MasterCard 2008 Annual Report Download - page 17

Download and view the complete annual report

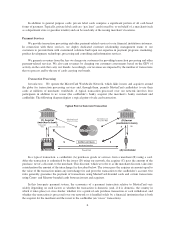

Please find page 17 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A significant portion of the merchant discount is generally paid from the acquirer to the issuer (or netted by

the issuer against amounts paid to the acquirer) in the form of an interchange fee. The balance of the merchant

discount is retained by the acquirer to cover its costs and profit margin. Acquirers may charge merchants

processing and related fees in addition to the merchant discount. Issuers may also charge cardholders fees for the

transaction, including, for example, fees for extending revolving credit. As described below, we charge issuers

and acquirers transaction-based and related fees and assessments for the services we provide them.

Interchange fees represent a sharing of a portion of payment system costs among the financial institutions

participating in a four-party payment card system such as ours. Generally, interchange fees are collected from

acquirers and passed to issuers (or netted by issuers against amounts paid to acquirers) to reimburse the issuers

for a portion of the costs incurred by them in providing services that benefit all participants in the system,

including acquirers and merchants. In some circumstances, such as cash withdrawal transactions, this situation is

reversed and interchange fees are paid by issuers. We establish default interchange fees that apply when there are

no other interchange fee arrangements in place between an issuer and an acquirer. We administer the collection

and remittance of interchange fees through the settlement process; however, we do not earn revenues from them.

As noted above, interchange fees are a significant component of the costs that merchants pay to accept payment

cards and are currently subject to regulatory, legislative and/or legal challenges in a number of jurisdictions. We

are devoting substantial management and financial resources to the defense of interchange fees and to the other

legal and regulatory challenges we face. See “Risk Factors—Legal and Regulatory Risks” in Item 1A of this

Report.

MasterCard Worldwide Network. We facilitate the authorization, clearing and settlement of the

transactions described above and similar transactions through the MasterCard Worldwide Network, our

proprietary, global telecommunications network. Among the platforms and systems encompassed in the

MasterCard Worldwide Network are the Global Clearing Management System (“GCMS”); the MasterCard

Single Message System (the “Single Message System”), also known as the MasterCard Debit Switch (“MDS”);

the MasterCard Dual Message System (the “Dual Message System”), formerly known as Banknet; and settlement

systems. The MasterCard Worldwide Network provides an intelligent architecture that combines both centralized

and peer-to-peer distributed transaction processing. This infrastructure is designed to automatically adapt to the

individual needs of each transaction, blending the speed and redundancy of peer-to-peer networking with the

real-time availability of value-added services provided from a central site. We believe our network is unique,

providing distinct advantages over networks deployed by our competitors and enabling us to provide our

customers around the world with quality scalable transaction processing that is consistently reliable, secure and

available.

Types of Transactions. Generally, the MasterCard Worldwide Network processes three types of

transactions: credit transactions; debit transactions that require the cardholder’s signature, which are referred to

as offline debit transactions; and debit transactions that require the cardholder to use a PIN, or personal

identification number, for verification, which are referred to as online debit transactions. In addition, some

payment cards are equipped with an RFID (radio frequency identification) microchip, which provides an

advanced authentification technique, and MasterCard PayPass®(described below), which allows contactless

payments requiring neither signature nor PIN.

Authorization, Clearing and Settlement. Authorization refers to the process by which a transaction is

approved by the issuer or, in certain circumstances such as when the issuer’s systems are unavailable or cannot

be contacted, by MasterCard or others on behalf of the issuer in accordance with the issuer’s instructions. For

credit and offline debit transactions, the Dual Message System provides for the transmission of authorization

requests and results among issuers, acquirers and other transaction processors or networks. For online debit

transactions, the Single Message System (or MDS) switches financial messages and provides transaction and

settlement reporting. Our rules, which may vary across regions, establish the circumstances under which

merchants and acquirers must seek authorization of transactions.

7