MasterCard 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

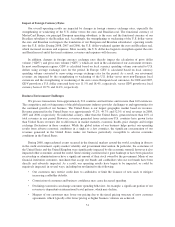

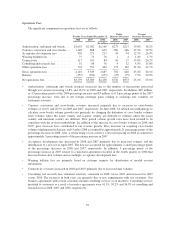

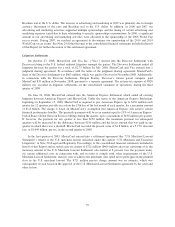

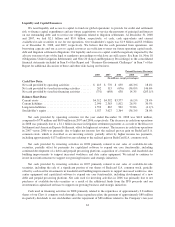

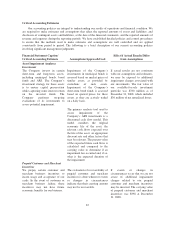

We recorded liabilities for certain litigation settlements in prior periods. Total liabilities for litigation

settlements changed from December 31, 2006, as follows:

(In millions)

Balance as of December 31, 2006 ............................................... $ 477

Provision for litigation settlements (Note 20) ...................................... 3

Interest accretion on U.S. Merchant Lawsuit ....................................... 38

Payments .................................................................. (114)

Balance as of December 31, 2007 ............................................... $ 404

Provision for Discover Settlement ............................................... 863

Provision for American Express Settlement ....................................... 1,649

Provision for other litigation settlements .......................................... 6

Interest accretion on U.S. Merchant Lawsuit ....................................... 33

Interest accretion on American Express Settlement .................................. 44

Payments on American Express Settlement ........................................ (300)

Payments on Discover Settlement ............................................... (863)

Payment on U.S. Merchant Lawsuit .............................................. (100)

Other payments and accretion .................................................. (1)

Balance as of December 31, 2008 ............................................... $1,736

* Note that table may not sum due to rounding.

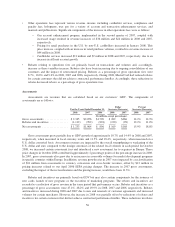

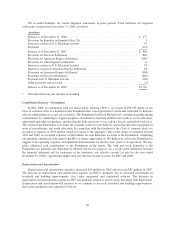

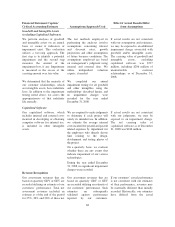

Contribution Expense—Foundation

In May 2006, in conjunction with our initial public offering (“IPO”), we issued 13,496,933 shares of our

Class A common stock as a donation to the Foundation that is incorporated in Canada and controlled by directors

who are independent of us and our customers. The Foundation builds on MasterCard’s existing charitable giving

commitments by continuing to support programs and initiatives that help children and youth to access education,

understand and utilize technology, and develop the skills necessary to succeed in a diverse and global work force.

The vision of the Foundation is to make the economy work for everybody by advancing innovative programs in

areas of microfinance and youth education. In connection with the donation of the Class A common stock, we

recorded an expense of $395 million which was equal to the aggregate value of the shares we donated. In both

2007 and 2006, we recorded expenses of $20 million for cash donations we made to the Foundation, completing

our intention, announced at the time of the IPO, to donate approximately $40 million in cash to the Foundation in

support of its operating expenses and charitable disbursements for the first four years of its operations. We may

make additional cash contributions to the Foundation in the future. The cash and stock donations to the

Foundation are generally not deductible by MasterCard for tax purposes. As a result of this difference between

the financial statement and tax treatments of the donations, our effective income tax rate for the year ended

December 31, 2006 is significantly higher than our effective income tax rates for 2007 and 2008.

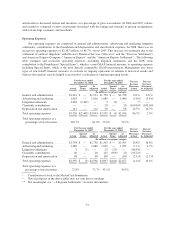

Depreciation and Amortization

Depreciation and amortization expenses increased $14 million in 2008 and decreased $2 million in 2007.

The increase in depreciation and amortization expense in 2008 is primarily due to increased investments in

leasehold and building improvements, data center equipment and capitalized software. The decrease in

depreciation and amortization expense in 2007 was primarily related to certain assets becoming fully depreciated.

Depreciation and amortization will increase as we continue to invest in leasehold and building improvements,

data center equipment and capitalized software.

60