MasterCard 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

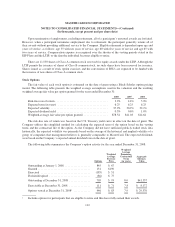

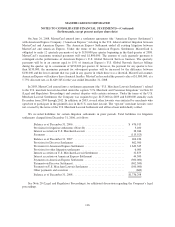

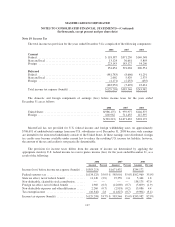

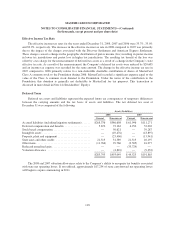

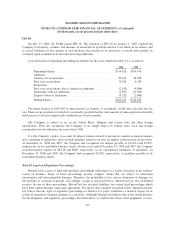

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

of $150,000 per quarter. If, however, the payment for any quarter is less than $150,000, the maximum payment

for subsequent quarters will be increased by the difference between $150,000 and the lesser amount that was paid

in any quarter in which there was a shortfall. MasterCard assumes American Express will achieve these financial

hurdles. Beginning September 9, 2008, MasterCard made two quarterly payments in the maximum amount

required by the settlement agreement as American Express had met the performance criteria set forth in the

agreement. Total future payments discounted at 5.75% over the payment term, or $1,649,345, are reflected on

MasterCard’s Statement of Operations as a litigation settlement for the twelve months ended December 31, 2008.

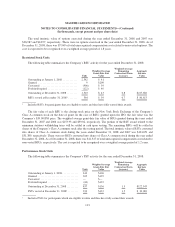

Currency Conversion Litigations

MasterCard International, together with Visa U.S.A., Inc. and Visa International Corp., are defendants in a

state court lawsuit in California. The lawsuit alleges that MasterCard and Visa wrongfully imposed an asserted

one percent currency conversion “fee” on every credit card transaction by U.S. MasterCard and Visa cardholders

involving the purchase of goods or services in a foreign country, and that such alleged “fee” is unlawful. This

action, titled Schwartz v. Visa Int’l Corp., et al., was brought in the Superior Court of California in February

2000, purportedly on behalf of the general public. Trial of the Schwartz matter commenced on May 20, 2002 and

concluded on November 27, 2002. The Schwartz action claims that the alleged “fee” grossly exceeds any costs

the defendants might incur in connection with currency conversions relating to credit card purchase transactions

made in foreign countries and is not properly disclosed to cardholders. MasterCard denies these allegations.

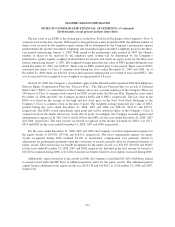

On April 8, 2003, the trial court judge issued a final decision in the Schwartz matter. In his decision, the trial

judge found that MasterCard’s currency conversion process does not violate the Truth in Lending Act or

regulations, nor is it unconscionably priced under California law. However, the judge found that the practice is

deceptive under California law, and ordered that MasterCard mandate that members disclose the currency

conversion process to cardholders in cardholder agreements, applications, solicitations and monthly billing

statements. As to MasterCard, the judge also ordered restitution to California cardholders. The judge issued a

decision on restitution on September 19, 2003, which requires a traditional notice and claims process in which

consumers have approximately nine months to submit their claims. The court issued its final judgment on

October 31, 2003. On December 29, 2003, MasterCard appealed the judgment. The final judgment and restitution

process have been stayed pending MasterCard’s appeal. On August 6, 2004, the court awarded plaintiff’s

attorneys’ fees and costs in the amount of $28,224 to be paid equally by MasterCard and Visa. Accordingly,

during the three months ended September 30, 2004, MasterCard accrued amounts totalling $14,112. MasterCard

subsequently filed a notice of appeal on the attorneys’ fee award on October 1, 2004. With respect to restitution,

MasterCard believes that it is likely to prevail on appeal. In February 2005, MasterCard filed an appeal regarding

the applicability of Proposition 64, which amended sections 17203 and 17204 of the California Business and

Professions Code, to this action. On September 28, 2005, the appellate court reversed the trial court, finding that

the plaintiff lacked standing to pursue the action in light of Proposition 64. On May 8, 2007, the trial court

dismissed the case.

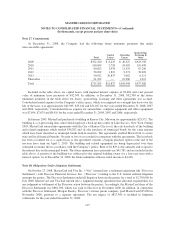

MasterCard International, Visa U.S.A., Inc., Visa International Corp., several member banks including

Citibank (South Dakota), N.A., Chase Manhattan Bank USA, N.A., Bank of America, N.A. (USA), MBNA, and

Citicorp Diners Club Inc. are also defendants in a number of federal putative class actions that allege, among

other things, violations of federal antitrust laws based on the asserted one percent currency conversion “fee.”

Pursuant to an order of the Judicial Panel on Multidistrict Litigation, the federal complaints have been

consolidated in MDL No. 1409 before Judge William H. Pauley III in the U.S. District Court for the Southern

District of New York. In January 2002, the federal plaintiffs filed a Consolidated Amended Complaint (“MDL

Complaint”) adding MBNA Corporation and MBNA America Bank, N.A. as defendants. This pleading asserts

two theories of antitrust conspiracy under Section 1 of the Sherman Act: (i) an alleged “inter-association”

122