Konica Minolta 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

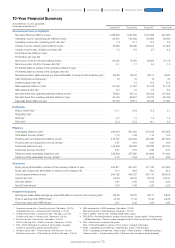

Management’s Discussion and Analysis

Operating Environment

Looking back at the world economy in fiscal year ended March 31,

2015, strong individual spending in the U.S. supported by robust

jobs numbers and a bullish stock market drove global growth.

Uncertainty remained in Europe amid ongoing fears concerning

Greece's financial problems and the problem involving Ukraine.

China saw its economic growth rate cool, and the speed of growth

slackened in emerging countries in Asia and Latin America. The

Japanese economy waxed and waned throughout the year, with

export-related industries enjoying improved business performance

as a result of a rising dollar-yen exchange rate while the domestic

economy felt the repercussions of a last-minute surge in demand

prior to a consumption tax hike in April 2014.

• Profit attributable to owners of the company

Net profit attributable to owners of the company stood at ¥40.9

billion, a 44.4% year-on-year increase. Tax expenses for the fiscal

year climbed to ¥7.9 billion as a result of a reversal of deferred tax

assets in connection with taxation system amendments.

Basic earnings per share were ¥81.01, a more than 50%

increase over the last period.

Return on equity* for the period significantly improved from

last fiscal year’s 6.1% to 8.7%. This was due to balance sheet

improvements from such factors as acquisition of treasury stock

and an increase in net profit attributable to owners of the company.

• Income before tax and minority interests

Financial revenue climbed ¥0.4 billion year on year to ¥2.5 billion,

financial expenses decreased ¥0.2 billion to ¥2.8 billion, and the

financial account balance improved by ¥0.6 billion. The Group

posted a ¥1.1 billion loss on equity method investments attributed

in part to a loss posted last period in connection with the

liquidation of an affiliate company. As a result, profit before tax rose

73.5% year on year to ¥65.4 billion.

• Gross profit

Gross profit for the period rose 10.1% year on year to ¥489.6

billion as a result of exchange-rate gains from a weaker yen, as

well as a gross profit increase in the Business Technologies

Business and cost-cutting measures throughout the organization.

The gross profit margin increased 1.3 points year on year to

48.8%.

• Operating profit

Other income stood at ¥6.8 billion, a ¥1.9 billion year-on-year

increase owing to the sale of fixed assets as an effort to further slim

down the balance sheet. Selling, general and administrative

expenses increased ¥39.1 billion year on year to ¥411.1 billion due

in part to a weaker yen, M&A strategy implementation, and an

increase in upfront investment towards a transformation of our

business portfolio. Other expenses fell to ¥19.5 billion, a ¥18.2

billion decrease year on year owing significantly to a total loss of

¥16.1 billion comprising an impairment loss and loss on withdrawal

from the glass substrates for HDDs business posted last period.

As a result, operating profit for the period was up 65.0% year on

year to ¥65.7 billion, while the operating profit ratio rose to 6.6%, a

2.3 point increase year on year.

• Revenue

Average Japanese yen rates against the U.S. dollar and euro for

the period were ¥109.93 and ¥138.77, respectively, constituting a

¥9.69 (9.7%) decrease against the dollar and a ¥4.40 (3.3%)

decrease against the euro compared to last period. Revenue for

the fiscal year under review increased 7.2% year on year to

¥1,002.7 billion, primarily driven by exchange-rate gains from a

weaker yen and by the Business Technologies Business, which

increased sales more than 10% over last period. The strong sales

figures for the Business Technologies Business were supported by

M&A activities, as well as original Konica Minolta sales strategies

that leveraged the Company’s considerable direct marketing

acumen and ability to offer suitable solutions to customers.

Operating Results

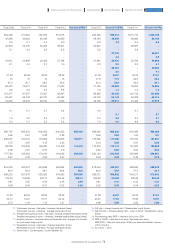

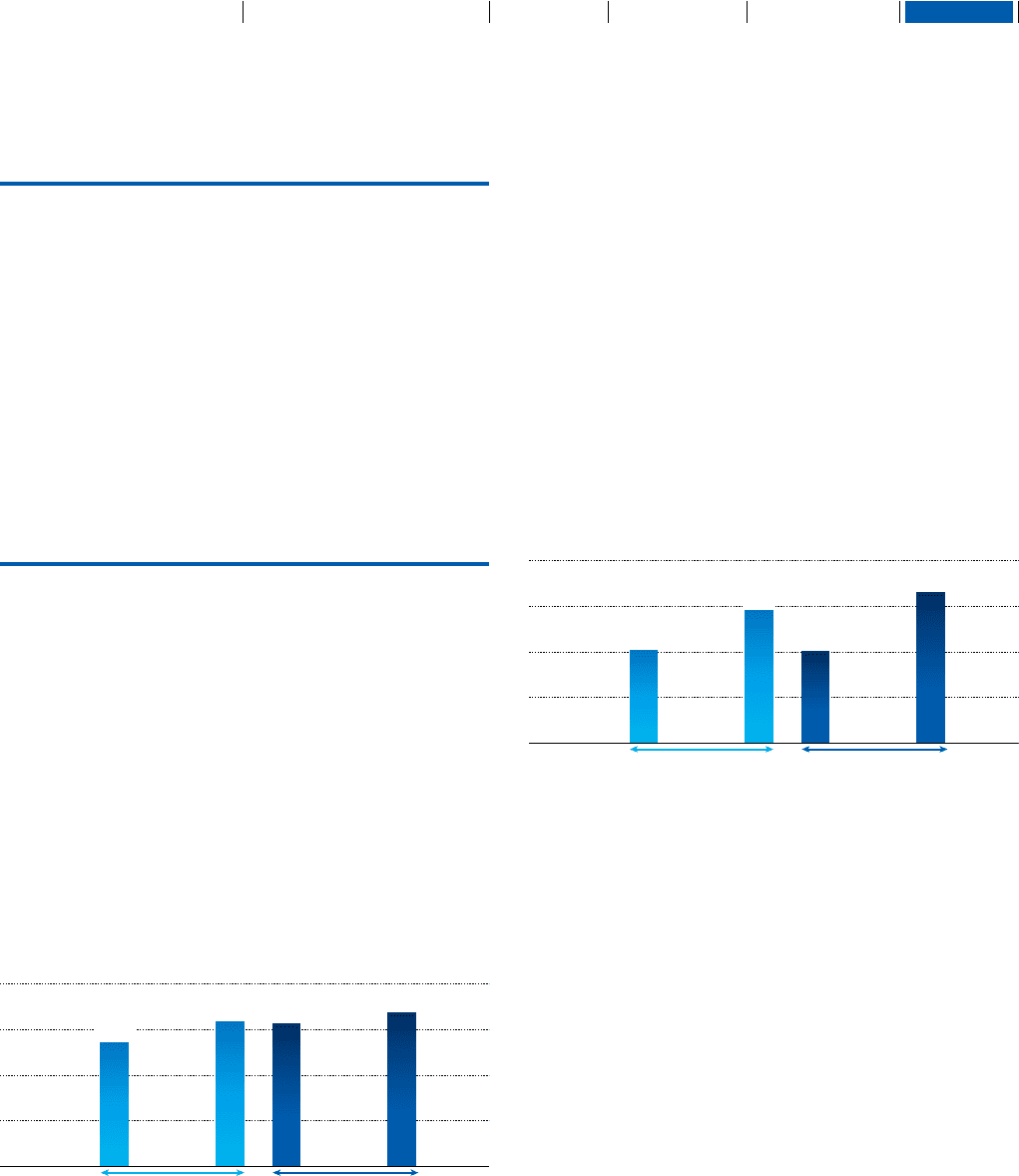

Revenue

Operating profit

1,200

900

600

300

0

(Billions of yen)

20132012 2014

(FY)

935.2 1,002.7

J-GAAP IFRS

943.7

813.0

80

60

40

20

0

(Billions of yen)

40.6 39.8

65.7

20132012 2014

(FY)

J-GAAP IFRS

58.1

75

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report