the growing influence of merchants have led to enhanced

competition in the global payments industry and demand for better pricing arrangements. Our revenue growth

was moderated by a $145 million, or 11.0%, and a $173 million, or 15.0%, increase in rebates and incentives to

our customers and merchants in 2008 and 2007, respectively.

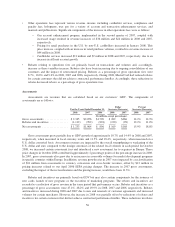

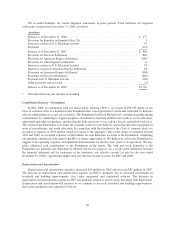

A significant portion of our revenue is concentrated among our five largest customers. In 2008, the net

revenues from these customers were approximately $1.5 billion, or 30%, of total net revenue. The loss of any of

these customers or their significant card programs could adversely impact our revenues and net income. See

“Risk Factors—Business Risks—Consolidation or other changes affecting the banking industry could result in a

loss of business for MasterCard and may result in lower prices and/or more favorable terms for our customers,

which may materially and adversely affect our revenue and profitability” in Item 1A of this Report. In addition,

as part of our business strategy, MasterCard, among other efforts, enters into business agreements with

customers. These agreements can be terminated in a variety of circumstances. See “Risk Factors—Business

Risks—We face increasingly intense competitive pressure on the prices we charge our customers, which may

materially and adversely affect our revenue and profitability” in Item 1A of this Report.

54