MasterCard 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

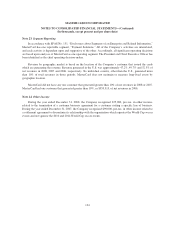

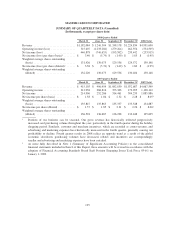

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

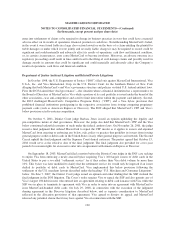

European Union. In September 2000, the European Commission issued a “Statement of Objections”

challenging Visa International’s cross-border default interchange fees under European Community competition

rules. On July 24, 2002, the European Commission announced its decision to exempt the Visa interchange fees

from these rules through the end of 2007 based on certain changes proposed by Visa to its interchange fees.

Among other things, in connection with the exemption order, Visa agreed to adopt a cost-based methodology for

calculating its interchange fees similar to the methodology employed by MasterCard, which considers the costs

of certain specified services provided by issuers, and to reduce its interchange rates for debit and credit

transactions to amounts at or below certain specified levels.

On September 25, 2003, the European Commission issued a Statement of Objections challenging

MasterCard Europe’s cross-border default interchange fees. On June 23, 2006, the European Commission issued

a supplemental Statement of Objections covering credit, debit and commercial card fees. On November 14 and

15, 2006, the European Commission held hearings on MasterCard Europe’s cross-border default interchange

fees. On March 23, 2007, the European Commission issued a Letter of Facts, also covering credit, debit and

commercial card fees and discussing its views on the impact of the IPO on the case. MasterCard Europe

responded to the Statements of Objections and Letter of Facts and made presentations on a variety of issues at the

hearings.

The European Commission announced its decision on December 19, 2007. The decision applies to

MasterCard’s default cross-border interchange fees for MasterCard and Maestro branded consumer payment card

transactions in the European Economic Area (“EEA”) (the European Commission refers to these as

“MasterCard’s MIF”), but not to commercial card transactions (the European Commission stated publicly that it

has not yet finished its investigation of commercial card interchange fees). The decision applies to MasterCard’s

MIF for cross-border consumer card payments and to any domestic consumer card transactions that default to

MasterCard’s MIF, of which currently there are none.

The decision required MasterCard to cease applying the MasterCard MIF, to refrain from repeating the

infringement, and not to apply its then recently adopted (but never implemented) Maestro SEPA and Intra-

Eurozone default interchange fees to debit card payment transactions within the Eurozone. MasterCard

understood that the decision gave MasterCard until June 21, 2008 to comply, with the possibility that the

European Commission could have extended this time at its discretion. The decision also required MasterCard to

issue certain specific notices to financial institutions and other entities that participate in its MasterCard and

Maestro payment systems in the EEA and make certain specific public announcements, regarding the steps it has

taken to comply. The decision does not impose a fine on MasterCard, but provides for a daily penalty of up to

3.5% of MasterCard’s daily consolidated global turnover in the preceding business year (which MasterCard

presently estimates to be approximately $500 U.S. per day) in the event that MasterCard fails to comply.

On March 1, 2008, MasterCard filed an application for annulment of the European Commission’s decision

with the EU Court of First Instance. MasterCard also has the right to seek interim relief to prevent the decision

from becoming effective before the outcome of its appeal or with respect to other aspects of the decision,

although it is uncertain whether MasterCard would receive any such relief.

On March 26, 2008, the European Commission announced that it has opened formal antitrust proceedings

against Visa Europe Limited, under Article 81 of the EC Treaty, in relation to Visa’s multilateral interchange

fees for cross-border consumer payment card transactions within the EEA and Visa’s ‘honor all cards’ rule as it

applies to these transactions.

127