MasterCard 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

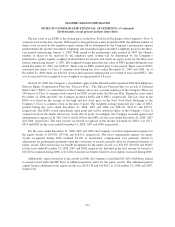

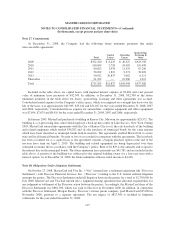

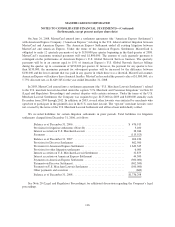

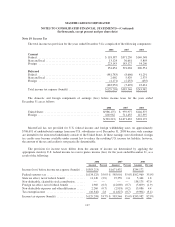

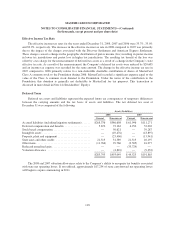

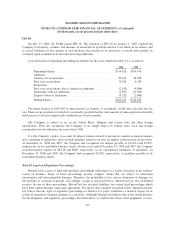

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

decision on MasterCard’s motion to dismiss in New Mexico. In December 2008, MasterCard reached an

agreement in principle to resolve the California state court actions described above for a payment by MasterCard

of $6,000. The parties are negotiating a settlement agreement that will be subject to court approval. On January 7,

2008, MasterCard executed a settlement agreement, in which it agreed to resolve the West Virginia consumer

action for a payment by MasterCard of $3,400, which is consistent with the reserve that MasterCard had

established for the case in the second quarter of 2007. The court granted final approval of this settlement on

August 22, 2008.

At this time, it is not possible to determine the outcome of, or, except as indicated above in the West

Virginia and California consumer actions, estimate the liability related to, the remaining consumer cases and no

provision for losses has been provided in connection with them. The consumer class actions are not covered by

the terms of the settlement agreement in the U.S. merchant lawsuit.

On April 29, 2005, a complaint was filed in California state court on behalf of a putative class of consumers

under California unfair competition law (Section 17200) and the Cartwright Act. The claims in this action seek to

piggyback on the portion of the DOJ antitrust litigation in which the United States District Court for the Southern

District of New York found that MasterCard’s CPP and Visa’s bylaw constitute unlawful restraints of trade under

the federal antitrust laws. See “—Department of Justice Antitrust Litigation and Related Private Litigations.”

MasterCard and Visa moved to dismiss the complaint and the court granted the defendants’ motion to dismiss the

plaintiffs’ Cartwright Act claims but denied the defendants’ motion to dismiss the plaintiffs’ Section 17200

unfair competition claims. MasterCard filed an answer to the complaint on June 19, 2006 and the parties are

proceeding with discovery. In November 2008, MasterCard and Visa moved for summary judgment seeking to

dismiss plaintiffs remaining causes of action. The parties are currently briefing the motion. At this time, it is not

possible to determine the outcome of, or estimate the liability related to, this action and no provision for losses

has been provided in connection with it.

eFunds Litigation

On December 13, 2006, MasterCard notified eFunds Corporation (“eFunds”) that it was terminating the

Marketing Sales and Services Alliance Agreement (the “Agreement”) whereby the parties agreed to work

together to provide debit processing services to financial institutions. On or about January 30, 2007, eFunds filed

a verified complaint against MasterCard in Superior Court for the State of Arizona, alleging that MasterCard’s

termination of the Agreement was improper. On December 23, 2008, the parties executed a settlement agreement

resolving the action. The settlement involved no financial payment by either party, and MasterCard and eFunds

agreed to a mutually satisfactory commercial resolution.

Interchange Litigation and Regulatory Proceedings

Interchange fees represent a sharing of payment system costs among the financial institutions participating

in a four-party payment card system such as MasterCard’s. Typically, interchange fees are paid by the acquirer to

the issuer in connection with transactions initiated with the payment system’s cards. These fees reimburse the

issuer for a portion of the costs incurred by it in providing services which are of benefit to all participants in the

system, including acquirers and merchants. MasterCard or its customer financial institutions establish default

interchange fees in certain circumstances that apply when there is no other interchange fee arrangement between

the issuer and the acquirer. MasterCard establishes a variety of interchange rates depending on such

considerations as the location and the type of transaction, and collects the interchange fee on behalf of the

institutions entitled to receive it and remits the interchange fee to eligible institutions. As described more fully

below, MasterCard’s interchange fees are subject to regulatory or legal review and/or challenges in a number of

124