MasterCard 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

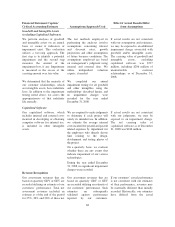

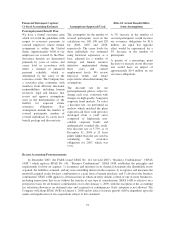

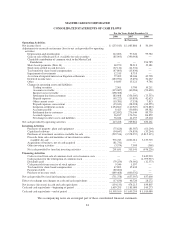

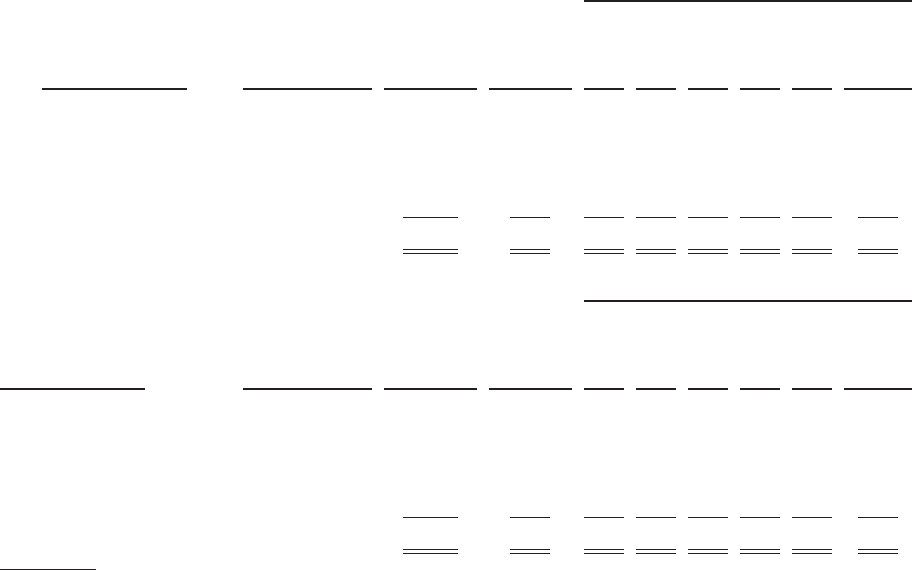

Interest Rate Risk

Our interest rate sensitive assets are our debt instruments, which we hold as available-for-sale investments.

With respect to fixed maturities, our general policy is to invest in high quality securities, while providing

adequate liquidity and maintaining diversification to avoid significant exposure. The fair value and maturity

distribution of the Company’s available for sale investments as of December 31 was as follows:

Maturity

(In millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2008

No

Contractual

Maturity 2009 2010 2011 2012 2013

2014 and

thereafter

Municipal bonds ......... fixed interest $ 485 $— $ 16 $ 68 $112 $101 $ 89 $ 98

Short-term bond funds .... fixed/variable

interest 103 103 ————— —

Auction rate securities .... variable interest 192 — ————— 192

Other .................. — — ————— —

Total .................. $ 780 $103 $ 16 $ 68 $112 $101 $ 89 $290

Maturity

(In millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2007

No

Contractual

Maturity 2008 2009 2010 2011 2012

2013 and

thereafter

Municipal bonds ......... fixed interest $ 555 $— $ 14 $ 61 $122 $134 $103 $120

Short-term bond funds .... fixed/variable

interest 306 306 ————— —

Auction rate securities .... variable interest 348 — ————— 348

Other .................. 99 99 ————— —

Total .................. $1,308 $405 $ 14 $ 61 $122 $134 $103 $468

* Note that amounts in the above table may not sum due to rounding

At December 31, 2008, we had various credit facilities to provide liquidity in the event of material member

settlement failures, settlement service operations and other operational needs. These credit facilities have variable

rates, which are applied to the borrowing based on terms and conditions set forth in each agreement. We had no

material borrowings at December 31, 2008 or 2007. See Note 13 (Debt) to the consolidated financial statements

in Item 8 of this Report for additional information.

In addition, as of December 31, 2008, we had a 7.36% fixed short-term secured note for $149 million with a

fair value of $155 million relating to the Company’s Variable Interest Entity, see Note 15 (Consolidation of

Variable Interest Entity) to the consolidated financial statements in Item 8 of this Report for additional

information.

Equity Price Risk

The Company did not have significant equity price risk as of December 31, 2008. At December 31, 2007,

MasterCard’s investment in shares of Redecard S.A. common stock, which was classified as an available-for-sale

security was subject to equity price risk. At December 31, 2007, the effect of a hypothetical 10 percent decline in

market value would have been approximately $10 million.

75