MasterCard 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

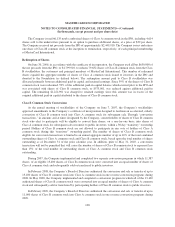

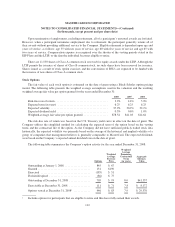

Ownership and Governance Structure

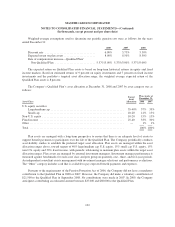

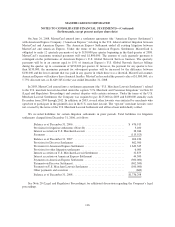

Equity ownership and voting power of the Company’s shares were allocated as follows as of December 31:

2008 2007

Equity

Ownership

General

Voting

Power

Equity

Ownership

General

Voting

Power

Public Investors (Class A stockholders) ............. 66% 86% 57% 85%

Principle or Affiliate Members (Class B

stockholders) ................................ 24% — 33% —

Foundation (Class A stockholders) ................. 10% 14% 10% 15%

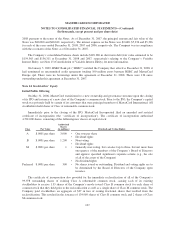

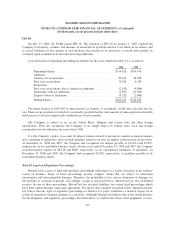

Note 15. Consolidation of Variable Interest Entity

On August 31, 1999, MasterCard International entered into a ten-year synthetic lease agreement for a global

technology and operations center located in O’Fallon, Missouri, called Winghaven. The lessor under the lease

agreement is MasterCard International O’Fallon 1999 Trust (the “Trust”). The Trust, which is a variable interest

entity was established for a single discrete purpose, is not an operating entity, has a limited life and has no

employees. The Trust financed the operations center through a combination of a third party equity investment

and the issuance of 7.36 percent Series A Senior Secured Notes (the “Secured Notes”) in the amount of $149,380

which are due September 1, 2009.

Annual rent for Winghaven of $11,390 is payable by MasterCard International and is equal to interest

payments on the Secured Notes and a return to equity-holders. The future minimum lease payments are $11,390

and are included in the future commitment schedule in Note 17 (Commitments). In conjunction with the

Winghaven lease agreement, MasterCard International executed a guarantee of 85.15 percent of the Secured

Notes outstanding totaling $127,197. Additionally, upon the occurrence of specific events of default, MasterCard

International guarantees repayment of the total outstanding principal and interest on the Secured Notes and

would take ownership of the facility. During 2004, MasterCard Incorporated became party to the guarantee and

assumed certain covenant compliance obligations, including financial reporting and maintenance of a certain

level of consolidated net worth. The amendment to the guarantee aligns the Company’s financial reporting and

net worth covenant obligations under the guarantee with similar obligations under MasterCard’s other debt

instruments. The Company entered into the amendment to the guarantee to better reflect the Company’s

corporate structure and to reduce the costs and administrative burden of complying with different debt covenants.

The Winghaven lease agreement permits MasterCard International to purchase the facility after August 31,

2006, upon 180 days notice. The purchase price is equal to the termination value defined in the lease and includes

amounts due to the holders of the Secured Notes and the investor equity, along with any accrued and unpaid

amounts due to the investor under the lease agreement. The amount due to the holder of the Secured Notes would

include the aggregate outstanding principal amount of the Secured Notes, as well as a “make-whole” amount and

any accrued and unpaid interest. The “make-whole” amount represents the discounted value of the remaining

principal and interest on the Secured Notes, less the outstanding principal balance. On August 29, 2008,

MasterCard exercised its option to extend the lease agreement for one additional ten-year term and notified the

equity investor and holders of the Secured Notes of its intent to repay the obligations issued through the Trust.

The repayment of aggregate outstanding principal and accrued interest on the Secured Notes is expected to occur

in March 2009, and subsequent to this repayment, the lease and guarantee agreements will be terminated.

MasterCard was in compliance with the covenants of the Secured Notes at December 31, 2008.

110