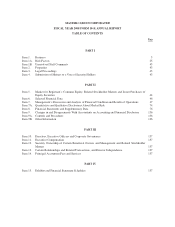

MasterCard 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.mastercardworldwide.com 3

Dear Fellow Shareholders:

In 2008 — in the face of a global economic crisis not seen in more than a generation —

we responded the way smart companies do: by aligning resources to meet the changing

needs of our customers. Despite the challenges, we achieved excellent operating results

while maintaining a healthy balance sheet.

Our customer-focused strategy has never been more important as we help our customers weather the headwinds of the

fi nancial crisis. This approach has served us well in the best of times and continues to do so now as we work with our

customers to optimize portfolios, maximize effi ciencies, mitigate risks and reduce charge-offs. By addressing these areas head

on, we’ve become an important ally in the toughest of times while positioning ourselves as a preferred partner for the future.

Immediate challenges aside, we continue to keep our eye on the big picture: the global migration to faster, more effi cient

and more secure forms of payment. Despite today’s priorities, our long-term objective remains the same: to steadily displace

cash and checks and advance commerce globally.

Strong Results Despite a Challenging Economy

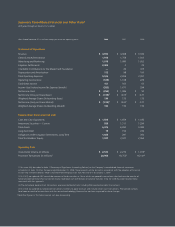

Overall, MasterCard revenues increased by 22.7 percent in 2008, to $5.0 billion. Excluding special items, we generated

net income of $1.2 billion for the year, or $9.45 per share on a diluted basis, compared with $1.0 billion, or $7.58 a share,

in 2007.1 Our operating margin, excluding the impact of special items, was 39 percent for full-year 2008, an 11.7 percentage

point improvement over 2007.1

MasterCard generated worldwide gross dollar volume (GDV) of more than $2.5 trillion, a 10.7 percent increase in local

currency terms over 2007. GDV was tempered in the fourth quarter by lower levels of consumer spending, particularly in

the United States. Worldwide purchase volume for 2008 rose 11.3 percent in local currency terms, to $1.9 trillion.

At year-end, our customers had issued 981 million MasterCard-branded cards, a 7.6 percent increase over 2007. Though

not refl ected in our GDV, we also have 652 million Maestro®-branded cards. Transactions processed across the MasterCard

Worldwide Network increased 11.8 percent, to 21 billion.

Growth was led by expanding use and acceptance of our cards in markets outside the United States. While we expect this

trend to continue, net revenue growth is anticipated to be lower in 2009 due to recessionary conditions in many economies.

Competitive Strengths Set MasterCard Apart

We are fortunate to meet the global economic challenges from a position of strength thanks to sound management

practices, the diversifi cation of our business and a host of advantages that set our organization apart. In particular, our

business model as a franchisor, processor and advisor represents a competitive advantage, as customers around the world

tap into the power of our brand, payment processing network and industry expertise.

Our brand positioning — ”the best way to pay for everything that matters” — resonates as deeply as ever as consumers and

businesses carefully consider each and every purchase. Our compelling product offerings can be used at more than 28.5 million

acceptance locations, including 1.5 million ATMs, as well as other locations where cash may be obtained. Meanwhile, our

global Priceless® campaign continues to transcend borders and cultures, appearing in 110 countries and 51 languages — and,

(1) Operating margin, net income and earnings per share, each of which excludes special items, are non-U.S. GAAP fi nancial

measures that are reconciled to their most directly comparable U.S. GAAP measures in the fi nancial table on the inside back cover.

“ Our customer-focused strategy has never been

more important as we help our customers weather

the headwinds of the fi nancial crisis.”

Robert W. Selander

President and Chief Executive Offi cer