MasterCard 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

Company’s pension liability and accumulated other comprehensive income as of December 31, 2008.

Additionally, the Company has an unfunded non-qualified supplemental executive retirement plan (the “Non-

qualified Plan”) that provides certain key employees with supplemental retirement benefits in excess of limits

imposed on qualified plans by U.S. tax laws. The term “Pension Plans” includes both the Qualified Plan and the

Non-qualified Plan.

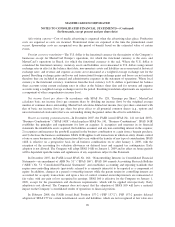

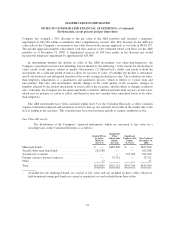

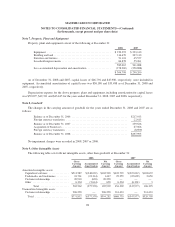

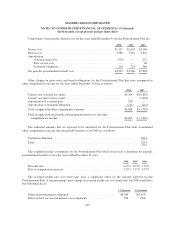

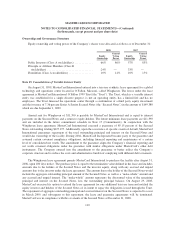

The Company uses a December 31 measurement date for its Pension Plans. The following table sets forth

the Pension Plans’ funded status, key assumptions and amounts recognized in the Company’s consolidated

balance sheets at December 31.

2008 2007

Change in benefit obligation

Benefit obligation at beginning of year ................................... $ 214,805 $ 201,370

Service cost ......................................................... 19,980 18,866

Interest cost ........................................................ 13,638 12,191

Voluntary plan participants’ contributions ................................. 989 83

Actuarial (gain)/loss .................................................. (18,990) 8,634

Benefits paid ........................................................ (13,387) (9,545)

Plan amendments .................................................... — (16,794)

Benefit obligation at end of year ........................................ $ 217,035 $ 214,805

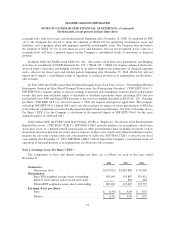

Change in plan assets

Fair value of plan assets at beginning of year .............................. $ 195,966 $ 198,133

Actual return on plan assets ............................................ (59,347) 7,295

Employer contribution ................................................ 24,625 —

Voluntary plan participants’ contributions ................................. 989 83

Benefits paid ........................................................ (13,387) (9,545)

Fair value of plan assets at end of year ................................... $ 148,846 $ 195,966

Funded status

Fair value of plan assets at end of year ................................... $ 148,846 $ 195,966

Benefit obligation at end of year ........................................ 217,035 214,805

Funded status at end of year ............................................ $ (68,189) $ (18,839)

Amounts recognized on the consolidated balance sheets consist of:

Accrued expenses .................................................... $ (2,332) $ (4,288)

Other liabilities, long term ............................................. (65,857) (14,551)

$ (68,189) $ (18,839)

Amounts recognized in accumulated other comprehensive income consist of:

Net actuarial loss .................................................... $ 88,108 $ 32,624

Prior service credit ................................................... (14,938) (17,267)

$ 73,170 $ 15,357

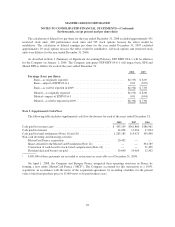

Weighted-average assumptions used to determine end of year benefit

obligations

Discount rate ........................................................ 6.00% 6.00%

Rate of compensation increase—Qualified Plan/Non-Qualified Plan ............ 5.37%/5.00% 5.37%/5.00%

100