MasterCard 2008 Annual Report Download - page 130

Download and view the complete annual report

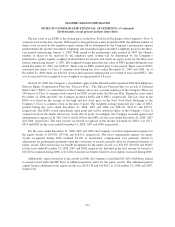

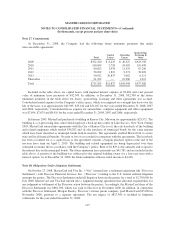

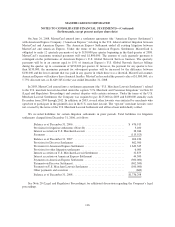

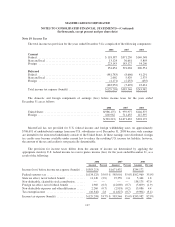

Please find page 130 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

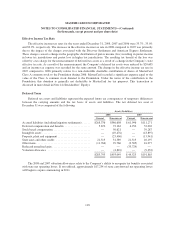

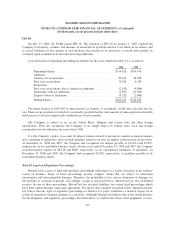

(In thousands, except percent and per share data)

enter into settlements of claims or be required to change its business practices in ways that could have a material

adverse effect on its results of operations, financial position or cash flows. Notwithstanding MasterCard’s belief,

in the event it were found liable in a large class-action lawsuit or on the basis of a claim entitling the plaintiff to

treble damages or under which it were jointly and severally liable, charges it may be required to record could be

significant and could materially and adversely affect its results of operations, cash flow and financial condition,

or, in certain circumstances, even cause MasterCard to become insolvent. Moreover, an adverse outcome in a

regulatory proceeding could result in fines and/or lead to the filing of civil damage claims and possibly result in

damage awards in amounts that could be significant and could materially and adversely affect the Company’s

results of operations, cash flows and financial condition.

Department of Justice Antitrust Litigation and Related Private Litigations

In October 1998, the U.S. Department of Justice (“DOJ”) filed suit against MasterCard International, Visa

U.S.A., Inc. and Visa International Corp. in the U.S. District Court for the Southern District of New York

alleging that both MasterCard’s and Visa’s governance structure and policies violated U.S. federal antitrust laws.

First, the DOJ claimed that “dual governance”—the situation where a financial institution has a representative on

the Board of Directors of MasterCard or Visa while a portion of its card portfolio is issued under the brand of the

other association—was anti-competitive and acted to limit innovation within the payment card industry. Second,

the DOJ challenged MasterCard’s Competitive Programs Policy (“CPP”) and a Visa bylaw provision that

prohibited financial institutions participating in the respective associations from issuing competing proprietary

payment cards (such as American Express or Discover). The DOJ alleged that MasterCard’s CPP and Visa’s

bylaw provision acted to restrain competition.

On October 9, 2001, District Court judge Barbara Jones issued an opinion upholding the legality and

pro-competitive nature of dual governance. However, the judge also held that MasterCard’s CPP and the Visa

bylaw constituted unlawful restraints of trade under the federal antitrust laws. On November 26, 2001, the judge

issued a final judgment that ordered MasterCard to repeal the CPP insofar as it applies to issuers and enjoined

MasterCard from enacting or enforcing any bylaw, rule, policy or practice that prohibits its issuers from issuing

general purpose credit or debit cards in the United States on any other general purpose card network. The Second

Circuit upheld the final judgment and the Supreme Court denied certiorari. The parties agreed that October 15,

2004 would serve as the effective date of the final judgment. The final judgment also provided for a two-year

period of rescission rights for an issuer to enter into an agreement with American Express or Discover.

On September 18, 2003, MasterCard filed a motion before the District Court judge in the DOJ case seeking

to enjoin Visa from enforcing a newly-enacted bylaw requiring Visa’s 100 largest issuers of debit cards in the

United States to pay a so-called “settlement service” fee if they reduce their Visa debit volume by more than

10%. This bylaw was later modified to clarify that the settlement service fee would only be imposed if an issuer

shifted its portfolio of debit cards to MasterCard. Visa implemented this bylaw provision following the

settlement of the U.S. merchant lawsuit described under the heading “U.S. Merchant and Consumer Litigations”

below. On June 7, 2007, the District Court judge issued an opinion and order finding that the SSF violated the

final judgment in the DOJ litigation. The Court’s order requires Visa to repeal the SSF and also permits any of

Visa’s largest 100 debit issuers who entered into an agreement relating to debit card issuance with Visa while the

SSF was in place to terminate its agreement with Visa in order to enter into an agreement with MasterCard to

issue MasterCard-branded debit cards. On July 29, 2008, in connection with the execution of the judgment

sharing agreement in the Discover litigation described below, and as separate consideration to MasterCard

reflected in the allocation provisions of that agreement, Visa agreed to dismiss its appeal and MasterCard

released any potential claims that it may have against Visa in connection with the SSF.

120