MasterCard 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advancing

commerce

when

it matters

most.

MasterCard Annual Report 2008

Table of contents

-

Page 1

Advancing commerce when it matters most. MasterCard Annual Report 2008 -

Page 2

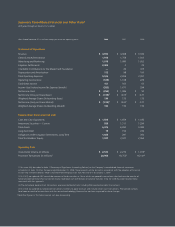

... Data* All ï¬gures throughout report in U.S. dollars Years Ended December 31 (in millions except per-share and operating data) 2008 2007 2006 Statement of Operations Revenue General and Administrative Advertising and Marketing Litigation Settlements Charitable Contributions to The MasterCard... -

Page 3

... of our customers. It's unmistakably clear that the value of electronic payments has never been greater. We are proud of our achievements - and of the role we play in advancing commerce around the world, particularly when it matters most. MasterCard Worldwide. â„¢ The Heart of Commerce. To learn... -

Page 4

...ï¬nances. Our products offer consumers the ï¬,exibility to pay for necessities like groceries, petrol and utility bills, as well as unforeseen expenses. Furthermore, consumers can make purchases quickly and securely while beneï¬tting from a host of innovations - including multi-function cards, tap... -

Page 5

... United States. Worldwide purchase volume for 2008 rose 11.3 percent in local currency terms, to $1.9 trillion. At year-end, our customers had issued 981 million MasterCard-branded cards, a 7.6 percent increase over 2007. Though not reï¬,ected in our GDV, we also have 652 million Maestro®-branded... -

Page 6

... our operations with Europay France, enabling French banks to provide competitive services while beneï¬ting from a single point of contact for their electronic payment needs. In addition, with innovation critical to delivering value, we acquired Ireland-based software company Orbiscom, building on... -

Page 7

...the United Kingdom, we partnered with Barclays Bank to launch the Barclaycard Business card program for small businesses and forged an agreement with Royal Bank of Scotland, the ï¬rst institution to leverage MasterCard inControl. This innovative platform provides advanced authorization, transaction... -

Page 8

6 MasterCard Annual Report 2008 In 2008, we continued to build our relationship with merchants and established valuable new partnerships. For example, we launched the Everyday Money MasterCard Credit Card with HSBC and Woolworths, Australia's largest retailer. Importantly, we continue to solicit ... -

Page 9

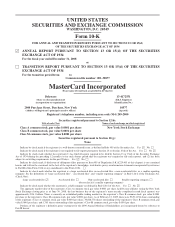

... Class A common stock, par value $.0001 per share New York Stock Exchange Class B common stock, par value $.0001 per share Class M common stock, par value $.0001 per share Securities registered pursuant to Section 12(g): None Indicate by check mark if the registrant is a well-known seasoned issuer... -

Page 10

[THIS PAGE INTENTIONALLY LEFT BLANK] -

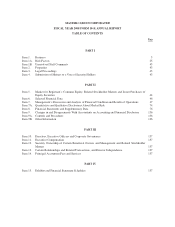

Page 11

MASTERCARD INCORPORATED FISCAL YEAR 2008 FORM 10-K ANNUAL REPORT TABLE OF CONTENTS Page PART I Item 1. Item 1A. Item 1B. Item 2. Item 3. Item 4. Business Risk Factors Unresolved Staff Comments Properties Legal Proceedings Submission of Matters to a Vote of Security Holders 3 25 43 43 43 43 PART II... -

Page 12

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 13

...related services (operations fees) and by assessing our customers based primarily on the dollar volume of activity on the cards that carry our brands (assessments). A typical transaction processed over our network involves four parties in addition to us: the cardholder, the merchant, the issuer (the... -

Page 14

... issuers, or establish the merchant discount charged by acquirers in connection with the acceptance of cards that carry our brands. Our business has a global reach and has continued to experience growth. Gross dollar volume ("GDV") on cards carrying the MasterCard brand as reported by our customers... -

Page 15

... global payments industry, which consists of all forms of payment including Paper-cash, personal checks, money orders, official checks, travelers checks and other paper-based means of transferring value; Cards-credit cards, charge cards, debit cards (including Automated Teller Machine ("ATM") cards... -

Page 16

... minus any interchange fee and posts the transaction to the cardholder's account. Our rules generally guarantee the payment of transactions using MasterCard-branded cards and certain transactions using Cirrus- and Maestro-branded cards between issuers and acquirers. In this four-party payment system... -

Page 17

...MasterCard Worldwide Network processes three types of transactions: credit transactions; debit transactions that require the cardholder's signature, which are referred to as offline debit transactions; and debit transactions that require the cardholder to use a PIN, or personal identification number... -

Page 18

...the exchange of funds along with associated fees. Settlement for credit, offline debit and online debit transactions is provided through the MasterCard Worldwide Network. Once clearing is completed, a daily reconciliation is provided to each customer involved in settlement, detailing the net amounts... -

Page 19

... for all MasterCard-branded cards (excluding Cirrus and Maestro) and for both MasterCard credit and charge card programs and MasterCard debit programs in the United States and in all of our regions other than the United States for the years ended December 31, 2008 and 2007. Growth rates are provided... -

Page 20

... to MasterCard, Maestro and Cirrus-branded cards. The allocation of our revenues varies among issuers and acquirers across our regions. Typical transaction-based fees include those associated with authorization, clearing and settlement and other value-added network products. We also charge cross... -

Page 21

...GDV for the year ended December 31, 2008. As of December 31, 2008, the MasterCard brand mark appeared on approximately 726 million consumer credit and charge cards worldwide, representing 3.6% growth from December 31, 2007. United States. We offer customized programs to customers to address specific... -

Page 22

...be used to obtain cash in bank branches or at ATMs. In addition, MasterCard- and Maestro-branded debit cards may be used to make purchases at the point of sale. As with our consumer credit programs, we support debit Gold MasterCard® programs and debit Platinum MasterCard® programs that issuers can... -

Page 23

...-border) access to cards allowing for varied types of transactions including cash withdrawal (deposit accounts), cash advance (credit accounts), cash drawdown (prepaid accounts), balance inquiries, account transfers and deposits at ATMs in the network. The MasterCard ATM locator can be utilized to... -

Page 24

..., in 2008, we partnered with government agencies to introduce the largest public sector benefits prepaid program awarded in the United States and Europe. MasterCard continues to work with corporate clients on a global basis to realize cost savings and efficiencies from prepaid solutions. In 2008... -

Page 25

... a new corporate brand, MasterCard Worldwide, to reflect our three-tiered business model as franchisor, processor and advisor and a new corporate vision statement, The Heart of Commerceâ„¢, to represent our strategic vision of advancing commerce globally. Our marketing activities combine advertising... -

Page 26

...obtained. Information on ATM and manual cash access locations is reported by our customers and is partly based on publicly-available reports of payment industry associations, government agencies and independent market analysts in Canada and the United States. Cards bearing the Maestro brand mark are... -

Page 27

... members of MasterCard, Maestro and Cirrus, and approximately 3,200 affiliate debit licensees. Our estimated gross settlement risk exposure for MasterCard-branded transactions, which is calculated using the average daily card charges made during the quarter multiplied by the estimated number of days... -

Page 28

..., and Site Data Protection. In addition, we offer several fraud detection and prevention programs, including our Expert Monitoring System. Generally, we charge our customers fees for these antifraud programs and services. Enterprise Risk Management MasterCard faces a number of risks in operating its... -

Page 29

... our business operations. Competition MasterCard programs compete against all forms of payment, including paper-based transactions (principally cash and checks), card-based payment systems, including credit, charge, prepaid, private-label and other types of general purpose and limited use cards, and... -

Page 30

... Factors-Business Risks-Our operating results may suffer because of substantial and increasingly intense competition worldwide in the global payments industry" in Item 1A in this Report. Finally, suits against us have been filed in several state and federal courts because of our currency conversion... -

Page 31

... face competition from established network operators. Whereas the MasterCard approach to mobile commerce centers on the use of the consumer's payment account as established by their card issuer, network operators may apply mobile consumer payments directly to the customer's monthly bill or prepaid... -

Page 32

... value of services and products offered; regulation and local laws; the success and scope of marketing and promotional campaigns; the impact of consolidation in the banking industry; new market entrants; and the ability to develop and implement competitive new card programs, systems and technologies... -

Page 33

... to certain types of financial institutions, including operators of credit card systems. Section 352 of the USA PATRIOT Act requires MasterCard to maintain a comprehensive anti-money laundering program and imposes similar requirements on some of our customers. Our anti-money laundering program must... -

Page 34

.... The version of the legislation ultimately reported by the House Judiciary Committee seeks to regulate interchange by allowing merchants to collectively seek to lower their interchange costs by exempting such action from the U.S. antitrust laws. The Credit Card Fair Fee Act also requires the... -

Page 35

... cross-border interchange fees for credit and debit cards under European Union competition rules. The decision required MasterCard to cease applying its default cross-border interchange fees for MasterCard and Maestro branded consumer payment card transactions in the European Economic Area (the "EEA... -

Page 36

... 8 of this Report for more details regarding the European Commission's decision. • In the United Kingdom, the Office of Fair Trading (OFT) issued a decision in September 2005 concluding that MasterCard's U.K. credit card interchange fees contravene U.K. and European Union competition laws. This... -

Page 37

...considered in setting interchange fees for four-party payment card systems such as ours, that do not regulate the merchant discount charged by proprietary end-to-end networks (such as those offered by American Express or Diners Club), which have already benefited from these regulations. In 2007, the... -

Page 38

.... The version of the legislation ultimately reported by the House Judiciary Committee seeks to regulate interchange by allowing merchants to collectively seek to lower their interchange costs by exempting such action from the U.S. antitrust laws. The Credit Card Fair Fee Act also requires the... -

Page 39

... and adversely affect our revenue and profitability. As a result of the settlement agreement in connection with the U.S. merchant lawsuit, merchants have the right to reject our debit cards in the United States while still accepting other MasterCard-branded cards, and vice versa. See Note 20... -

Page 40

... one other regulation under this law is expected to be issued in 2009. Once fully implemented, these regulations could have a material impact on our customers' businesses by increasing costs of issuance and/or decreasing the ability of card issuers to set the price of credit. The Board of Governors... -

Page 41

... and data use and security in the jurisdictions in which we do business, and we and our customers could be negatively impacted by these regulations. For example, in the United States, we and our customers are respectively subject to Federal Trade Commission and banking agency information safeguard... -

Page 42

... of operations and overall business, as well as have an impact on our reputation. Business Risks Unprecedented global economic events in financial markets around the world have directly and adversely affected many of our customers, merchants that accept our brands and cardholders who use our brands... -

Page 43

...related services and from assessments on the dollar volume of activity on cards carrying our brands. In order to increase transaction volumes, enter new markets and expand our card base, we seek to enter into business agreements with customers through which we offer incentives, pricing discounts and... -

Page 44

... global payments industry is highly competitive. Our payment programs compete against all forms of payment, including paper-based transactions (principally cash and checks), card-based systems, including credit, charge, prepaid, private-label and other types of general purpose and limited use cards... -

Page 45

... Express, Discover, private-label card networks and certain alternative payments systems, operate end-to-end payments systems with direct connections to both merchants and consumers, without involving intermediaries. These competitors seek to derive competitive advantages from their business models... -

Page 46

...-border transactions using MasterCard, Maestro and Cirrus-branded cards and generate a significant amount of revenue from fees for processing cross-border and currency conversion transactions. In addition, we charge relatively higher operations fees for settlement, authorization and switch fees on... -

Page 47

cardholders using cards that carry our brands. Each issuer determines these and most other competitive card features. In addition, we do not establish the discount rate that merchants are charged for card acceptance, which is the responsibility of our acquiring customers. As a result, our business ... -

Page 48

... if an acquirer defaults on its merchant payment obligations, in order to maintain the integrity and acceptance of our brands. Our estimated gross legal settlement exposure, which is calculated using the average daily card charges made during the quarter multiplied by the estimated number of days to... -

Page 49

... merchant systems that process and store information related to credit and debit card transactions, which affected, and may potentially affect, millions of MasterCard, Visa, Discover and American Express cardholders. As a result, we may be subject to lawsuits in connection with data security... -

Page 50

...purchase price is paid with our stock, it could be dilutive to our stockholders. Changes in the regulatory environment may adversely affect our benefit plans. We provide certain retirement benefits to our U.S. employees through the MasterCard Accumulation Plan (MAP), a qualified cash balance benefit... -

Page 51

...common stock into shares of our Class A common stock on a one-for-one basis for subsequent transfer or sale to an eligible holder, subject to annual aggregate and other limits. The Company completed two such voluntary conversion programs during 2007 and one such program during 2008 and has announced... -

Page 52

... of MasterCard or for us to cease to engage in the business of providing core network authorization, clearing and settlement services for branded payment card transactions. In addition, the holders of our Class M common stock have the right to elect up to three of our directors. Because shares of... -

Page 53

... 31, 2008, MasterCard and its subsidiaries owned or leased 78 commercial properties. We own our corporate headquarters, a three-story, 472,600 square foot building located in Purchase, New York. There is no outstanding debt on this building. Our principal technology and operations center is a 528... -

Page 54

...Issuer Purchases of Equity Securities Price Range of Common Stock Our Class A common stock commenced trading on the New York Stock Exchange under the symbol "MA" on May 25, 2006. The following table sets forth the intra-day high and low sale prices for our Class A common stock for the four quarterly... -

Page 55

...a quarterly cash dividend on our outstanding Class A common stock and Class B common stock. However, the declaration and payment of future dividends is at the sole discretion of our Board of Directors after taking into account various factors, including our financial condition, settlement guarantees... -

Page 56

... and 2007, were derived from the audited consolidated financial statements of MasterCard Incorporated included in Item 8 in this Report. The statement of operations data presented below for the years ended December 31, 2005 and 2004, and the balance sheet data as of December 31, 2006, 2005 and 2004... -

Page 57

...of operating expenses excluding litigation settlements to the most directly comparable GAAP measure to allow for a more meaningful comparison of results between periods. Operating expenses-The non-cash charge associated with the donation of shares of Class A common stock to the MasterCard Foundation... -

Page 58

... our customers. Accordingly, we do not issue cards, extend credit to cardholders, determine the interest rates (if applicable) or other fees charged to cardholders by issuers, or establish the merchant discount charged by acquirers in connection with the acceptance of cards that carry our brands. We... -

Page 59

... to providing our customers with coordinated services through integrated, dedicated account teams in a manner that allows us to capitalize on our expertise in payment programs, marketing, product development, technology, processing and consulting and information services for these customers. By... -

Page 60

... with the adoption of Financial Accounting Standards Board ("FASB") Staff Position Emerging Issues Task Force 03-6-1 on January 1, 2009. The data set forth for processed transactions represents all transactions processed by MasterCard, including PIN-based online debit transactions. 2 3 4 5 50 -

Page 61

... by changes in foreign currency exchange rates, especially the strengthening or weakening of the U.S. dollar versus the euro and Brazilian real. The functional currency of MasterCard Europe, our principal European operating subsidiary, is the euro, and the functional currency of our Brazilian... -

Page 62

...' banks), merchants and cardholders. Operations fees are charged to issuers, acquirers or their delegated processors for transaction processing services, specific programs to promote MasterCard-branded card acceptance and additional services to assist our customers in managing their businesses... -

Page 63

... acquirers accepting transactions from cardholders with non-U.S. issuers, compliance and penalty fees, holograms and publications. Cardholder services are benefits provided with MasterCard-branded cards, such as insurance, telecommunications assistance for lost cards and locating automated teller... -

Page 64

...Geographic region or country Retail purchase or cash withdrawal We process most of the cross-border transactions using MasterCard, Maestro and Cirrus-branded cards and process the majority of MasterCard-branded domestic transactions in the United States, United Kingdom, Canada, Brazil and Australia... -

Page 65

... of the 2008 percentage increase and $3 million, or 0.3 percentage points of the 2007 percentage increase, were due to net foreign exchange gains relating to exchange rate volatility on settlement activities. Currency conversion and cross-border revenues increased primarily due to increases in cross... -

Page 66

... U.S. dollar and euro compared to the foreign currencies of the related local volumes in each period. In October 2008, we increased certain assessment fees and introduced a new assessment fee to acquirers in Europe. These price changes in October 2008 contributed approximately 2 percentage points of... -

Page 67

... Services ("Discover" and the "Discover Settlement") and American Express Company ("American Express" and the "American Express Settlement"). The following table compares and reconciles operating expenses, excluding litigation settlements and the 2006 stock contribution to the Foundation ("Special... -

Page 68

... introduce new service offerings and access new markets globally. Our advertising and marketing strategy is to increase global MasterCard brand awareness, preference and usage through integrated advertising, sponsorship, promotional, interactive media and public relations programs on a global scale... -

Page 69

... to a separate agreement. The net pre-tax expense of $828 million was recorded in litigation settlements, in the consolidated statement of operations, during the third quarter of 2008. On June 24, 2008, MasterCard entered into the American Express Settlement which ended all existing litigation... -

Page 70

... in Canada and controlled by directors who are independent of us and our customers. The Foundation builds on MasterCard's existing charitable giving commitments by continuing to support programs and initiatives that help children and youth to access education, understand and utilize technology, and... -

Page 71

...tax rate for the years ended December 31, 2008, 2007 and 2006 was 33.7%, 35.0% and 82.9%, respectively. The decrease in the effective income tax rate in 2008 compared to 2007 was primarily due to the impact of the charges associated with the Discover Settlement and American Express Settlement. These... -

Page 72

... affected by the tax benefits related to the charges for the Discover Settlement and the American Express Settlement. The Company's effective tax rate for 2006 was significantly affected by the $395 million charitable contribution of MasterCard Class A common stock to the Foundation. Due... -

Page 73

...to support increased workforce, data center equipment and capitalized software to expand our core functionality, including development of a new debit and prepaid processing platform. Net cash used for investing activities in 2006 was primarily due to net purchases of available-for-sale-securities as... -

Page 74

... financial statements included in Item 8 of this Report for more information. On December 2, 2008, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable on February 10, 2009 to holders of record on January 9, 2009 of our Class A common stock and Class B common stock... -

Page 75

...Class B common stock to public investors. In February 2009, the Company's Board of Directors authorized the conversion and sale or transfer of up to 11.0 million shares of Class B common stock into Class A common stock in one or more conversion programs during 2009. See Note 14 (Stockholders' Equity... -

Page 76

... future marketing, computer hardware maintenance, software licenses and other service agreements. Future cash payments that will become due to our customers under agreements which provide pricing rebates on our standard fees and other incentives in exchange for increased transaction volumes are not... -

Page 77

... short-term bond funds is assessed based on quoted prices for these assets, as they are actively traded on a daily basis. The primary analysis tool used to assess impairment of the Company's ARS investments is a discounted cash flow model. This model considers the original economic life of the asset... -

Page 78

... an impairment charge. The net carrying value of capitalized software as of December 31, 2008 was $166 million. Revenue Recognition Our assessment revenues that are based on quarterly GDV or GEV are recorded utilizing an estimate of our customers' performance. Total net assessment revenues included... -

Page 79

..., which considers our expected postsettlement credit rating and rates for sources of credit that could be used to finance the payment of such obligations with similar terms. For the U.S. Merchant Lawsuit Settlement, a one percent increase in the discount rate would have increased annual interest... -

Page 80

... Statement Caption/ Critical Accounting Estimate The American Express Settlement was discounted at 5.75% over the three-year payment term. Assumptions/Approach Used Effect if Actual Results Differ from Assumptions For the American Express Settlement, a one percent increase in the discount rate... -

Page 81

...% for the years ended December 31, 2007 and 2006. The Company reviews external data and its own historical trends to determine the health care trend rates for postretirement medical costs. 71 A quarter of a percentage point decrease in our discount rate would increase our pension projected benefit... -

Page 82

... the United States. Approximately 3,600 of our employees are covered by the Plan. Severance benefits are determined primarily by years of service and career level in accordance with either a standard or enhanced payment schedule, which is determined by the cause of the severance action. The Company... -

Page 83

... to the inherent complexities associated with projecting future financial performance. The Company's calculation of the expected impact of FSP EITF 03-6-1 on EPS for the years ended December 31 is as follows: 2008 2007 Earnings (Loss) per Share: Basic-as originally reported ...Basic-impact of EITF... -

Page 84

... Value Commitments to sell foreign currency ... $66 $- $50 $- Our settlement activities are subject to foreign exchange risk resulting from foreign exchange rate fluctuations. This risk is limited to the typical one business day timeframe between setting the foreign exchange rates and clearing... -

Page 85

... statements in Item 8 of this Report for additional information. Equity Price Risk The Company did not have significant equity price risk as of December 31, 2008. At December 31, 2007, MasterCard's investment in shares of Redecard S.A. common stock, which was classified as an available-for-sale... -

Page 86

... 2007 and for the years ended December 31, 2008, 2007 and 2006 Management's Report on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Operations ...Consolidated Statements of Cash Flows... -

Page 87

... accepted in the United States of America. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. As required by Section 404 of the Sarbanes-Oxley Act of 2002, management has assessed the effectiveness of MasterCard's internal control... -

Page 88

... our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective... -

Page 89

... share data) ASSETS Cash and cash equivalents ...Investment securities, at fair value: Trading ...Available-for-sale ...Municipal bonds held-to-maturity ...Accounts receivable ...Income taxes receivable ...Settlement due from customers ...Restricted security deposits held for customers ...Prepaid... -

Page 90

... CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended December 31, 2008 2007 2006 (In thousands, except per share data) Revenues, net ...Operating Expenses General and administrative ...Advertising and marketing ...Litigation settlements ...Charitable contributions to the MasterCard Foundation... -

Page 91

... and equipment ...Capitalized software ...Purchases of investment securities available-for-sale ...Proceeds from sales and maturities of investment securities available-for-sale ...Acquisition of business, net of cash acquired ...Other investing activities ...Net cash provided by (used in) investing... -

Page 92

..., net of tax ...Adoption of new tax accounting standard (FIN 48) ...Cash dividends declared on Class A and Class B common stock, $.60 per share ...Share based payments ...Stock units settled in cash for taxes ...Tax benefit for share based compensation ...Purchases of treasury stock ...Conversion of... -

Page 93

MASTERCARD INCORPORATED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) For the Years Ended December 31, 2008 2007 2006 (In thousands) Net Income (Loss) ...Other comprehensive income (loss): Foreign currency translation adjustments ...Defined benefit pension and postretirement plans ...... -

Page 94

... Europe") (together, "MasterCard" or the "Company"), provide payment solutions, including transaction processing and related services to customers principally in support of their credit, deposit access (debit), electronic cash and Automated Teller Machine ("ATM") payment card programs, and travelers... -

Page 95

... balance sheets, which approximated fair value as of December 31, 2008 due to their short-term, highly liquid nature. These instruments include cash and cash equivalents, accounts receivable, settlement due from customers, restricted security deposits held for customers, prepaid expenses, accounts... -

Page 96

... securities. Settlement due from/due to customers-The Company operates systems for clearing and settling payment transactions among MasterCard International members. Net settlements are generally cleared daily among members through settlement cash accounts by wire transfer or other bank clearing... -

Page 97

... of 10 or 20 years. MasterCard capitalizes average internal costs incurred for payroll and payroll related expenses by department for the employees who directly devote time to the design, development and testing phases of each capitalized software project. The Company reviews intangible assets with... -

Page 98

...Subject to approval by the Board of Directors, members may be charged for the amount of any settlement losses incurred during the ordinary activities of the Company. MasterCard has also guaranteed the payment of MasterCard-branded travelers cheques in the event of issuer default. The term and amount... -

Page 99

...upon estimated performance and the contracted discount rates for the services provided. MasterCard also enters into agreements with certain customers to provide volume as well as other support incentives such as marketing, which are tied to performance. MasterCard may incur costs directly related to... -

Page 100

... in general and administrative expenses in the statement of operations. Where local currency is the functional currency, translation from the local currency to U.S. dollars is performed for balance sheet accounts using current exchange rates in effect at the balance sheet date and for revenue and... -

Page 101

..., inputs and valuation techniques used to measure the fair value of plan assets and concentrations of credit risk. FSP SFAS 132R-1 is effective for fiscal years ending after December 15, 2009. FSP SFAS 132R-1 will not impact the Company's consolidated results of operations or financial position as... -

Page 102

...France integrated their operating structures in France by forming a new entity, MasterCard France ("MCF"). The Company accounted for this transaction as a 100% acquisition, in accordance with the terms of the acquisition agreement, by recording a liability for the present value of the fixed purchase... -

Page 103

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Note 4. Investment Securities Costs and Fair Values-Available for Sale: The major categories of the Company's available-for-sale investment securities, for which ... -

Page 104

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Company has assigned a 20% discount to the par value of the ARS portfolio and recorded a temporary impairment of $47,940 within accumulated other comprehensive income. The... -

Page 105

... of the Company's investment securities at December 31, 2008, is as follows: Available-For-Sale Amortized Cost Fair Value Held-To-Maturity Carrying Value Fair Value Due within 1 year ...Due after 1 year through 5 years ...Due after 5 years through 10 years ...Due after 10 years ...No contractual... -

Page 106

... the high credit quality of the Company's other investment securities, no other investment securities were considered to be other-than-temporarily impaired in 2008 or 2007. During 2008, MasterCard sold all of its remaining 6,141 shares of Redecard S.A. and realized a pre-tax gain, net of commissions... -

Page 107

... Prepaid customer and merchant incentives represent payments made to customers and merchants under business agreements. Note 6. Other Assets Other assets consisted of the following at December 31: 2008 2007 Customer and merchant incentives ...Cash surrender value of keyman life insurance ...Cost... -

Page 108

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Note 7. Property, Plant and Equipment Property, plant and equipment consist of the following at December 31: 2008 2007 Equipment ...Building and land ...Furniture and ... -

Page 109

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Additions to capitalized software primarily relate to internal projects associated with system enhancements or infrastructure improvements. Amortizable customer ... -

Page 110

... in accumulated other comprehensive income consist of: Net actuarial loss ...Prior service credit ...Weighted-average assumptions used to determine end of year benefit obligations Discount rate ...Rate of compensation increase-Qualified Plan/Non-Qualified Plan ...100 $ 214,805 $ 19,980 13,638... -

Page 111

... ...Accumulated benefit obligation ...Fair value of plan assets ... $217,035 196,536 148,846 $214,805 193,421 195,966 Components of net periodic pension costs were as follows for each of the years ended December 31: 2008 2007 2006 Service cost ...Interest cost ...Expected return on plan assets... -

Page 112

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Weighted-average assumptions used to determine net periodic pension cost were as follows for the years ended December 31: 2008 2007 2006 Discount rate ...6.00% 5.75% 5.50... -

Page 113

... 2008, the discretionary profit sharing amount related to 2007 Company performance was paid directly to employees as a short-term cash incentive bonus rather than as a contribution to the Savings Plan. In addition, the Company has several defined contribution plans outside of the United States. The... -

Page 114

... ...Amounts recognized in accumulated other comprehensive income consist of: Net actuarial gain ...Prior service credit ...Transition obligation ...Weighted-average assumptions used to determine end of year benefit obligation Discount rate ...Rate of compensation increase ... $ 51,598 $ 60,346 1,951... -

Page 115

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Components of net periodic benefit costs for the years ended December 31 for the Postretirement Plan are: 2008 2007 2006 Service cost ...Interest cost ...Amortization ... -

Page 116

... to the original terms of the Credit Facility agreement. Borrowings under the facility are available to provide liquidity in the event of one or more settlement failures by MasterCard International customers and, subject to a limit of $500,000, for general corporate purposes. A facility fee of... -

Page 117

... 136 euros outstanding under this agreement at December 31, 2007. Note 14. Stockholders' Equity Initial Public Offering On May 31, 2006, MasterCard transitioned to a new ownership and governance structure upon the closing of its IPO and issuance of a new class of the Company's common stock. Prior... -

Page 118

...programs in which 11,387 shares, of an eligible 13,400 shares, of Class B common stock were converted into an equal number of shares of Class A common stock and subsequently sold or transferred to public investors. In February 2008, the Company's Board of Directors authorized the conversion and sale... -

Page 119

... such time. Shares of Class B common stock are non-registered securities that may be bought and sold among eligible holders of Class B common stock subject to certain limitations. Stock Repurchase Program In April 2007, the Company's Board of Directors authorized a plan for the Company to repurchase... -

Page 120

... to the guarantee to better reflect the Company's corporate structure and to reduce the costs and administrative burden of complying with different debt covenants. The Winghaven lease agreement permits MasterCard International to purchase the facility after August 31, 2006, upon 180 days notice. The... -

Page 121

... of two additional years of service. The performance units vested over three and five year periods. During 2006, in connection with the IPO, the Company offered employees who had outstanding awards under the EIP Plans the choice of converting certain of those awards to restricted stock units ("RSUs... -

Page 122

... as a result of stock option exercises and the conversions of RSUs are expected to be funded with the issuance of new shares of Class A common stock. Stock Options The fair value of each stock option is estimated on the date of grant using a Black-Scholes option pricing model. The following table... -

Page 123

... average period of 1.2 years. Performance Stock Units The following table summarizes the Company's PSU activity for the year ended December 31, 2008: Weighted Average Grant-Date Fair Value Weighted Average Remaining Contractual Term (in years) Aggregate Intrinsic Value Units Outstanding at January... -

Page 124

... percent and per share data) The fair value of each PSU is the closing price on the New York Stock Exchange of the Company's Class A common stock on the date of grant. With regard to the performance units granted in 2008, the ultimate number of shares to be received by the employee upon vesting will... -

Page 125

... MasterCard to secure state and local financial benefits. No gain or loss was recorded in connection with the agreements. The leaseback has been accounted for as a capital lease as the agreement contains a bargain purchase option at the end of the ten-year lease term on April 1, 2013. The building... -

Page 126

... MasterCard assumes American Express will achieve these financial hurdles. MasterCard recorded the present value of $1,800,000, at a 5.75% discount rate, or $1,649,345 for the year ended December 31, 2008. In 2003, MasterCard entered into a settlement agreement (the "U.S. Merchant Lawsuit Settlement... -

Page 127

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Note 19. Income Tax The total income tax provision for the years ended December 31 is comprised of the following components: 2008 2007 2006 Current Federal ...State and ... -

Page 128

... years ended December 31, 2008, 2007 and 2006 were 33.7%, 35.0% and 82.9%, respectively. The decrease in the effective income tax rate in 2008 compared to 2007 was primarily due to the impact of the charges associated with the Discover Settlement and American Express Settlement. These charges caused... -

Page 129

... tax benefits for the years ended December 31, is as follows: 2008 2007 Beginning balance ...Additions: Current year tax positions ...Prior year tax positions ...Reductions: Prior year tax positions, due to changes in judgments ...Settlements with tax authorities ...Expired statute of limitations... -

Page 130

... Express or Discover. On September 18, 2003, MasterCard filed a motion before the District Court judge in the DOJ case seeking to enjoin Visa from enforcing a newly-enacted bylaw requiring Visa's 100 largest issuers of debit cards in the United States to pay a so-called "settlement service" fee... -

Page 131

... to a separate agreement, Morgan Stanley, Discover's former parent company, paid MasterCard $35,000 in November 2008. On November 15, 2004, American Express filed a complaint against MasterCard, Visa and eight member banks, including JPMorgan Chase & Co., Bank of America Corp., Capital One Financial... -

Page 132

... Express had met the performance criteria set forth in the agreement. Total future payments discounted at 5.75% over the payment term, or $1,649,345, are reflected on MasterCard's Statement of Operations as a litigation settlement for the twelve months ended December 31, 2008. Currency Conversion... -

Page 133

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) conspiracy among MasterCard (together with its members), Visa (together with its members) and Diners Club to fix currency conversion "fees" allegedly charged to cardholders of "no less than... -

Page 134

... was terminating the Marketing Sales and Services Alliance Agreement (the "Agreement") whereby the parties agreed to work together to provide debit processing services to financial institutions. On or about January 30, 2007, eFunds filed a verified complaint against MasterCard in Superior Court for... -

Page 135

.... On June 22, 2005, a purported class action lawsuit was filed by a group of merchants in the U.S. District Court of Connecticut against MasterCard International Incorporated, Visa U.S.A., Inc. Visa International Service Association and a number of member banks alleging, among other things, that... -

Page 136

..., the group of purported class plaintiffs filed a supplemental complaint alleging that MasterCard's initial public offering of its Class A Common Stock in May 2006 (the "IPO") and certain purported agreements entered into between MasterCard and its member financial institutions in connection with... -

Page 137

... Statement of Objections covering credit, debit and commercial card fees. On November 14 and 15, 2006, the European Commission held hearings on MasterCard Europe's cross-border default interchange fees. On March 23, 2007, the European Commission issued a Letter of Facts, also covering credit, debit... -

Page 138

... service fee ("MSF"), the fee paid by issuers to acquirers when a customer uses a MasterCard-branded card in the United Kingdom either at an ATM or over the counter to obtain a cash advance. Until November 2004, the interchange fees and MSF were established by MasterCard U.K. Members Forum Limited... -

Page 139

...awards of substantial damages. Poland. In April 2001, in response to merchant complaints, the Polish Office for Protection of Competition and Consumers (the "PCA") initiated an investigation of MasterCard's (and Visa's) domestic credit and debit card default interchange fees. MasterCard Europe filed... -

Page 140

... on the revenues of MasterCard's New Zealand customers and on MasterCard's overall business in New Zealand. Australia. In 2002, the Reserve Bank of Australia ("RBA") announced regulations under the Payments Systems (Regulation) Act of 1998 applicable to four-party credit card payment systems in... -

Page 141

... average daily card charges during the quarter multiplied by the estimated number of days to settle. The Company has global risk management policies and procedures, which include risk standards, to provide a framework for managing the Company's settlement risk. Member-reported transaction data and... -

Page 142

... perform under its settlement and travelers cheque guarantees. The Company's global risk management policies and procedures, which are revised and enhanced from time to time, continue to be effective as evidenced by the historically low level of losses that the Company has experienced from customer... -

Page 143

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) (In thousands, except percent and per share data) Note 22. Foreign Exchange Risk Management The Company enters into foreign currency forward contracts to minimize risk associated with anticipated receipts and ... -

Page 144

... assets by geographic location. MasterCard did not have any one customer that generated greater than 10% of net revenues in 2008 or 2007. MasterCard had one customer that generated greater than 10%, or $359,319, of net revenues in 2006. Note 24. Other Income During the year ended December 31, 2008... -

Page 145

...fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated financial statements included in Item 8 of this Report, these amounts will be revised in accordance with the adoption of Financial Accounting Standards Board Staff Position Emerging Issues Task Force 03-6-1 on... -

Page 146

... over financial reporting. Item 9B. Other Information On February 12, 2009, the Company, in the ordinary course of business, issued 53 shares of its Class M common stock to new principal members of MasterCard International, which was offset by the retirement of 16 shares of Class M common stock due... -

Page 147

... transactions with related persons, the review, approval or ratification of such transactions and director independence appear in the Proxy Statement and is incorporated by reference into this Report. Item 14. Principal Accountant Fees and Services The information required by this Item with respect... -

Page 148

SIGNATURES Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. MASTERCARD INCORPORATED (Registrant) Date: February 19, ... -

Page 149

... NANCY J. KARCH Nancy J. Karch Director Date: February 19, 2009 /S/ MARC OLIVIÉ Marc Olivié Director Date: February 19, 2009 /S/ JOSÉ OCTAVIO REYES LAGUNES José Octavio Reyes Lagunes Director Date: February 19, 2009 /S/ MARK SCHWARTZ Mark Schwartz Director Date: February 19, 2009 /S/ JACKSON... -

Page 150

... Chase Bank, N.A. as co-administrative agent, and J.P. Morgan Securities Inc., as co-arranger (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q filed May 2, 2006 (File No. 000-50250)). Lease, dated as of August 31, 1999, between MasterCard International... -

Page 151

... Chase Bank, National Association (incorporated by reference to Exhibit 10.1 to the Company's Quarterly Report on Form 10-Q filed May 9, 2005 (File No. 000-50250)). Member Business Agreement, dated July 1, 2003, by and between MasterCard International Incorporated, HSBC Bank USA and HSBC Bank Nevada... -

Page 152

... MasterCard Incorporated 2006 Long Term Incentive Plan, amended and restated effective October 13, 2008. 10.27+ Form of Restricted Stock Unit Agreement for awards under 2006 Long Term Incentive Plan (incorporated by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K filed February... -

Page 153

... Stock Unit Agreement for awards under 2006 Non-Employee Director Equity Compensation Plan (incorporated by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q filed November 1, 2006 (File No. 001-32877)). 10.33 Form of Indemnification Agreement between MasterCard Incorporated... -

Page 154

...Exhibit 18.1 to the Company's Quarterly Report on Form 10-Q filed May 14, 2003 (File No. 000-50250)). List of Subsidiaries of MasterCard Incorporated. Consent of PricewaterhouseCoopers LLP. Certification of Robert W. Selander, President and Chief Executive Officer, pursuant to Rule 13a-14(a)/ 15d-14... -

Page 155

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 156

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 157

...Group Gary J. Flood President, Global Products and Solutions David R. Carlucci 2 (Chair) Chairman, Chief Executive Ofï¬cer and President IMS Health Incorporated Noah J. Hanft General Counsel, Chief Payment System Integrity & Compliance Ofï¬cer and Corporate Secretary Martina Hund-Mejean Steven... -

Page 158

... and Exchange Commission (SEC) are available upon request from the company. Visit our website, www.mastercardworldwide.com, for updated news releases, stock performance, financial reports, recent investments, community presentations, SEC filings, corporate governance and other investor information... -

Page 159

...changes in general economic or industry conditions, or other circumstances such as those set forth in MasterCard Incorporated's filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2008, Quarterly Reports on Form 10-Q and... -

Page 160

www.mastercardworldwide.com © 2009 MasterCard