Konica Minolta 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

temporary differences will reverse in the foreseeable future

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current

tax liabilities and when they relate to income taxes levied by the same tax authority on the same taxable entity (including

consolidated tax payments).

(1) Estimation and determination

The consolidated financial statements for the Group incorporate management’s estimates and judgments.

The assumptions serving as bases for estimation are reviewed on an ongoing basis. Effects due to changes in estimates are

recognized in the period when the estimate is changed and for future fiscal periods.

Actual results may differ from accounting estimates and the assumptions forming their basis.

(2) Estimates and determinations that have significant effects on the amounts recognized in the consolidated

financial statements of the Group are as follows.

1) Impairment of non-financial assets

The Group conducts impairment tests whenever there is any indication that the recoverable amount of a non-financial asset

(excluding inventories, deferred tax assets and post-retirement benefit plan assets) may fall below its carrying amount.

When conducting an impairment test, principal factors indicating that impairment may have occurred include a substantial

worsening of business performance compared with past or estimated operating performance, significant changes in the uses of

acquired assets or changes in overall strategy, or a substantial worsening of industry or economic trends.

Goodwill is allocated to an assets CGU or groups of CGUs based on the region where business is conducted and business

category, and impairment tests are conducted on goodwill once each year or when there is an indication of impairment.

Calculations of recoverable amounts used in impairment tests are based on assumptions set using such factors as an asset’s

useful life, future cash flows, pre-tax discount rates and long-term growth rates. These assumptions are based on the best

estimates and judgments made by management. However, these assumptions may be affected by changes in uncertain future

economic conditions, which may have a material impact on the consolidated financial statements in future periods.

The method for calculating recoverable amounts is described in note 3. (12) “Impairment of non-financial assets”.

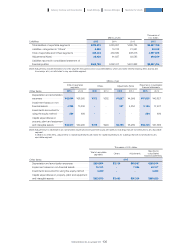

2) Provisions

The Group records various provisions in the consolidated statement of financial position, including provision for product warranties

and provision for restructuring.

These provisions are recognized based on the best estimates of the expenditures required to settle the obligations taking into

consideration of risks and the uncertainty related to the obligations as of the fiscal year-end date.

Expenditures required to settle the obligations are calculated by taking possible results into account comprehensively.

However, they may be affected by the occurrence of unexpected events or changes in conditions which may have a material impact

on the consolidated financial statements in future periods.

The nature and amount of provisions are described in note 19 “Provisions”.

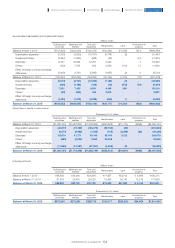

3) Employee benefits

The Group has in place various post-retirement benefit plans, including defined benefits plans. The present value of defined benefit

obligations on each of these plans and the service costs are calculated based on actuarial assumptions. These actuarial

assumptions require estimates and judgments on variables, such as discount rates. The Group obtains advice from external pension

actuaries with respect to the appropriateness of these actuarial assumptions including these variables.

The actuarial assumptions are determined based on the best estimates and judgments made by management. However, there

is the possibility that these assumptions may be affected by changes in uncertain future economic conditions, or by the publication

or the amendment of related laws, which may have a material impact on the consolidated financial statements in future periods.

These actuarial assumptions and related sensitivity analysis are described in note 21 “Employee benefits”.

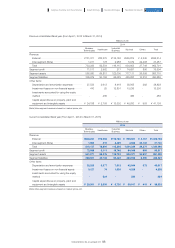

4) Recoverability of deferred tax assets

In recognizing deferred tax assets, when judging the possibility of the future taxable income, the Group estimates the timing and

amount of future taxable income based on the business plan.

The timing when taxable income arises and the amount of such income may be affected by changes in uncertain future

economic conditions. Therefore, this may have a material impact on the consolidated financial statements in future periods.

The content and amount related to deferred tax assets are described in note 16 “Income taxes”.

4. Critical accounting estimates and determining estimates

96

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report