MasterCard 2008 Annual Report Download - page 74

Download and view the complete annual report

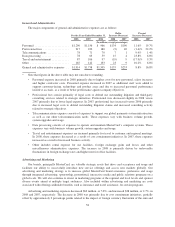

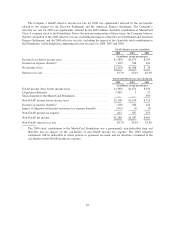

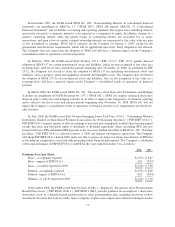

Please find page 74 of the 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.unsecured, subordinated notes that matured in June 2008. See Note 13 (Debt) and Note 14 (Stockholders’ Equity)

to the consolidated financial statements included in Item 8 of this Report for more information on our debt

repayment and stock repurchase plan, respectively. Cash used in financing activities in 2007 primarily related to

the repurchase of approximately $601 million of our Class A common stock through a repurchase plan and

payment of $74 million in dividends to our shareholders. The net cash provided by financing activities in 2006

primarily related to the proceeds received from the sale of Class A common stock to investors in the IPO

(including the proceeds received pursuant to the underwriters’ option to purchase additional shares) of

approximately $2.5 billion, partially offset by $1.8 billion for the redemption of Class B common stock and a $12

million dividend payment.

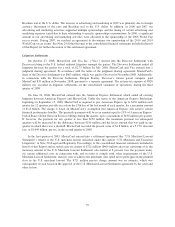

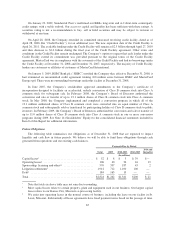

On October 27, 2008, MasterCard and Visa entered into the Discover Settlement relating to the U.S. federal

antitrust litigation amongst the parties. In connection with the Discover Settlement, MasterCard was required to

pay $863 million to Discover and received $35 million from Morgan Stanley, Discover’s former parent company,

in November 2008. Also, on June 24, 2008, MasterCard entered into the American Express Settlement. Under its

terms, beginning on September 15, 2008, MasterCard is required to pay American Express up to $150 million

each quarter for 12 quarters, payable in cash on the 15th day of the last month of each quarter, for a maximum

amount of $1.8 billion. In 2003, MasterCard entered into the U.S. Merchant Lawsuit Settlement. Under the terms

of the U.S. Merchant Lawsuit Settlement, the Company is required to pay $100 million annually each December

through the year 2012. See Note 18 (Obligations Under Litigation Settlements) and Note 20 (Legal and

Regulatory Proceedings) to the consolidated financial statements included in Item 8 of this Report for additional

information on these litigation settlements.

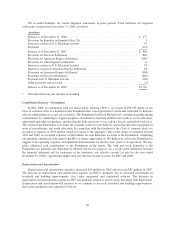

As of December 31, 2008, the Company held $192 million of auction rate securities (“ARS”) classified as

long-term available-for-sale securities. As of December 31, 2007, the Company held $348 million of ARS

classified as current available-for-sale securities. This change in classification is due to failure of the auction

mechanism and a continued lack of liquidity in the ARS market. The stated maturity of the securities ranges from

10 to 33 years, and the securities are collateralized by student loans with guarantees, ranging from approximately

95% to 98% of principal and interest, by the U.S. government, via the Department of Education. We determined

that the fair value of the ARS does not approximate par value, assigned a 20% discount to the par value of the

ARS portfolio and recorded a temporary impairment within other comprehensive income during 2008. We have

the intent and ability to hold the ARS until recovery of fair value, which may be maturity or earlier if called or if

liquidity is restored in the market. See Note 4 (Investment Securities) to the consolidated financial statements

included in Item 8 of this Report for more information.

On December 2, 2008, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on February 10, 2009 to holders of record on January 9, 2009 of our Class A common stock and Class B common

stock. The aggregate amount payable for this dividend was $20 million as of December 31, 2008.

On February 3, 2009, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on May 8, 2009 to holders of record on April 13, 2009 of our Class A common stock and Class B common stock.

The aggregate amount needed for this dividend is estimated to be $20 million. The declaration and payment of

future dividends will be at the sole discretion of our Board of Directors after taking into account various factors,

including our financial condition, settlement guarantees, operating results, available cash and anticipated cash

needs.

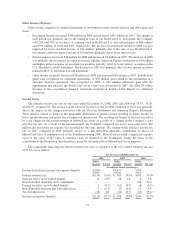

On August 29, 2008, MasterCard notified the equity investor and holders of secured notes related to its

variable interest entity (the “Trust”) of its intent to repay the equity investor and the obligations issued through

the Trust. The repayment of aggregate outstanding principal and accrued interest on the secured notes, and

repayment of the equity investor and make-whole payment, is expected to occur in March 2009 for a total

amount of $165 million. MasterCard was in compliance with the covenants of the secured notes at December 31,

2008. See Note 15 (Consolidation of Variable Interest Entity) to the consolidated financial statements included in

Item 8 of this Report for additional information.

64